Dow Booms Despite WHO’s Dire Vaccine Warning

As the Dow 30 sauntered higher, big tech fanned the updraft lifting the index. | Source: Spencer Platt/Getty Images/AFP

- The Dow Jones secured a massive rally on Monday

- Stocks rose as U.S. ISM manufacturing beat expectations and Congress rebooted stimulus talks.

- Weighing on the Dow outlook, the WHO warns a coronavirus vaccine may not be a “silver bullet” for the pandemic.

The Dow Jones kicked off August with a bang, racing more than 200 points higher as the tech sector continued to carry the stock market on its ever-broadening shoulders.

The rally belied a potential storm brewing on the horizon.

Struggling employment data cast shade on the pickup in manufacturing activity. Tensions in Congress are preventing more stimulus from flooding into the economy. And worst of all, health experts warn the stock market may be holding its breath for a “silver bullet” that doesn’t exist.

Dow Jones Rallies as Manufacturing Makes an Uneven Recovery

Wall Street’s three major indices all rose aggressively on Monday. As of 3:37 pm ET, the Dow Jones Industrial Average (DJIA) had bounced 217.93 points or 0.82% to 26,646.25.

The S&P 500 jumped 0.76% to 3,296.09, while the Nasdaq headlined the rally with a 1.49% surge to 10,904.87.

