Dow Futures Gains Nervously as China Puts 10 Cities on Coronavirus Lockdown

Over two dozen people have now died after being infected by the coronavirus spread as China restricts tens of millions of people on lockdown on the eve of the Lunar New Year. | Source: AFP/Ben Stansall

- Dow futures rose Friday, unintimidated by the deadly respiratory disease threatening China.

- The death toll from coronavirus is now approaching 30 people in China.

- A UN health agency panel responsible for declaring global health emergencies narrowly voted against declaring the virus an international concern.

The Dow Jones Industrial Average Index commanded a cautious upside move Friday as more Chinese cities came under travel restrictions. The death toll in China from the coronavirus outbreak has now risen to 26 . Travel restrictions were consequently imposed across 10 cities. Some 40 million citizens will reportedly be impacted by the quarantine.

Dow Futures Rise Cautiously

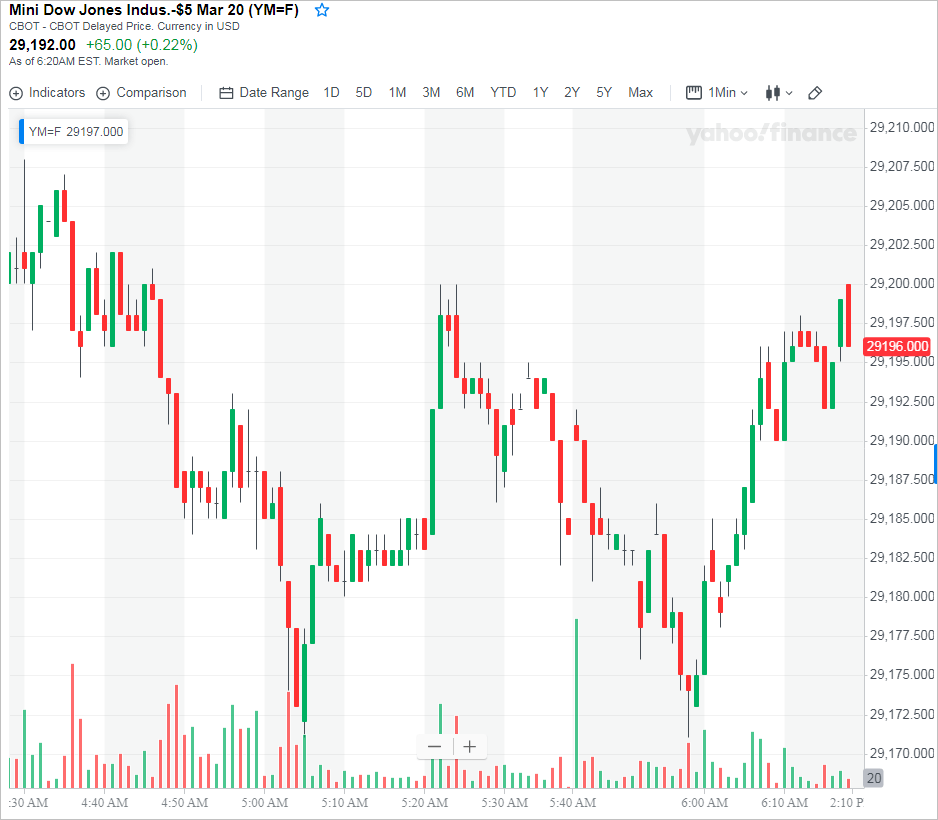

After closing Thursday at 29,160 points, Dow futures rose tepidly by 0.22% on Friday brushing aside fears of a global coronavirus contagion.

The cautious rise comes after the Dow closed in the red on Thursday. The Shanghai SE Composite Index lost nearly three percentage points on Thursday. Hong Kong’s Hang Seng index closed in the green though as did other Asian indices such as the Nikkei 225 and the Taiwan TSEC 50 Index.

Although the WHO claimed the Coronavirus is not a global health emergency, more cases are being reported beyond Chinese borders. In South Korea, for instance, a second case was reported on Friday.

Divisions at the WHO have been brought to the limelight as well. Though the WHO stated that it was too early to call it a “public health emergency of international concern”, the chair of the UN health agency’s emergency advisory committee Didier Houssin revealed that the panel had been divided on the matter on an “almost 50-50” basis .

S&P 500 and Nasdaq Futures Gain Despite Trade Deal ‘Disaster’

Other US index futures also rose weakly on Friday. The S&P Futures edged up by 0.21% while Nasdaq Futures rose by 0.33%. With the Nasdaq having closed at a record high on Thursday, the tech-heavy index could break yet another record on Friday if it sustains the upward trajectory.

The cautious moves by the main US indixes comes on the back of some experts at the World Economic Forum labeling the US-China phase one trade deal as a “disaster” . The signing of the deal earlier this month had brought relief to the markets.

During a panel discussion at Davos, the chairman of Asian conglomerate Far East Consortium, David Chiu, stated that the U.S. was taking on China at the “wrong time” as the leverage that existed ten years ago is no longer there.