Dow Eyes Surprising Recovery as Fed Rate Cut Rumors Swirl

The Dow Jones eyed a surprising recovery on Thursday as Federal Reserve rate cut rumors swirled on Wall Street. | Source: AP Photo/Richard Drew

By CCN.com: The Federal Reserve has consistently rebuffed pressure to conform its interest rate policy to the Trump administration’s wishes. However, as the trade war rages, some analysts believe the Fed could cut its benchmark rate by the year’s end, capitulating to the White House and providing the Dow Jones with much-needed positive momentum.

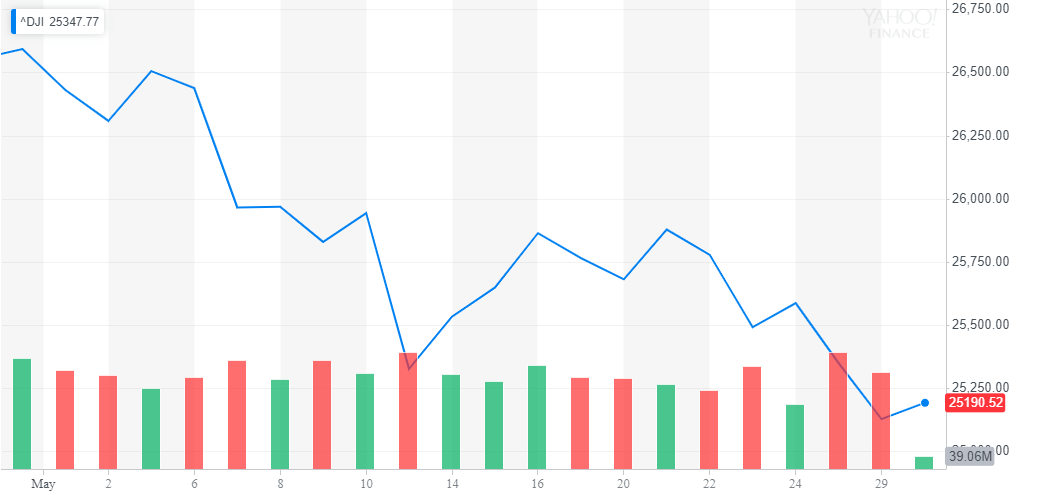

Minutes after its opening, the Dow Jones climbed by 85 points to clear the 25,200 point threshold, as the rapid decline in the yield of the U.S. Treasury note stabilized overnight.

The DJIA later pared those gains, and by 3:31 pm ET the index had slipped into the red. The Dow last traded at 25,113.25 for a decline of 13.16 points or 0.05%.

Even so, rumors about a Federal Reserve interest rate cut suggest the Dow could soon receive a major boost from the central bank.

Why the Fed Could Capitulate on an Interest Rate Cut

Last week, Dallas Federal Reserve President Robert Kaplan said in an interview with The Wall Street Journal that he is concerned about the rate of growth of the global economy.

“At this point, I’m a little concerned about global growth generally. I’m not sure I have a great insight other than, I’m watching it,” said Kaplan.

The fear of a full-blown trade war and the imposition of additional restrictions has rattled the global equities market and the Dow Jones in recent weeks.

On May 29, as reported by CCN.com, local sources revealed that China is seriously considering restrictions on rare earth metal exports that are critical in the manufacturing of products as diverse as cancer treatment drugs and smartphones.

“Based on what I know, China is seriously considering restricting rare earth exports to the US. China may also take other countermeasures in the future,” Hu Xijin, the editor-in-chief of English and Chinese editions of the Global Times, said.

Should the trade dispute grow so dire that Beijing – which controls 70 percent of the global rare earths market – follow through on the apparent threat to ban exports to the United States, the conflict could ensnare the world’s two largest economies for years.

In his interview, Dallas Fed President Kaplan added that although he remains unsure whether the Fed would raise or drop the benchmark interest rate, the central bank is carefully observing trade tensions and their impact on the global economy.

Kaplan said :

“I’m agnostic at this point about whether the next move is up or down. I’m watching very carefully how these trade tensions unfold because I have a concern…whether that could cause some deceleration in the rate of growth.”

Slowing Economy Puts Pressure on 2019 Dow Recovery

According to the Commerce Department, the gross domestic product of the U.S. has grown at a lower-than-expected rate at 3.1 percent compared to the projected 3.2 percent annual rate.

The slowdown in the growth of the U.S. economy in the first quarter of 2019 comes from a decline in U.S. corporate profits and overall business sentiment, as seen in the lagging performance of the Dow Jones and other stock market indices in May.

Credit Suisse chief economist James Sweeney stated that the unexpected increase in U.S. tariffs could hit the recovery of global industrial production, intensifying geopolitical risks and stalling the growth of the global economy.

“The abrupt increase in U.S. tariffs on imports from China is a new shock that will likely end or stall the nascent recovery in global industrial production that appeared to be underway,” Sweeney said .

Though many strategists expect a partial trade deal following the upcoming G20 Summit, the fear of the U.S. imposing additional sanctions on $300 billion worth of Chinese goods is leading to the decline in the confidence of investors in the near-term.

Until the meeting occurs, investors in the equities market expect to see wild volatility in the Dow Jones, S&P 500, and Nasdaq, as investors rush to hedge their holdings in secure options like bonds and U.S. Treasury notes.

“Some of it is hedging the event, and some of it is investors knowing other people will care about the event. The market is definitely starting to focus more on it and its potential impact on markets,” Pravit Chintawongvanich, an equity derivatives strategist at Wells Fargo Securities, told FT.

Click here for a real-time Dow Jones Industrial Average price chart.