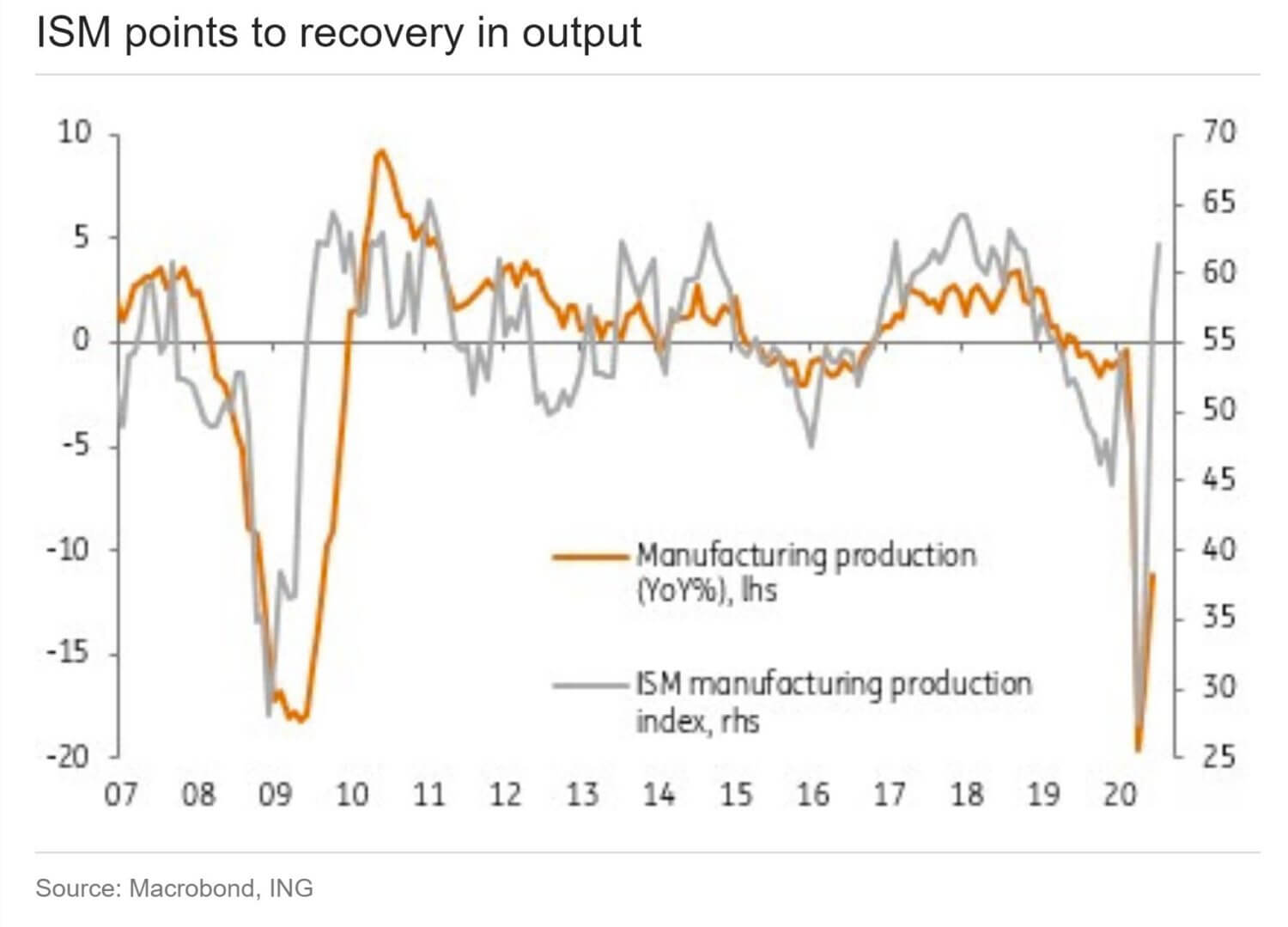

Today’s economic data centered on the global manufacturing sector. U.S. industrial activity beat expectations , with the ISM purchasing manager’s index coming in at 54.2.

Watch: U.S. ISM Manufacturing PMI Hits Highest Level Since February

Coupled with China’s solid Caixin PMI reading overnight (the third straight increase for Asia’s biggest economy), industrial conditions continue to point towards a global manufacturing rebound.

Unfortunately for Dow bulls, every piece of good news is undercut by a stubborn lack of employment in the U.S.

Employment Data Could Get Rough – Especially Since a Vaccine Is Not a ‘Silver Bullet’

Economist James Knightley noted that the manufacturing employment statistics missed estimates, diminishing the importance of the headline PMI figure.

Knightley warns this is further proof that a rough batch of labor market data awaits the economy over the next several months.

We are far more cautious than the market on Friday’s US jobs report, forecasting employment growth of 750,000 versus the consensus forecast of 1.5 million. In fact, the data from Homebase and the Census Bureau’s Household Pulse survey pointing to the risk of an outright decline. So, while the economy has bounced since early May on re-openings, making further significant gains through 2H20 will be much tougher.

Despite hopes that a pandemic-crushing vaccine is in the works, the World Health Organization (WHO) fears this optimism is misplaced. The WHO warns there may never be a “silver bullet,” suggesting some of the damage to the labor market could be permanent.

Political Deadlock Is a Headwind for the U.S. Stock Market

Aside from the economic fundamentals, the stock market’s principal concern this week rests with Congress.

Stimulus talks between Democrats and Republicans are restarting , but it doesn’t appear there is anything close to agreement on several core issues. Unemployment remains the chief sticking point.

Watch: Congress Can’t Agree on Urgently Needed Stimulus

Wall Street is extremely confident that there is more stimulus coming. It would be a significant blow to market sentiment if the typical brinkmanship did not result in a deal.

Consumer confidence was already waning before the additional $600 benefit expired. It’s only a matter of time before flagging sentiment manifests in spending data.

From a purely market-based perspective, one positive nugget of good news for bulls is that Donald Trump’s approval rating recovered to 51% among likely U.S. voters in a recent poll. The caveat is that this poll came Rasmussen, which critics allege is sometimes too friendly to Republicans.

Watch: Are Trump’s Polls Really as They Bad as They Look?

While the president is still in a deep hole versus Joe Biden , a close-fought race would reduce the risk of what investors believe would be the worst outcome for markets: a Democratic sweep.

Dow 30 Stocks: Apple & Microsoft Carry the Index

As the Dow 30 sauntered higher, big tech fanned the updraft lifting the index.

Given its 11% weighting in the DJIA , Apple stock’s 2.8% gain accounted for a massive slice of the rally. A monster 4.5% move in Microsoft stock gave the Dow further support.

The $1.6 trillion software giant is making an uncharacteristically-splashy move to swoop up a piece of TikTok. The app’s China-based developer has its back against the wall if it hopes to continue operating in the U.S. Investors believe this could deliver MSFT a very lucrative opportunity.

Watch: Wall Street Believes TikTok Is a Slam Dunk For Microsoft

Most of the other moves in the Dow were less dramatic, though Boeing secured an impressive 3% rally.

Coca-Cola was the worst-performing stock in the index, suffering a 1.8% loss.