Dow Erupts Higher But ‘Big Short’ Investor Fears Market ‘Bubble’

The Dow erupts higher on Thursday, but "Big Short" legend Michael Burry warns of a bubble in a key segment of the US stock market. | Source: AP Photo / Mark Lennihan

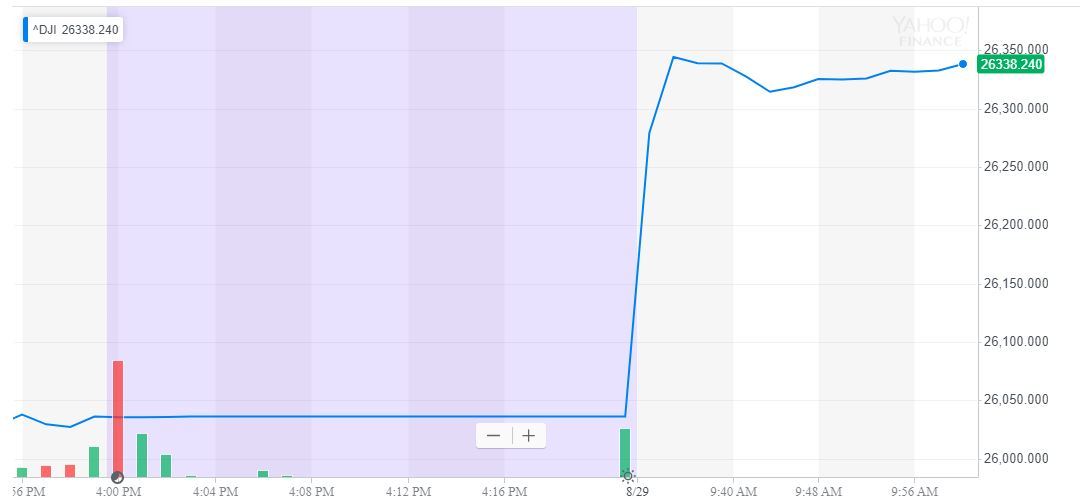

By CCN.com: The Dow erupted higher on Thursday, surging more than 275 points after Beijing – not President Trump – flinched ahead of a crucial trade war tariff deadline.

However, famed investor Michael Burry – who was played by Christian Bale in The Big Short – warns that a bubble is forming in a critical segment of the stock market: passive investing.

Dow Blasts Toward Phenomenal Rally

All of Wall Street’s major indices roared at Thursday’s opening bell. As of 10:10 am ET, the Dow Jones Industrial Average had gained 277.42 points. The 1.07% rally launched the DJIA to 26,313.52.

The S&P 500 jumped 32 points or 1.11% to 2,919.94. Nine of 11 primary sectors reported gains, led by energy.

The Nasdaq outperformed its peers, surging 111.81 points or 1.42% to 7,966.89.

The CBOE VIX, a measure of implied volatility, dropped 6.51% to 18.09, indicating relative calm in the market.

‘Big Short’ Legend Warns of Stock Market Bubble

The stock market sped toward a second straight mammoth recovery after China stunned Wall Street by declining to retaliate against President Trump’s latest tariff threats. Beijing also vowed to maintain a “calm attitude” and pursue a peaceful resolution to the trade war.

Those remarks triggered an immediate spike in Dow stocks, many of which have languished in no man’s land as the White House and Beijing took potshots at one another over the past several weeks.

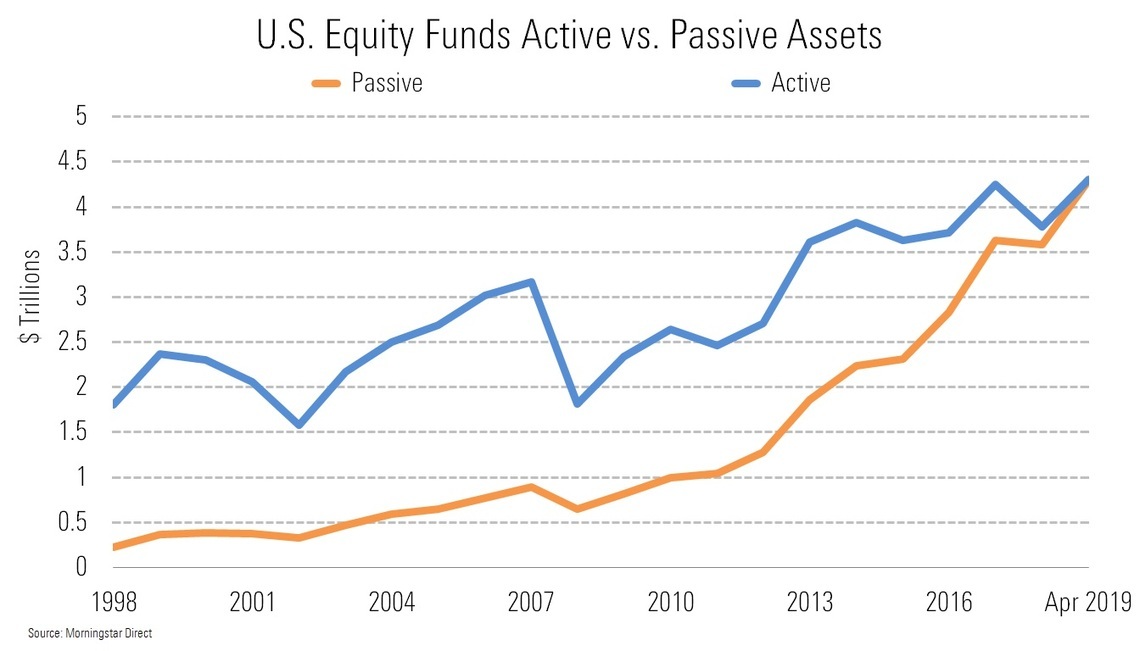

But while trade war optimism spurred the market higher this morning, some investors fear that the meteoric rise of passive investing presents a long-term threat to the S&P 500 and other large-cap heavy indices.

Michael Burry, who raked in a windfall shorting the housing bubble, warns that the passive investing boom could lead to diminishing returns for investors since passive fund weightings lead to a glut of large-cap holdings in most portfolios.

“The bubble in passive investing through ETFs and index funds as well as the trend to very large size among asset managers has orphaned smaller value-type securities globally,” Burry told Bloomberg.

His advice? Buck the passive investing trend and go long on small-cap value stocks.

However, it’s not likely that investors will heed his advice, as most buyers have abandoned actively-managed funds in droves in favor of low-fee passive funds that track major indices like the S&P 500.

According to Moody’s , assets in passive US stock market funds will exceed those in actively managed funds by 2021.

Click here for a real-time Dow Jones Industrial Average chart.