Dow Leaps Higher as Chinese Stock Market Closes Best Day in 3 Years

Both the Chinese and U.S. stock markets jumped higher on Monday after Donald Trump delayed the trade deal deadline. | Source: REUTERS / Stringer

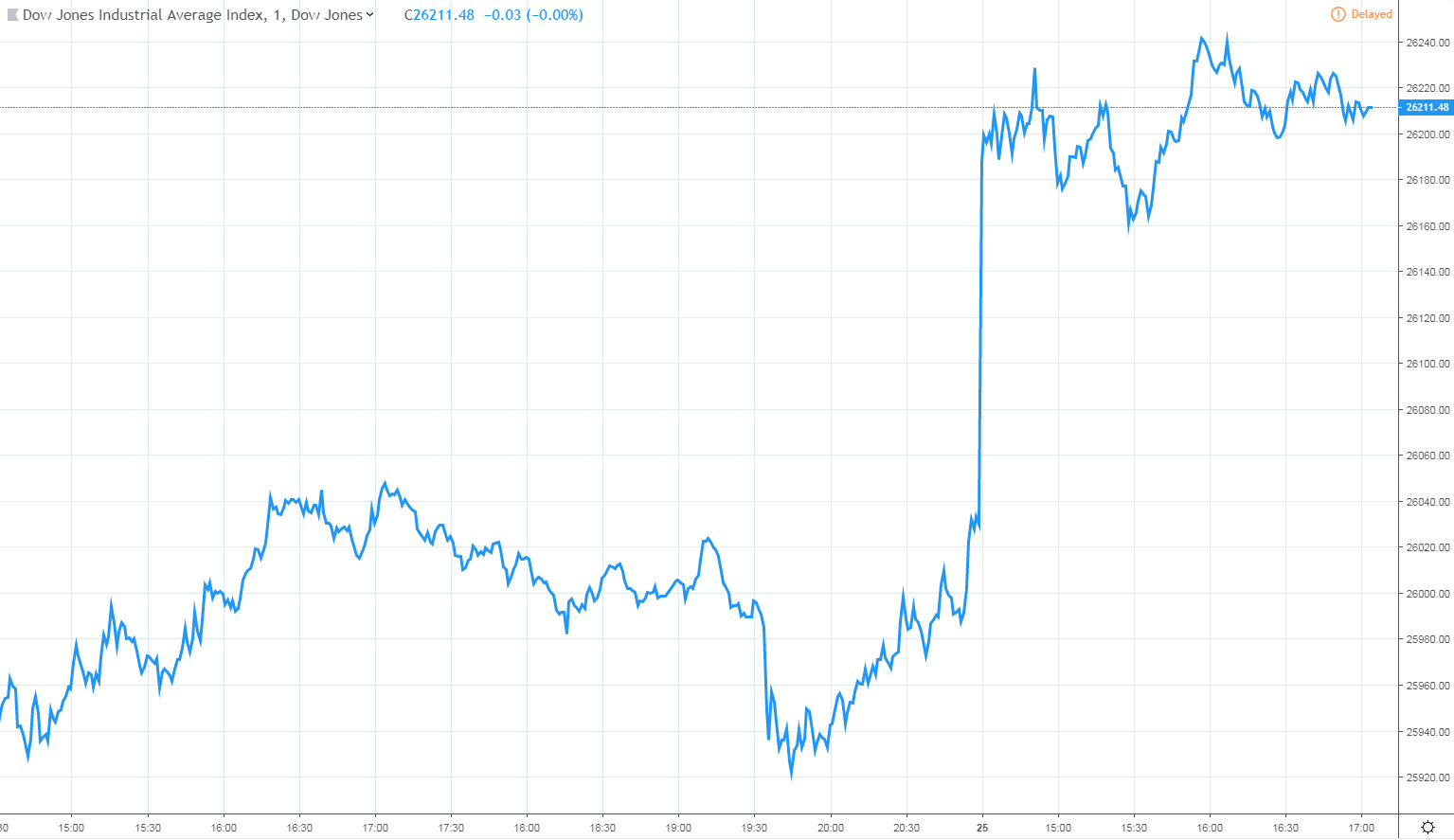

The Dow and overall U.S. stock market surged on Monday after President Trump confirmed that he would extend trade negotiations with China and hold off on a planned tariff hike early next month.

Dow Extends Bullish Revival; S&P 500 & Nasdaq Follow

All of Wall Street’s major indexes reported gains at the beginning of the week, reflecting a strong pre-market for Dow futures. The Dow Jones Industrial Average climbed 179 points, or 0.7%, to 26,211.48. The blue-chip index is coming off its ninth straight weekly gain.

The broader S&P 500 Index rose 0.5% to 2,807.60, with eight of 11 primary sectors adding to the rally. Financials stocks outperformed the market, gaining 1.3% as a collective. Shares of industrials and information technology companies rose by at least 0.8%. On the opposite side of the ledger, utilities stocks fell 0.7%.

A strong performance in technology lifted the Nasdaq Composite Index to significant gains. The tech-driven average rose 0.7% to 7,579.42.

Wall Street and global equity markets surged at the start of the week after President Trump and China’s Xinhua news agency touted significant progress in bilateral trade negotiations. In a tweet, Trump said he would plan a summit with Chinese President Xi Jinping to “conclude an agreement” so long as both sides continue to make progress.

The most encouraging aspect of the talks centered on the issue of technology transfer, intellectual property protection, and currency manipulation. The latter two issues form the basis of criminal charges against Huawei Technologies Corp, the Chinese telecom giant being accused by U.S. lawmakers of stealing intellectual property and encouraging their employees to do the same. The Trump administration has further accused China of undervaluing the yuan to gain an unfair trading advantage but has stopped short of labeling it a ‘currency manipulator.’

Related: Bye Bye Trade War? China Plans $1 Trillion Buying Spree to Reduce US Trade Deficit.

Chinese Bull Market Returns

Signs of progress on trade propelled Chinese stocks to their best day in three years. The benchmark Shanghai Composite Index surged 5.6% on Monday to close at 2,961.28, its biggest percentage gain since July 2015. The gains officially lifted the index into a bull market, which is defined as a gain of at least 20% from a recent low.

The Shanghai Shenzhen CSI 300 Index climbed 6% to 3,729.48. Hong Kong’s Hang Seng Index rallied 0.5% to 28,959.30.

Chinese investors are breathing a collective sigh of relief following a year of bloodshed for mainland markets. China’s equity markets took a beating in 2018 from fears of a slowing domestic economy and escalating trade war with the United States. Although trade talks have allayed some of those fears, the world’s second-largest economy is mired in a multi-year slowdown that is expected to intensify in the near term.

In 2018, China’s gross domestic product (GDP) expanded 6.6%, down from 6.8% the previous year and the slowest rate of expansion in almost three decades.

Featured image courtesy of REUTERS / Stringer. Chart via TradingView.