Dow Plunges but History Awaits ‘Spectacular’ 20% Stock Pump

The Dow is caught reeling from Beijing's latest blow on Trump's trade deal. | Source: AP Photo/Richard Drew

- The Dow Jones Industrial Average (DJIA) plunged 152 points on Thursday.

- The drop comes despite the Federal Reserve’s generous 0.25% cut in the benchmark interest rate yesterday. The third cut in as many meetings.

- Historically, the stock market has returned 20% in the 12 months after a triple-cut.

The Dow Jones Industrial Average (DJIA) suffered a painful stock market open on Thursday, triggered by a Bloomberg report that poured cold water on hopes for a full trade deal between Trump and China.

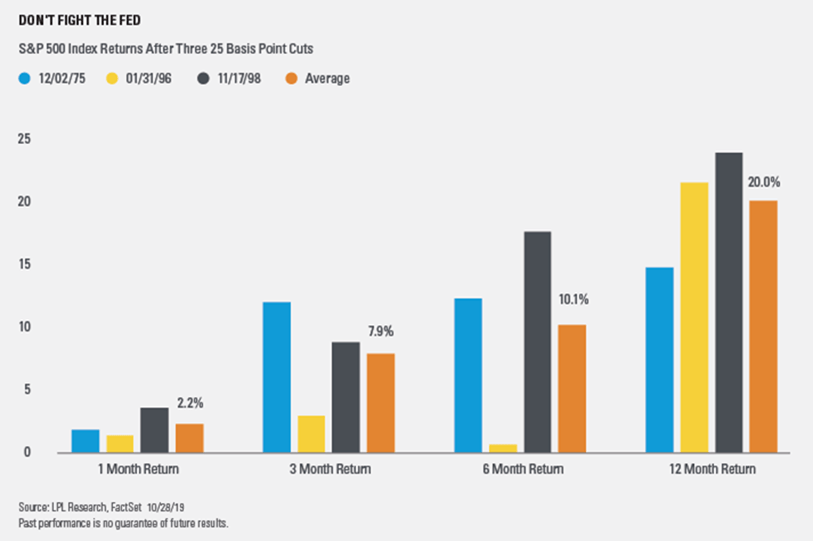

However, the long-term horizon could still be a boon for stocks if history repeats itself. With the Federal Reserve slashing the benchmark interest rate for a third-straight time on Wednesday, LPL Financial crunched the numbers to see how the stock market reacted after previous triple cuts.

The simple answer is: “spectacular.”

“How good have returns been in those periods in which the Fed has delivered a trio of interest rate cuts of 25 basis points? They have been spectacular in the 6-and-12 month period following those decisions by the rate-setting Federal Open Market Committee” – Mark DeCambre, MarketWatch.

Dow Jones collapses 152 points

The DJIA dipped 152 points at 10.19 am ET on reports that China has severe doubts that a long-term trade deal can be reached.

The S&P 500 and Nasdaq Composite saw similar plunges. Bitcoin fell below the $9k mark to $8,997.

Spectacular stock market gains of 20% after triple rate cuts

Every time the Federal Reserve has intervened to lower interest rates three times in a row, the near-term and long-term returns have been positive. Combining data from 1975, 1996 and 1998, LPL Financial calculated the following average gains after the third cut:

- 1 month: 2.2%

- 3 month: 7.9%

- 6 month: 10%

- 12 month: 20%

Jerome Powell’s Fed struck a cautious tone about future rate cuts, but futures traders are already beginning to price in further cuts going into 2020 . The Fed’s official wording explained:

“The Committee will continue to monitor the implications of incoming information for the economic outlook as it assesses the appropriate path of the target range for the federal funds rate.”

Counter argument: Dow faces new challenges this time

While history predicts a 20% stock market spike in the coming year, market conditions are very different in 2019 going into 2020. The S&P 500 is already at all-time highs, with the Dow and Nasdaq just shy of the mark.

Larger macro issues also plague investor sentiment and growth prospects. The uncertainty of Trump’s trade deal with China, the looming 2020 presidential election and the seemingly endless torture of Brexit negotiations, for example.

While traders would be well advised to follow LPL’s advice to “not fight the Fed,” the upside may be more limited than in previous rate-cut cycles.

This article was updated at 10.23 am ET to reflect current prices.