Dow Trembles After Top Analyst Reveals Shocking Boeing Forecast

Boeing stock crashed more than 4 percent in pre-market trading, wiping more than 100 points off of the Dow. | Source: Drew Angerer / Getty Images / AFP

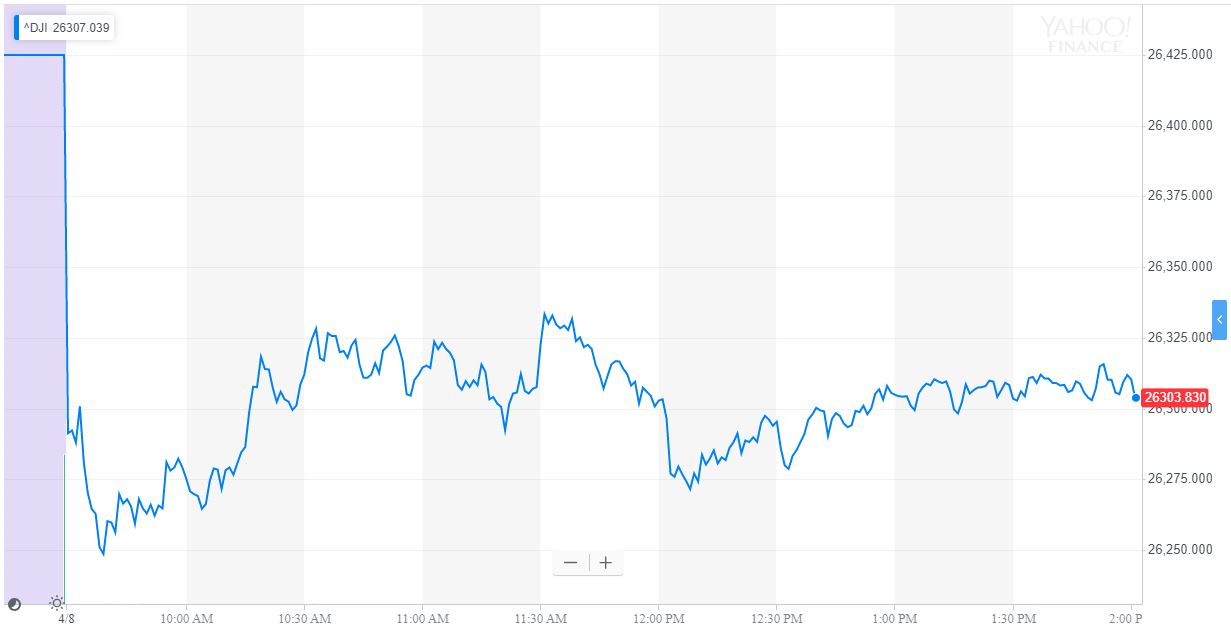

The Dow lurched into a somber Monday trading session as a cocktail of shocking news piled onto the already-bearish outlook for its largest index component, Boeing.

Dow Shudders as Largest Component Crashes Almost 5%

Just ahead of the closing bell, the Dow Jones Industrial Average had lost 83.56 points or 0.32 percent; the index was last seen at 26,341.43 after falling more than 180 points earlier in the day. The S&P 500 and Nasdaq recovered from earlier losses to climb 0.1 percent to 2,895.72 and 0.19 percent to 7,953.88, respectively.

On Friday, the US stock market advanced to moderate gains, with the S&P 500 rising 0.46 percent to 2,892.74 and the Nasdaq climbing 0.59 percent to 7,938.69. The Dow lagged its sister indices but still managed to creep to 26,424.99 for a gain of 40.36 points or 0.15 percent.

All three indices slipped into decline on Monday as Wall Street braced for what bearish analysts fear could be a brutal earnings season, as portended by Walgreens Boots Alliance’s absolutely dismal earnings report last week.

However, the Dow faces added pressure from Boeing, its largest index component, as the aerospace giant continues to struggle to contain the fallout over its controversial 737 MAX 8 aircraft model.

Boeing Stock Resumes Tailspin Amid Downgrades, Shock Production Cuts

On Monday, analysts at Bank of America Merrill Lynch downgraded Boeing stock to neutral from buy and slashed its price target to $420 from $480, a decline of nearly 13 percent.

The harsh downgrade followed Boeing’s shocking announcement on Friday that it would “temporarily” reduce 737 production by more than 19 percent while it scrambles to roll out a software patch for the faulty anti-stall system that played a central role in both the Lion Air and Ethiopian Airlines 737 MAX 8 crashes.

SunTrust RH analyst Michael Ciarmoli warned that the production cuts are “a negative surprise that has the potential to weigh on industry-wide financials, sentiment, and valuation.”

Other analysts seem to agree. According to Bank of America’s Ronald Epstein, 737 MAX 8 and 9 aircraft could remain grounded as long as six to nine months – as much as triple the original estimate. More worrisome is that he believes the reputational damage from the two 737 MAX 8 crashes could permanently reduce the aircraft model’s market share and provide airlines with leverage over Boeing when negotiating prices.

“The reputational loss from these events could erode long-term market share and pricing power of the 737 MAX,” Epstein warned in a note to clients. “A six month delay also means lower margins due to penalties owed to customers, weaker negotiating position with airlines as airlines consider cancellations, and operational inefficiencies from the production disruption.”

Just this morning, the South China Morning Post reported that China Aircraft Leasing Group Holdings (CALC) put the brakes on a $5.8 billion order for 50 Boeing 737 MAX jets until the firm is confident that safety issues have been properly addressed.

“The purchase has been suspended and we have stopped paying the instalments,” said Chen Shuang, chairman of CALC and chief executive of China Everbright, the financial arm of China Everbright Group.

Boeing shares plunged by 4.4 percent for the day, shaving more than 100 points off of what could have been a minor session gain for the Dow.