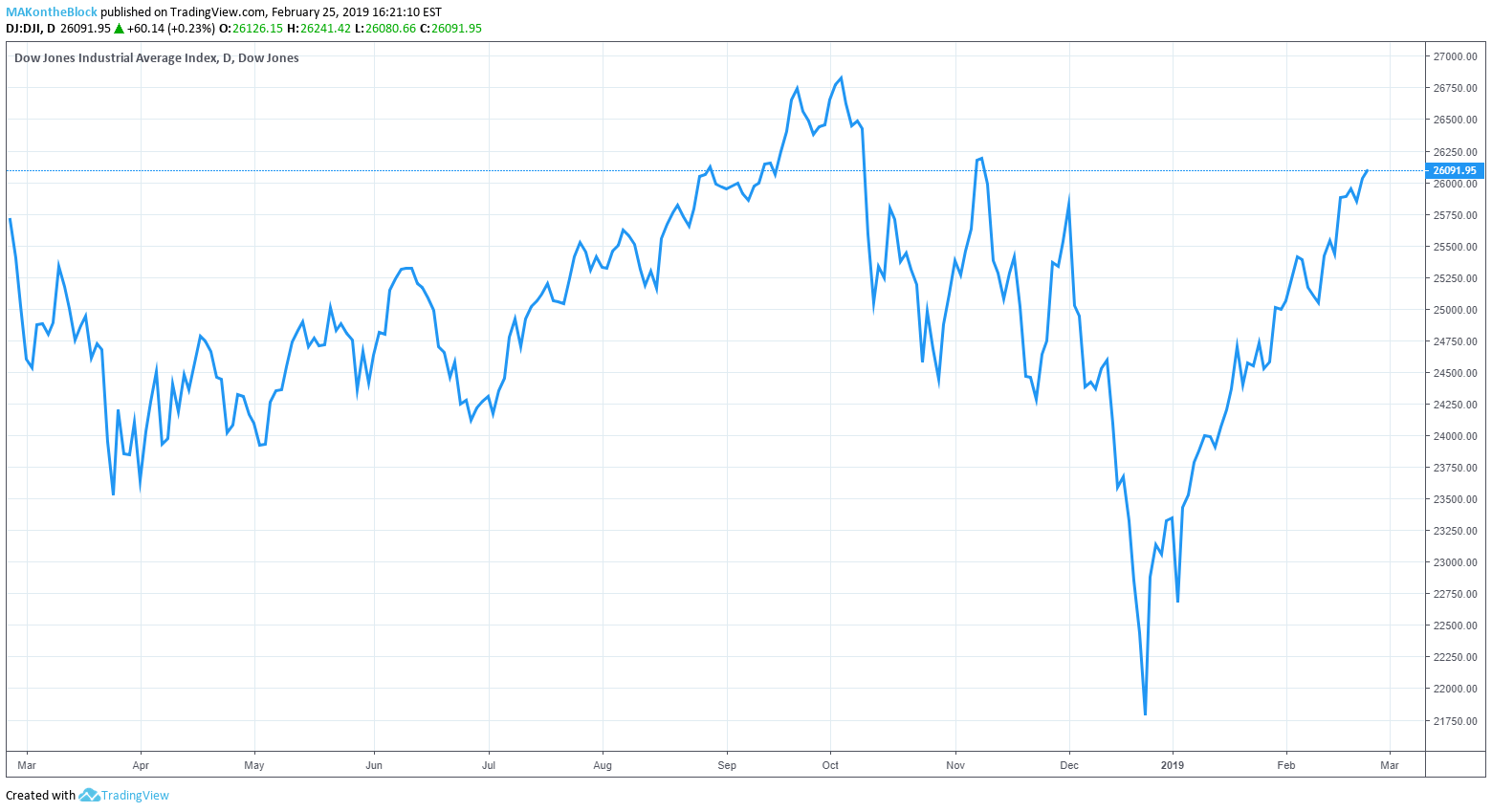

2019 Dow Recovery ‘Nothing More Than a Bear Market Rally’

Investors might not want to trust the mammoth recovery seen by the Dow Jones and other US stock market indices. | Source: Shutterstock

The Dow Jones Industrial Average and wider US stock market have made extraordinary recoveries in 2019, but several equities analysts warn that stocks remain firmly in a bear market.

Stock Market Recoveries Following Sell-Offs Are Head Fakes

A former adviser to the president of the Dallas Federal Reserve, Danielle DiMartino Booth , wrote in a Bloomberg op-ed that the Dow’s push past 26,000 from its late December low is just a “head fake.”

