Dow Futures Hop Higher as House Clips Trump’s Iran War Wings

The House is shackling Donald Trump from engaging in any additional military action in Iran as positive economic data buoys markets. | Source: AP Photo/ Jacquelyn Martin

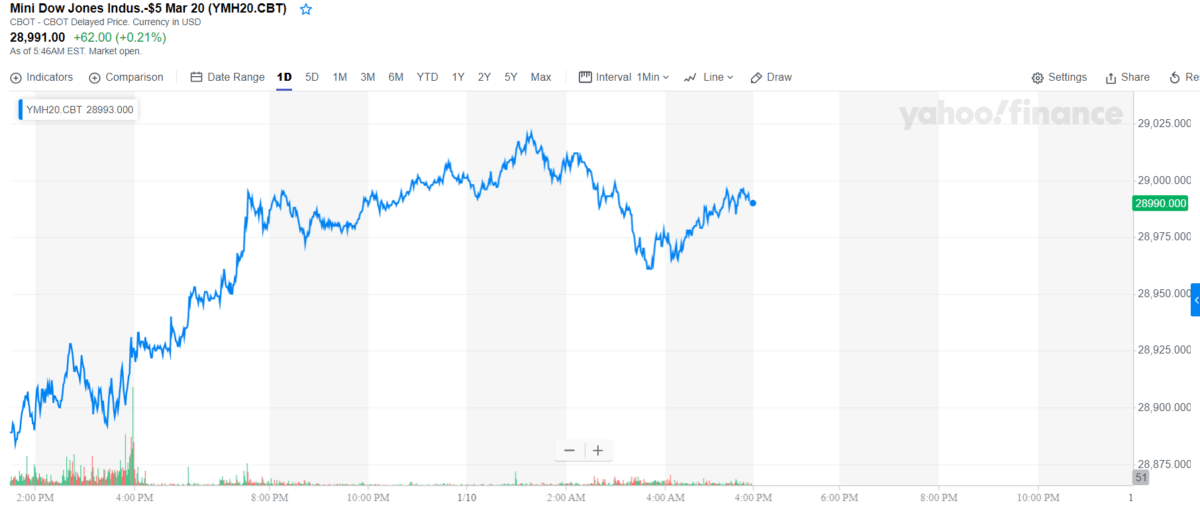

- Dow Jones Industrial Average futures are higher Friday morning.

- The US House of Representatives is trying to curb Trump’s authority.

- Positive economic data could be a tailwind for the stock market today.

Dow Jones Industrial Average (DJIA) futures are up early Friday morning after the U.S. House of Representatives clipped President Trump’s wings. The House passed a resolution yesterday that would limit Trump’s ability to wage a war on Iran. The resolution passed the Democrat-controlled House with a vote of 224-194.

https://twitter.com/indusdotnews/status/1215579496826523648

The measure – if passed by the Republican-controlled Senate – would require Trump to seek approval of the Congress to go to war if tensions with Iran rise. But Trump would have the authority to go to war with Iran without congressional approval in case there is an imminent threat of attack from the latter. The good news for the Dow is that there appears to be no imminent threat of war.

The Dow Jones has been soaring over the past couple of sessions as tensions with Iran have been on the wane. Trump has indicated that he is against armed conflict, and is instead opting for more economic sanctions on Iran.

Iran, on the other hand, is also looking to tone down the rhetoric and is inviting third-parties to mediate.

Dow futures jump as tensions in the Middle East decrease

The de-escalation of a potential armed conflict between the U.S. and Iran could lead to a higher stock market open today. Dow futures are up 62 points, or 0.21 percent, as of 5.46 am ET.

Futures on the S&P 500 are also up 0.24 percent, while Nasdaq Composite futures are up 0.37 percent.

Positive economic data could be a tailwind for the stock market

Declining U.S.-Iran tensions might not be the only catalyst for the Dow and the broader stock market today. A couple of important data points indicating the health of the U.S. economy are set to be released today.

Nonfarm payrolls data will be released at 8.30 AM ET today. According to a poll of economists by Dow Jones, nonfarm payrolls in December are expected to increase by 160,000, down from November’s impressive gains of 266,000.

The indications for the US job market have been positive of late. According to ADP’s non-farm employment numbers, the private sector added 202,000 jobs last month, beating the forecast by a margin of 42,000.

December’s unemployment figures will also be released along with the nonfarm payrolls report. A better-than-expected performance on that front could buoy the Dow and the broader stock market as it would mean that the state of employment in the U.S. is strong.

But there’s one thing that could temper the Dow’s potential gains today. President Trump had earlier indicated that he will soon begin negotiating on a phase two trade deal between the U.S. and China. He now seems to be dialing down, warning that the market might have to wait until after the 2020 election before the next phase of a deal is reached.

This statement could erode some of the stock market’s enthusiasm and temper the Dow’s latest rally. But continued progress on the U.S.-Iran front and a spate of positive economic data should prove to be a catalyst for the market today.