Dow Rockets but ‘Big Short’ Recession Oracle Warns: ‘It’s a Bubble’

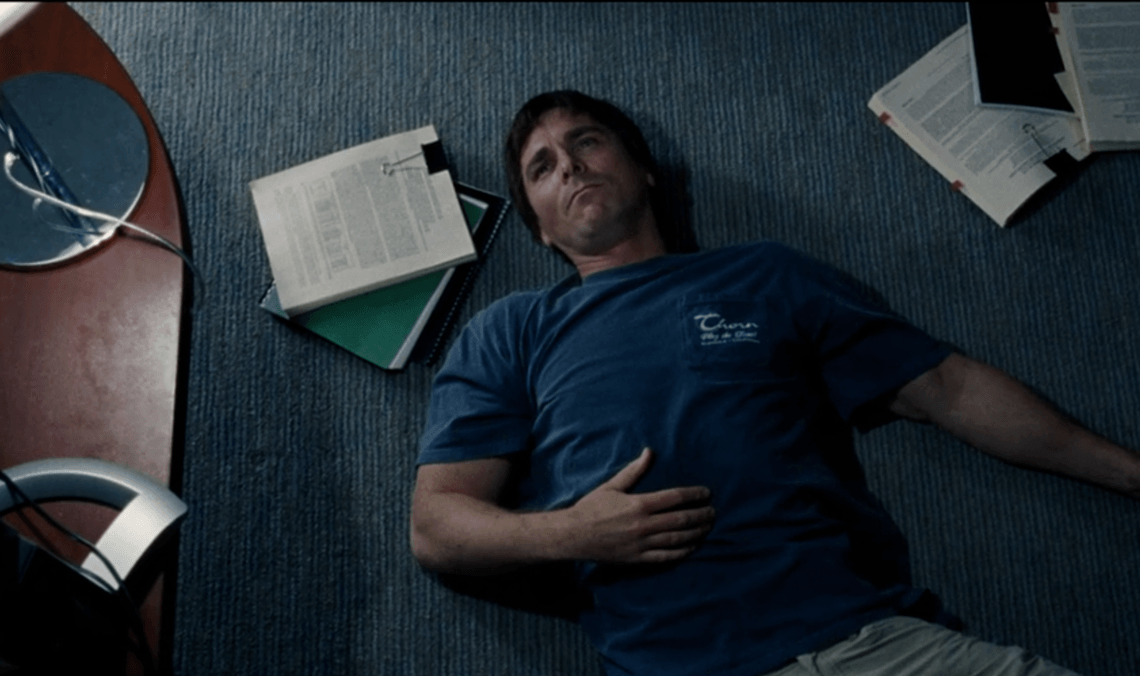

The longer the bubble, the worse the crash will be, warns 'The Big Short' analyst who called the 2008 recession. | Source: Regency Enterprises and Paramount Pictures

The Dow Jones Industrial Average is set to open 250 points on Thursday after China and the US scheduled new trade talks for October. But don’t be fooled, the inflated stock market is a bubble, according to Michael Burry.

Burry, portrayed by Christian Bale in the movie The Big Short, famously predicted the housing bubble and subsequent recession in 2008. His biggest concern right now is passive investing in index funds, like Dow Jones exchange-traded funds (ETFs). Speaking to Bloomberg , Burry didn’t offer a timeline for the collapse but warned:

“Like most bubbles, the longer it goes on, the worse the crash will be.”

Dow to open 250 points higher

At 8.31 am ET, Dow Jones Industrial Average (DJIA) futures jumped 244 points pointing to a strong open on Wall Street. The move higher was mirrored by S&P 500 futures and Nasdaq Composite futures.

The early rise was triggered by news that China and the US will sit down in October to hash out the next round of trade negotiations. China’s Ministry of Commerce confirmed that talks were ongoing with a view to meeting in Washington DC in early October.

It’s “very much like the 2008 bubble”

Despite the spirited rally in stocks this week, Michael Burry sees a different outcome. He said the true valuation of the stock market is completely distorted by the trillions of dollars flowing through index funds. A total of 50 percent of stock allocations are now in passive funds.

In other words, Wall Street is no longer picking stocks based on rational, fundamental valuations. Instead, they’re allocating trillions to passive funds which track the entire market as one.

“This is very much like the bubble in synthetic asset-backed CDOs before the Great Financial Crisis in that price-setting in that market was not done by fundamental security-level analysis.”

Burry famously saw the housing bubble before anyone else and profited by shorting the CDOs. In the same way that CDOs disguised the true values of US mortgages, today’s ETFs disguise the true valuations of the underlying stocks.

Dow at risk of collapse?

Burry isn’t the first money manager to express concern over the inflated stock market. As CCN.com reported, there are nine recession alarms flashing red, while Wall Street giant UBS advised clients to wind down their stock positions.

With the stock market in bubble territory, where does Michael Burry see value? In small-cap stocks. Since they don’t feature heavily in passive funds and ETFs, they’re undervalued in his opinion.

This article was updated at 8.31 am ET to reflect updated price movements.