Dow Slithers Higher, But ‘Shallow Recession’ Lurks

The Dow Jones slithered higher on Monday, but one economist warns that the US economy will succumb to a "shallow recession" in 2020. | Source: Drew Angerer / Getty Images / AFP

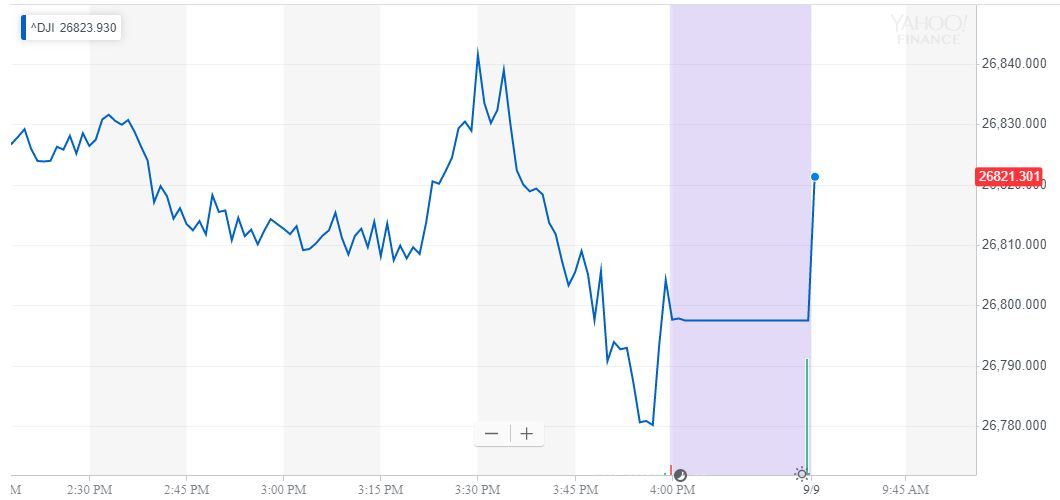

The Dow crept higher on Monday, as the US stock market began its quest to record a third straight weekly gain amid rampant trade war optimism.

However, the top economist at investment bank CLSA warns that the US economy is headed for an unavoidable “shallow recession” that could place the market in a precarious position ahead of the 2020 US presidential election.

Dow Rises for Fourth Straight Day

All of Wall Street’s major indices advanced to slight gains at the opening bell. The Dow Jones Industrial Average edged 22.96 points or 0.09% higher. The DJIA now stands at 26,820.42.

The S&P 500 rose 6.87 points or 0.23% to 2,985.58. Six of 11 primary sectors reported gains, led by communication services (+0.62%).

The Nasdaq assembled a similar advance, climbing 18.41 points or 0.23% to 8,121.48.

CLSA Economist Warns of Plunging Economic Growth

The Dow slithered to tepid gains following a surprising 16% year-over-year decline in Chinese exports to the United States. This suggests that the Trump administration’s tariffs have caused Beijing more economic pain than most analysts expected and could render China eager to achieve a trade war “breakthrough” when negotiations resume in early October.

Unfortunately, this bullish mood might be short-lived.

According to the South China Morning Post , CLSA Chief Economist Eric Fishwick believes that the US economy will succumb to a “shallow recession” in 2020. This means that while the US economy might not technically contract, growth will slow so dramatically that it triggers a global recession.

“We are already at the weakest point in terms of global trade and global manufacturing since 2010, which has happened as a result of the US slowing from about 3.5% to 2% growth,” Fishwick said. “My fear is the US will continue to slow.”

The Hong Kong-based CLSA warns that US growth could slide as low as 1%, which would threaten global manufacturing activity and likely lead to the first contraction in global trade since the financial crisis.

Meanwhile, Bloomberg reports that this shallow recession has already begun to creep into the US manufacturing sector.

Industrial production recorded two straight quarterly contractions for the first time since 2016. Then manufacturing activity contracted in August , also for the first time since 2016. Factory jobs have begun to disappear in crucial swing states like Pennsylvania, even if they appear resilient at a national level.

If Fishwick and CLSA are correct, then the Federal Reserve’s coming interest rate cut could be too little, too late to sustain the US economy’s longest-ever expansion.

Click here for a real-time Dow Jones Industrial Average chart.