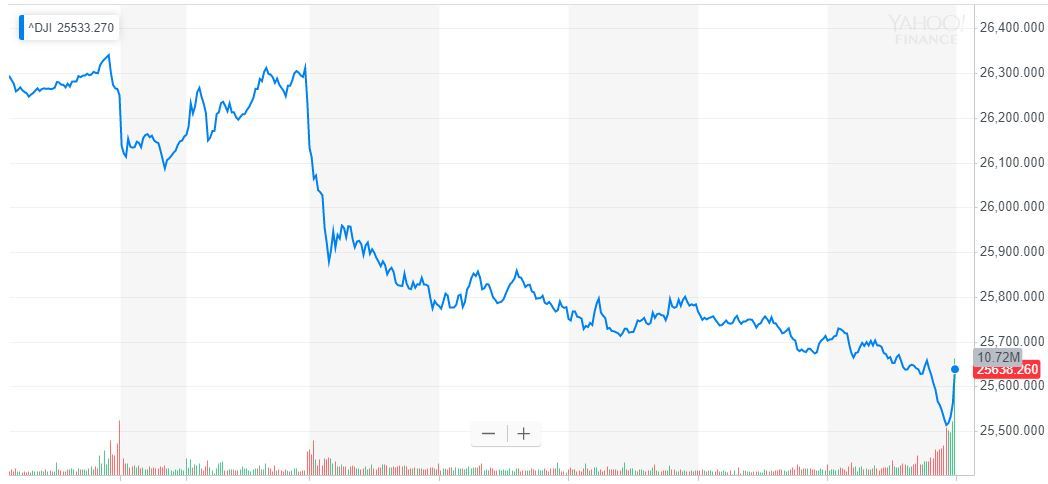

Dow Crashes 623 Points, Erases Weekly Gains in 15 Brutal Minutes

The Dow crashed more than 600 points, erasing ALL of its hard-fought weekly gains during a brutal 15-minute tailspin. | Source: REUTERS / Brendan McDermid

By CCN.com: The Dow and broader U.S. stock market plunged anew on Friday after President Trump unleashed a fiery tweetstorm urging American businesses to shift their production domestically and look for “an alternative to China.”

Economic data added fuel to the fire after U.S. home sales plunged by 12.8%.

Dow Plunges; S&P 500, Nasdaq Follow

In the span of just 15 minutes, the Dow Jones Industrial Average wiped out its entire weekly gain on Friday. After falling as much as 745 points, the DJIA closed 623.34 points, or 2.37%, lower at 25,628.90.

The broad S&P 500 Index fell 2.59% to 2,847.11, with all 11 primary sectors reporting declines. Energy and Information technology stocks plunged more than 3% to lead the market lower.

Sliding technology shares weighed heavily on the Nasdaq Composite Index, which fell 3.00% to 7,751.77.

Home Sales Plunge as Housing Market Weakens

U.S. home sales plunged to six-year lows in July, walking back most of their gains from the previous month and fueling concerns about a protracted slowdown in real estate.

Sales fell 12.8% to a seasonally adjusted annual rate of 649,000, the Department of Commerce reported Friday. Analysts in a median estimate called for a decline of only 0.2%.

Residential real estate has been under pressure for the past two years due to rising housing costs. First-time buyers have gotten the short-end of the stick as wages failed to keep pace with higher home prices and more stringent lending terms.

Mortgage costs have been trending downward for most of 2019 and remain well below the historic average. With the Federal Reserve set to lower interest rates again next month, banks and other lenders could pass on even more savings to borrowers.

The federal funds rate impacts mortgages indirectly. Housing hit another rough patch last year as the Fed raised interest rates more aggressively.

Click here for a real-time Dow Jones Industrial Average chart.