Dow Tiptoes Past 27,000 After Trump Savages Fed ‘Boneheads’

President Trump is urging the Fed to ease monetary policy into uncharted territory. | Source: AP Photo / Evan Vucci

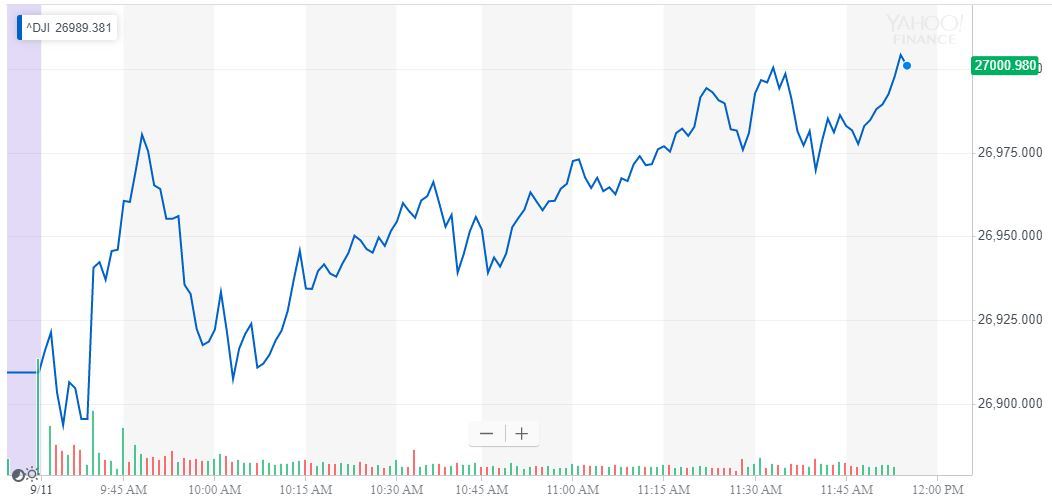

The Dow tiptoed higher on Wednesday, advancing toward a sixth straight winning session after President Donald Trump intensified his one-sided war of words with the “Boneheads” at the Federal Reserve.

Dow Huffs & Puffs Past 27,000

The stock market’s last few sessions haven’t been spectacular, but they’ve been sufficiently bullish to keep the Dow Jones Industrial Average winning streak alive. On Wednesday, the Dow brushed off an early-morning dip to climb 107.95 points or 0.40%. The rally carried the DJIA past the 27,000 mark to 27,017.38.

The index is now primed to record its sixth straight advance and creep closer to its all-time high, which rests just below 27,400.

The Dow’s top performer was also its largest component. Boeing stock soared 3.32% to $381.75. Altogether, seven of the DJIA’s 30 members increased by at least 1.00%.

The S&P 500 rose 14.34 points or 0.48% to 2,994.02. Ten of 11 primary sectors reported gains, led by utilities (+0.89%). Only real estate (-0.21%) traded lower on Wednesday.

The Nasdaq surged 71.80 points or 0.89% to 8,155.96. Apple stock’s 2.88% rally helped lift the tech-heavy index higher.

The CBOE VIX, which tracks implied stock market volatility, declined 3.55% to 14.67, though safe-haven asset gold ticked 0.21% higher to $1,502.40.

Trump’s Twitter Antics Overshadow Tariff Exemptions

The Dow and its fellow indices benefited from a healthy dose of trade war optimism. Most notably, China announced that it would waive tariffs on 16 US goods for 12 months , beginning on September 17.

This is the first time Beijing has issued tariff exemptions for US products since the trade war began last year, and it precedes an important round of top-level trade negotiations that insiders believe could lead to a “breakthrough .”

However, President Trump continues to domineer Wall Street’s attention, first by firing National Security Advisor John Bolton, and then by launching a new attack against his “enemy” at the Federal Reserve, Jerome Powell.

Writing on Twitter this morning, Trump savaged the “Boneheads” at the Fed who are missing out on a “once in a lifetime opportunity” to slash rates all the way into negative territory and then leverage those rates to refinance the national debt.

According to CME’s FedWatch Tool, the market overwhelmingly expects the Fed to cut its benchmark target by 25-basis points to 1.75% to 2.00% at its policy meeting next week. However, the probability of the Fed maintaining its current target has climbed above 10% from 0% one month ago. The probability of a 50-basis point cut has declined to 0%.

Trump has long made the Federal Reserve a scapegoat on which to hang both slowing economic growth and stock market struggles. On multiple occasions , he has alleged that the Dow would be 10,000 points higher if the Fed “knew what it was doing.”

Fed Interest Rate Cuts Trigger Bank Layoffs

Despite Trump’s claims, interest rate cuts are not an unqualified economic boon.

Just today, Charles Schwab announced that it would lay off 600 employees, or 3% of its entire workforce. The reason? Low interest rates.

Perhaps best known for its stock brokerage service, Schwab is also the United States’ 13th-largest bank. According to CNBC , one of its largest income sources is net interest revenue. Falling rates have pressured that revenue by reducing the margin between loans and deposits.

Will Trump Tweet the Stock Market Into Decline?

Speaking of Trump’s Twitter feed, it’s flashing an unconventional warning that could portend an end to the Dow’s five-day winning streak.

As CCN.com reported, Bank of America Merrill Lynch research found that the S&P 500 incurs an average loss of 9 basis points on days when Trump unleashes 35 or more tweets. That’s compared to an average gain of 5 basis points when he tweets five or fewer times.

Trump has not exceeded the 35-tweet threshold during the Dow’s current daily winning streak. However, according to Trackalytics , he has already tweeted 32 times today.

Click here for a live Dow Jones Industrial Average chart.