Dow Ends Volatile Quarter on High Note But Economic Dangers Remain

. | Source: REUTERS / Brendan McDermid

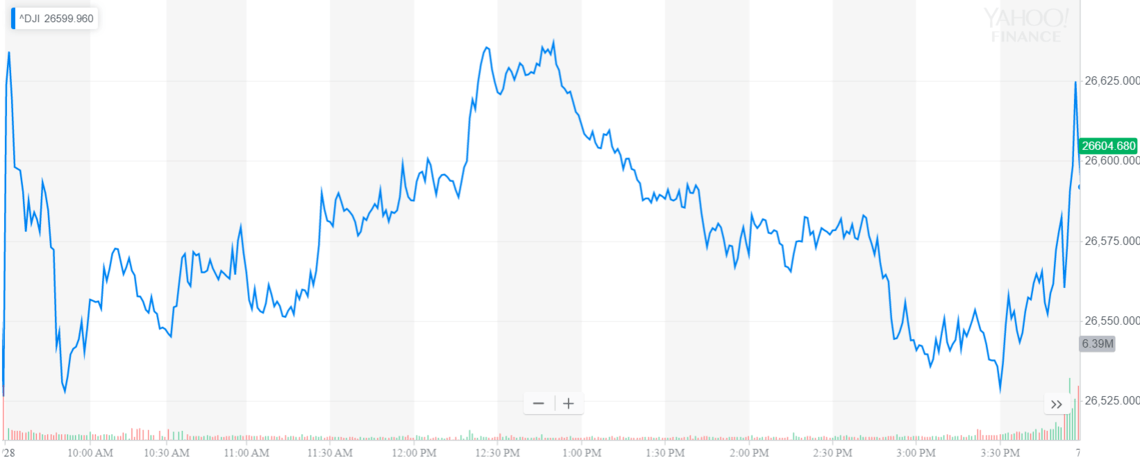

The Dow and broader U.S. stock market traded in positive territory on Friday, as investors turned their attention to an upcoming meeting between President Trump and China’s Xi Jinping,

The meeting, which is scheduled for Saturday in Japan, wraps up a highly volatile quarter that required central-bank intervention to ease pressure off the stock market.

Dow Edges Higher; S&P 500, Nasdaq Follow

All of Wall Street’s major indexes reported gains, mirroring a positive pre-market session for Dow futures. The Dow Jones Industrial Average rose 73.38 points, or 0.3%, to 26,599.96.

The broad S&P 500 Index of large-cap stocks rose 0.6% to 2,941.76, with financials leading the way.

The technology-focused Nasdaq Composite Index advanced 0.6% to close at 8,006.24.

A measure of implied volatility known as the CBOE VIX rose by more than 16% during the quarter. Back in May, the so-called “fear index” peaked above 20, which is right around the historic average. It has since fallen back down to the 15-16 range, where it has held for the past three weeks.

Economic Uncertainty Remains

The U.S. stock market returned to record levels this month, but the gains were largely fueled by expectations that the Federal Reserve will lower interest rates in July. Just one month ago, stocks were plunging because of the U.S.-China trade war and signs of a slowing domestic economy.

It’s ironic that the Fed is planning to lower interest rates when most of its metrics are exceeding expectations. Stocks are surging, unemployment is at its lowest level in 50 years, job growth is running at 108 consecutive months, wages are exceeding core inflation by more than one percentage point, and yet the Fed is planning to slash rates.

One segment of the market that isn’t buying the economic-growth narrative is bonds. Yields have been on a downward spiral since the start of the year, having only recently dropped below 2% for the first time since 2016.

Yields hastened their decline following the June Federal Open Market Committee (FOMC) meeting, where officials dropped their reference to ‘patience’ with respect to monetary policy.

The FOMC is scheduled to meet again on July 30-31 and, for the first time in more than a decade, will probably lower the federal funds rate. For traders, the likelihood of a rate cut is 100%, according to CME Group’s FedWatch Tool.

Click here for a real-time Dow Jones Industrial Average price chart.