Dow Smashes Through 26,000 as US Treasury Bond Yields Spike

Rising bond yields propelled the Dow Jones toward a spectacular advance on Monday, but economist David Rosenberg says he's not convinced. | Source: AP Photo / Richard Drew

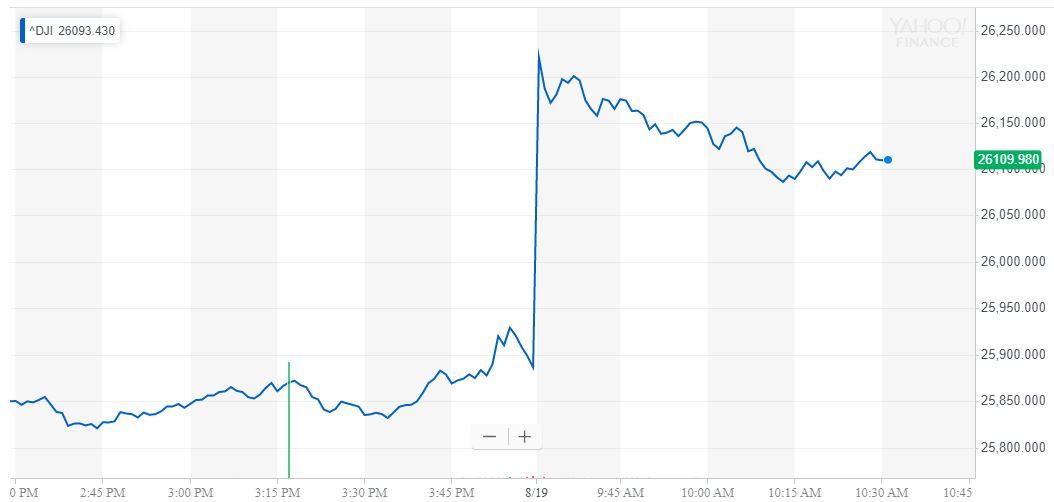

By CCN.com: Rising bond yields propelled the Dow Jones toward a spectacular advance on Monday, as the US stock market continued to claw itself out of the cavernous hole it dug for itself earlier in the month.

However, one so-called perma-bear claims that the market is still flashing a dangerous warning sign.

Dow Races Toward Fabulous Rally

All of Wall Street’s major indices secured mammoth gains at the opening bell, though prices dipped as the session matured. As of 10:35 am ET, The Dow Jones Industrial Average had gained 242.55 points or 0.94%. The DJIA last traded at 26,128.56.

The S&P 500 rallied 30.97 points, or 1.07%, to 2,919.65. All 11 primary sectors recorded gains.

The Nasdaq led the pack with a 1.23% surge to 7,993.24. The tech-heavy index had briefly cleared the 8,000 level.

Bond Yields Spike, Sending the Dow Jones Higher

Stock prices rose in tandem with US Treasury bond yields, assuaging fears that the bond market was portending a recession.

The yield on the 30-year Treasury note jumped as high as 2.1%, just days after sliding below 2% for the first time ever. Bond yields rise as prices fall, indicating that investors are exiting these low-risk assets for more volatile investments.

The main yield curve – the difference between the yield on the 10-year and 2-year Treasury bonds – also widened to nearly 0.1% this morning.

The main yield curve briefly inverted last week for the first time since 2007, setting off recession alarms across Wall Street.

Rosenberg: Stock Market Is Waving a Major Red Flag

However, bond yields remain near historic lows, and not everyone is convinced that the market’s bearish forecast has changed.

David Rosenberg, the chief economist at Gluskin Sheff, warned that the overall market recovery masks several serious red flags.

Specifically, he noted that the S&P 500 sectors most sensitive to market cycles remain in “deep correction terrain. The energy sector, for instance, entered the day at 419.03, nearly 28% below its 52-week high.

“If you look deep enough, the equity market is sending the same weak-growth message the bond market is flashing. The cyclically-sensitive sectors of the SPX are back in deep correction terrain, down 18% from their highs.”

This, Rosenberg suggested, indicates that the market is quietly bracing itself for stagnation in economic growth.

Click here for a real-time Dow Jones Industrial Average chart.