Dow Teeters as ANOTHER Government Shutdown Threatens Economy

The Dow teetered on Thursday as a confluence of bearish factors - including a looming government shutdown - spooked Wall Street. | Source: Shutterstock

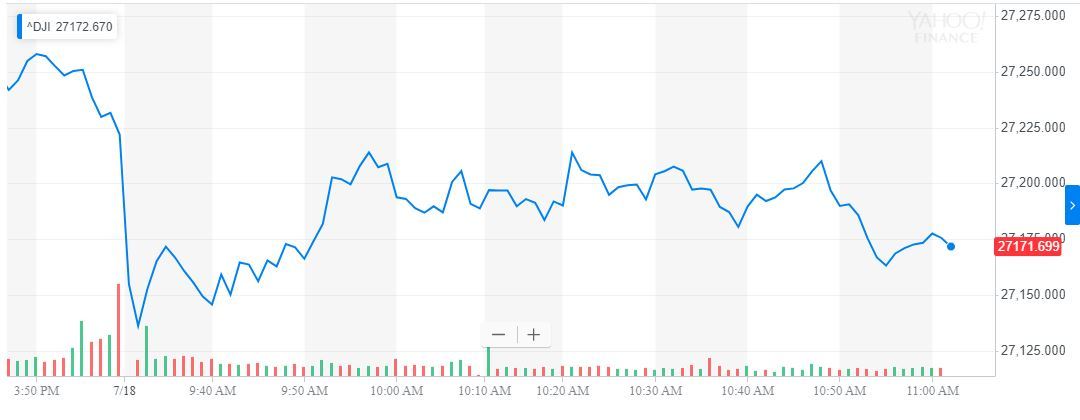

The Dow and US stock market risked falling for a third consecutive day as a confluence of bearish factors tested Wall Street’s fortitude.

Disappointing earnings, “complicated issues” stalling US-China trade negotiations, and the threat of another crippling government shutdown all roiled the markets on Thursday.

Dow slides toward a third straight loss

The Dow, S&P 500, and Nasdaq all flashed red during the morning session. The Dow Jones Industrial Average declined 58.24 points or 0.21%, reducing the DJIA to 27,161.61.

The S&P 500 traded sideways but remained well below the 3,000 mark. The index last traded at 2,984.22 for a razor-thin loss of 0.13 points.

The Nasdaq tracked with the Dow, declining 0.21% or 18.09 points to 8,167.12.

Will the US economy suffer another government shutdown?

All eyes on Wall Street remain fixed on US Treasury Secretary Steven Mnuchin as he juggles multiple major threats to the US economy.

Chief among these risks is the potential for another government shutdown . Mnuchin recently revealed that the US government has burned through almost all of its cash. He asked Congress to raise the debt ceiling so that the Treasury can continue to write checks without defaulting on its obligations when the well runs dry in September.

However, congressional Democrats led by House Speaker Nancy Pelosi refused to raise the debt ceiling without a more robust budget agreement.

While the White House and Congress technically have more than a month to negotiate a spending agreement, the legislature is scheduled to go on recess in just eight days. Speaker Pelosi has said that they must strike a deal by Friday or else lawmakers will not have time to pass it before they head back to their districts for the month of August.

Mnuchin claims that the Trump administration and congressional leaders have reached a tentative consensus on “top-line” budget matters, according to the Wall Street Journal . He said that investors should not be concerned about a government shutdown – or the havoc it could wreak on the Dow and broader stock market.

“I don’t think the markets should be concerned,” he said. “I think that everybody is in agreement that we won’t do anything that puts the U.S. government at risk in terms of our issue of defaulting. I think that nobody wants a shutdown in any scenario.”

However, just one day prior an unnamed Trump administration official told the Washington Post and Politico that the two sides have a “way to go ” to reach a deal.

‘Complicated issues’ loom over US-China trade talks

Concurrently, Mnuchin and US Trade Representative Robert Lighthizer are trying to salvage the US-China trade talks, which remain contentious even after Trump and Xi agreed to resume negotiations.

Mnuchin and Lighthizer plan to speak on the phone with Beijing on Thursday, but the Treasury secretary conceded in a CNBC interview that “complicated issues” continue to stunt progress.

That’s a much more sober take than he delivered last month when he seemed to suggest that negotiators could more or less pick up where they left off when relations grew frosty in May.

“We were about 90% of the way there and I think there’s a path to complete this,” he said.

Earnings batter stocks

Investor fears compounded on Thursday following indications that corporate earnings season will turn out even worse than analysts had expected.

The poster-child for this trend is Netflix, whose stock cratered after it revealed that it had lost US subscribers following a price increase.

Click here for a real-time Dow Jones Industrial Average price chart.