Dow Struggles to Extend Rally as Market Braces for Earnings Disaster

The Dow struggled to extend its four-day rally into a fifth straight session as the stock market braced for an earnings disaster. | Source: AP Photo / Richard Drew

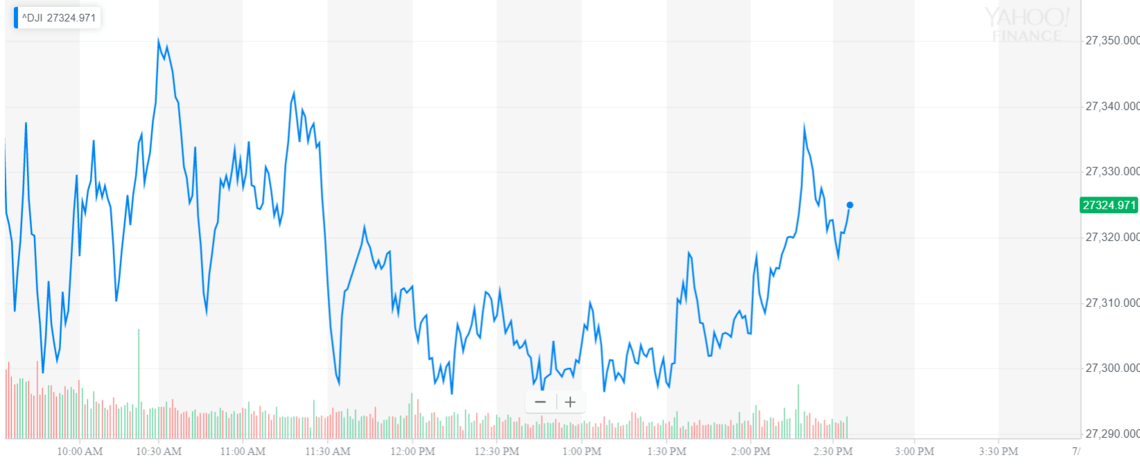

The Dow and broader U.S. stock market struggled for direction Monday, just one session removed from a new all-time high, as investors quickly shifted their focus to corporate earnings season.

Dow Struggles for Direction

U.S. stock markets traded mixed for most of the session on Monday, mirroring a tepid pre-market for Dow futures. After trading within a 70-point range, the Dow Jones Industrial Average inched to a slight gain in the late afternoon. The DJIA last traded at 27,338.23 for an increase of 6.2 points or 0.02%.

The broad S&P 500 Index of large-cap stocks also drifted between slight gains and losses, eventually settling flat at 3,013.53. Losses were primarily concentrated in energy, financials, and industrials companies. On the opposite side of the ledger, utilities, and information technology shares outperformed by a slim margin.

The technology-focused Nasdaq Composite Index broke through the gridlock, rising 0.18% to 8,258.78, a new record high.

Citigroup Kicks Off Earnings Season

Second-quarter earnings season began in earnest Monday after Citigroup Inc. (NYSE: C) reported better than expected results, raising optimism that the major banks would defy global growth risks.

The Wall Street mega-bank reported per-share earnings of $1.95 on revenues of $18.76 billion. Analysts had called for an EPS of $1.80 on sales of $18.5 billion.

Bank earnings are set to continue this week with JPMorgan Chase & Co (NYSE: JPM), Wells Fargo & Co (NYSE: WFC), and Bank of America Corp (NYSE: BAC) all scheduled to report.

S&P 500 companies are expected to report an earnings decline of 3% year-over-year, according to FactSet , a financial research firm. If the forecast holds, it will mark the second straight quarter of earnings declines. The last time that happened was in Q1 and Q2 of 2016.

Corporate America is facing strong headwinds overseas with key markets experiencing lackluster growth. On Monday, China’s statistics bureau said national gross domestic product (GDP) expanded 6.2% annually in the second quarter, the weakest pace of expansion in 27 years. And that came after notable improvements to retail sales, industrial production, and fixed-asset investment in June.

Click here for a real-time Dow Jones Industrial Average (DJIA) price chart.