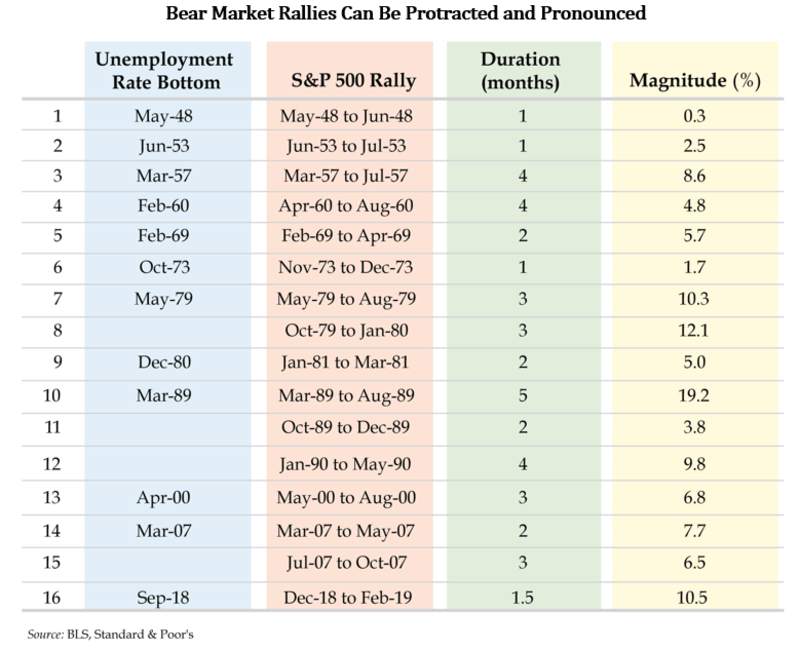

“History is replete with examples of major recoveries following big sell-offs, many of which turn out to be head fakes otherwise known as bear market rallies.”

She notes that AdMacro Ltd warned its clients that the January jobs report of 304,000 new jobs looked good but hid a recession signal. The US unemployment rate actually rose to 4%, the highest since June 2018.

January data from Challenger, Gray & Christmas points to layoffs rising for six months, compared to previous year’s data. Increased layoffs could be due to mergers and acquisitions, one strategy companies follow to reduce costs.

Commenting on these statistics, DiMartino Booth wrote:

“Every time the three-month average unemployment rate exceeded its six-month average at cycle peaks over the past 50 years — like it did in January — the U.S. economy has experienced a recession.”

Dow Jones and US Stock Market in Trouble

Wall Street strategists speculated earlier this month that an “earnings recession ” might be due. US companies could be about to experience two consecutive quarters of profit reductions. Analysts are increasingly lowering forecasts downward. Apple’s shock revisions earlier this year are a prime example.

DiMartino Booth says automotive dealers have too much stock, leading to a contraction in automotive production in January 2019. This impacts the Midwest, a stalwart of economic growth recently. Federal Reserve data says motor vehicle and parts manufacturing has pivoted from 8.4% growth to a 0.7% contraction in January.

Tax refunds are also down, and even more Fed data says consumer account balances are rising, a sign of slowing spending. The author says:

“It is not at all unusual to see protracted and magnificent surges punctuate bear markets. In the five months through August 1989, the S&P 500 rallied 19.2 percent before backsliding.”

‘Nothing More Than a Bear Market Rally’

Crescat Capital issued a note to their investors last week with a similar sentiment. It warns:

“We believe September of 2018 marked the essential peak of the US stock market for the current economic cycle.”

The analysts predict a bear market for 2019 and a global recession which “will not be officially acknowledged until well after it began.”

Crescat says stocks are potentially overvalued, earnings are fallingj, and economic indicators are “deteriorating.”

“Our analysis shows that when the Fed halts and/or reverses its monetary tightening late in a business cycle… it is not a bullish signal at all. Instead, it is a reliable sign that we are in the early stages of a macro downturn that can often very quickly lead to recession.”

The US Federal Reserve’s promise to be “patient” in regard to future interest rate hikes was indeed the catalyst to the current stock market recovery. Combined with trade-talk optimism, Crescat Capital says:

“We are highly confident that what we have seen year to date in 2019 is nothing more than a bear market rally.”

Both Federal Reserve activity – including the reduction of its bonds balance sheet – and economic decline in China could be the “beginning of the bursting of the everything bubble.”

Do You Trust the Dow’s 2019 Bounce?

The Dow Jones and wider US stock market continues to show aggregate gains for 2019. Some expect the markets to rally further as the prospect of a positive trade deal between the US and China grows.

But, is this surge indeed a bear market rally, and – if so – will it be followed by the recession naysayers expect?

Featured Image from Shutterstock