Dow Jones: Boeing Bulls Brace for NYSE Bell After Another 737-Max Crash

Source: Shutterstock

Author has a bearish interest in Boeing shares. This article is not investment advice and should not be interpreted as such.

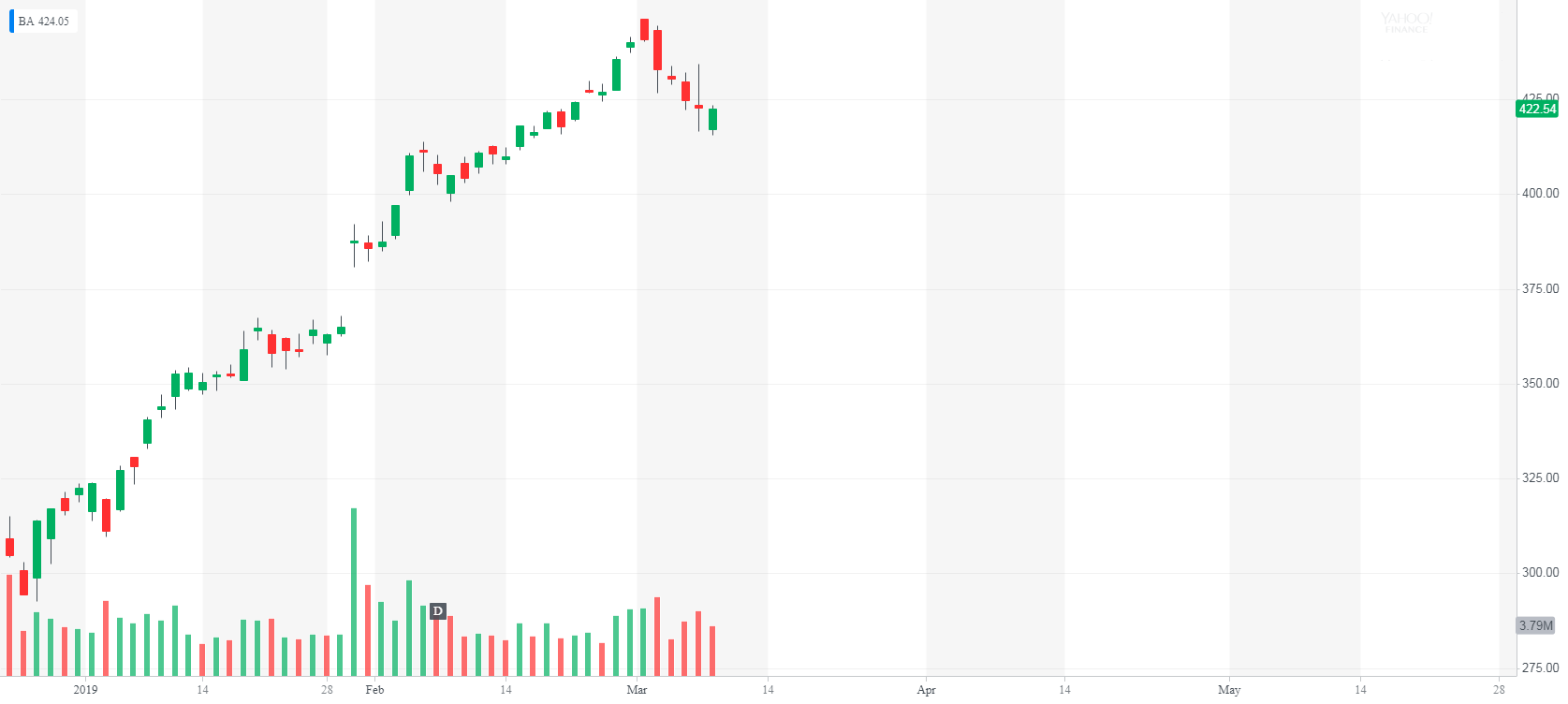

The crash of a brand-new Boeing 737 Max in Ethiopia is the second major incident for the US Aerospace company’s hottest commodity. The tragedy which cost the lives of more than 150 people sent shock waves around the world. Beyond the terrible circumstances of losing an entire jetliner, the internet is buzzing with talk of how this might affect Boeing’s share price at the open of trade on Monday. The New York Stock exchange’s BA shares have been one of the top performers in the Dow this year , and so naturally there are a lot of people with a lot to lose if funds start slashing positions at the NYSE’s opening bell. Boeing (BA) is an integral part of the price-weighted Dow Jones and the S&P 500.

