Dow Futures Points to New Record High. Next Stop? Navarro’s 30,000 Target

The Dow hit a new milestone after closing before the weekend at 28,000. | Source: Photo by Johannes EISELE / AFP

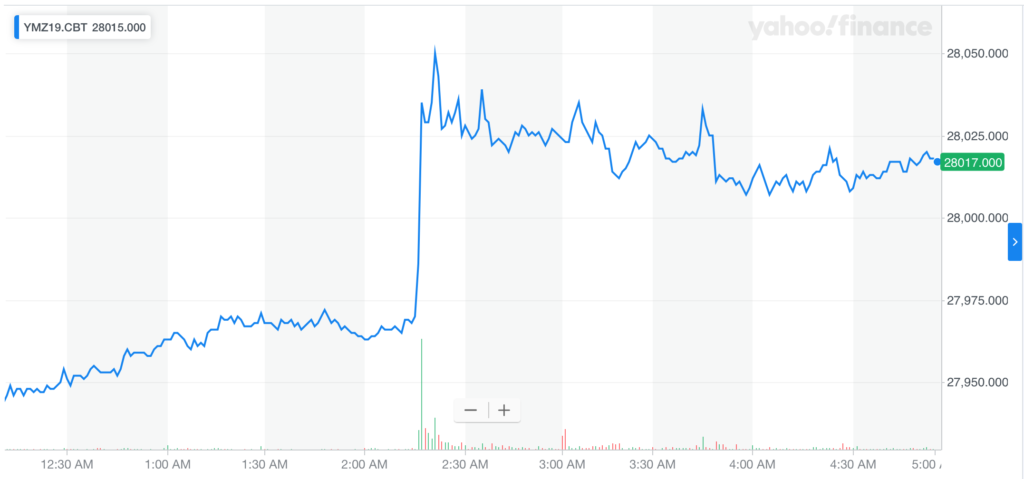

- Dow Jones Industrial Average (DJIA) futures point to a record-breaking stock market open above 28,000.

- White House advisor Peter Navarro predicts a comfortable rise to 30,000 in the coming months.

- Some optimistic analysts see a “generational top” of 40,000.

Dow Jones Industrial Average (DJIA) futures point to another record-breaking day on Wall Street. The Dow is poised to open above 28,000 for the first time ever, carving out a new stock market record.

Peter Navarro, assistant to President Trump and director of trade and manufacturing policy, thinks the stock market rally is just getting started . Having broken the psychological 28,000 mark, he sees an inevitable higher.

We could get Dow up to 30,000.

Dow futures point to fresh record high

Dow futures contracts climbed 61 points in early trading Monday, looking to extend last week’s stellar run on the stock market. The Dow’s implied open is now at a record high, above 28,000.

S&P 500 futures and Nasdaq Composite futures rose 0.17% and 0.24% respectively. Bitcoin traded at $8,455.

Navarro: Dow could hit 30,000 “with a little help”

In order to hit the benchmark 30,000, the US stock market will need a fresh catalyst. Perhaps a conclusion to the US-China trade deal?

Navarro thinks the answer lies closer to home, in the new trade deal between Mexico, Canada, and the US.

What we need here is a little help from our friends and maybe not so much friends. Nancy Pelosi needs to put the US-Mexico-Canada (trade) agreement on the floor. I think people need to know that that deal is far more important than the China deal in the scheme of things. It is twice the volume of trade and five-times the exports.

Trump ripped up the former NAFTA treaty and a replacement trade deal is “imminent” according to Pelosi .

I do believe that if we can get this to the place it needs to be, which is imminent, that this can be a template for future trade agreements, a good template.

Ultimately, it could this trade deal that pushes the Dow to 30,000, not the China deal.

What about Dow 40,000?

Even 30,000 once seemed like an impossible benchmark, but some analysts are looking further ahead. Yves Lamoureux, president of research firm Lamoureux & Co., thinks 40,000 is now in play .

What I’m expecting…is another big move, in which people really go nuts. That’s what’s kind of missing here.

Lamoureux thinks we haven’t yet entered the ‘euphoria’ period typical of late-stage bull runs. Once a “generational top” of 40,000 is achieved, he says, there will be an epic plateau stretching as long as a decade.

Factors in play this week

All eyes remain on the China-US trade negotiations going into this week. US Treasury Secretary Stephen Mnuchin reportedly held “constructive” calls with Chinese chief negotiator Liu He over the weekend, boosting trader sentiment.