Wall Street Will be Watching Boeing’s 5000 Plane Order Book

First of all, it’s relevant to take a look at just how important the 737 Max is to Boeing’s bottom line. The company’s shares were up approximately 30% at their peak this year amid a stellar outlook for the company. With yearly revenue exceeding $100 billion for the first time there was plenty for investors to get excited about. What was the principal driver of this enthusiasm? Well, namely it was the incredible sales figures being racked up in the 737 Max. The plane was the fastest-selling jet in company history, and the orders just came piling in with more than 5,000 deliveries planned . It takes a while to make these planes, so in January 2019, there were approximately 350 planes delivered . This leaves thousands of planes left to be delivered.

The order book is where things could get tricky for Boeing bulls. While we cannot know the exact details of the delivery contracts, clearly Boeing Company cannot deliver planes that might not be safe. For a forward-looking market-place that probably factors in these orders immediately, the fact they may be in jeopardy is worrying. There was already some notable press in the Wall Street Journal about Boeing potentially withholding safety information on the 737-Max, so there is a historical issue that might add some weight to fears after the recent disaster. In fact this video was posted last year about just these types of concerns,

The 737-Max Could Yet Be Proven Safe

The good news for Boeing is that there are experts who are not blaming the safety of the plane. Instead, they are aligning the problems with a lack of training and correct management of the aircraft. Here is an aviation expert explaining what he believes is likely causing these devastating outcomes, and its more to do with pilot flight habits than a broken aircract.

Boeing has PR Battle on its Hands

If this is found to be the case, then any dip in the share price could be short-lived. If the 737-Max is provably a safe airplane, then there should be no real problem continuing to fill the orders they have received. In this case, the biggest battle could be in public relations where airlines could worry about reduced sales on flights which use the now infamous “Max” name. The fact that “737-MAX safe?” was a top search on google searches associated with Boeing is just one example of this. The public is quite resilient to this sort of fear, and if the FAA says a plane is safe, then they tend to trust them to do their job. The US has a tremendous aviation record , and people are aware of this.

If we push aside the crash, there is no doubt Boeing has been on a meteoric rise. The recent dip is still tiny in comparison to its sharp upward trend.

Boeing Shares Recovered Quickly From Lion Air Crash

Analysts were singing BA’s praises into the close last week, but as this interesting quote from Ed Carson for Investors Business Daily, suggests both bulls and bears could find themselves right for a time if the previous crash is anything to go off,

“After the Lion Air 737 Max crash, Boeing stock tumbled 6.6%. That day also marked the low of the first leg of the late 2018 stock market correction. Then again, Boeing stock has a big influence, as the most expensive stock in the price-weighted Dow Jones and a major S&P 500 index component. Boeing stock recouped its Oct. 29 loss within three days.

Boeing Shares Momentum Was Fading Prior to Disaster In Ethiopia

Perhaps most concerning from a technical standpoint is Boeing’s potentially overbought share price. Even before Sunday’s accident, analysts were growing concerned about a possible overvaluation. An easing of trade tensions with China has helped fuel even stronger demand amid a record $100 billion in revenue. Even back in February, there were analysts like Miller Tabak’s Matt Maley suggesting you shouldn’t chase the stock much higher and wait for a pullback,

“Great move, all-time high. That’s the kind of breakout you want to see. But on a very short-term basis nothing moves in a straight line. We would like to see, it would actually be healthy if the stock [were] to pull back here and then take another shot at trying to break out of the top end of that pattern,”

We could certainly see the recent pull-back accelerate on Monday. If the storm clouds clear over safety, there will be a lot of money waiting to pile into the discounted uptrend. The big “if” is just how bad the fallout from the Ethiopian Airlines crash will be.