Dow Crashes as Moody’s Reveals 16 Fatal Recession Triggers

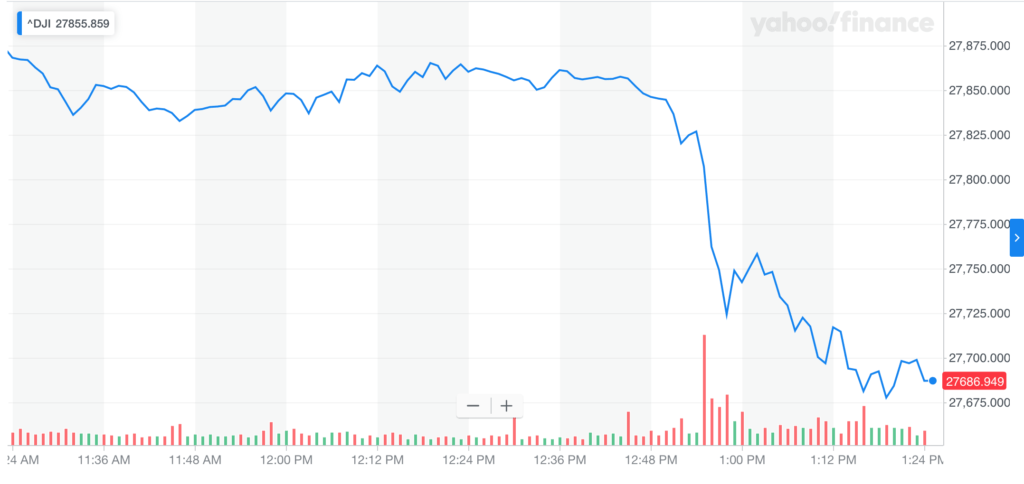

There are recession bells going off around the world and as the Dow takes a triple-digit plunge. | Source: AP Photo/Seth Wenig

- The Dow Jones Industrial Average (DJIA) dropped 236 points on Wednesday.

- Ratings agency Moody’s issued a ‘recession triggers’ chart with 16 high-risk events.

- The European Central Bank (ECB) also issued a warning over global growth.

The Dow Jones Industrial Average (DJIA) plunged 236 points on Wednesday, extending a second day of weakness on the stock market. As US-China talks disintegrate once again, Moody’s issued a gloomy assessment of the economy going into 2020.

In a note to investors, Moody’s chief economist Mark Zandi revealed a list of 16 events that could trigger a recession. Top of the list, as you might expect, is the ongoing trade war between US and China. If economic stagnation persists, Zandi warned that unemployment will quickly follow.

Zandi, speaking to Market Watch , said:

Recession risks for next year remain uncomfortably high. The economy is barely growing at its potential, which means unless growth picks up soon, unemployment will begin to rise.

Dow in triple-digit plunge

The Dow dumped 236 points as of 1.23 pm ET. Wall Street extends yesterday’s miserable trading session amidst a backdrop of US-China trade war confusion.

The S&P 500 and the Nasdaq fell 0.81% and 1.13% respectively. Bitcoin also traded lower at $8,068.

Recession risks, ranked according to risk and severity

Zandi ranked the recessionary triggers according to their likelihood and their potential impact on the economy. He ranks global trade war escalation at the top, both highly likely and severe in its impact.

He added:

If the president follows through on his threat to raise tariffs again on China in December, a recession next year is likely. However, if the president stands down and provides a clear path to winding down the tariffs, the economy will likely avoid a recession.

Other likely triggers include a manufacturing recession, escalating violence in Hong Kong, Trump’s impeachment and an equity market drawdown. These events, however, would have low-medium impact on the economy.

On the other end of the spectrum, the removal of Fed chairman Jerome Powell and the return of a European debt crisis would have a seismic impact on the global economy. However, these events are less likely.

The most concerning group are those in the middle of the chart; both likely and potential seismic. Zandi puts ‘central bank policy error,’ ’no deal Brexit,’ and ‘oil price shock’ in this bucket.

ECB adds more pressure to the Dow

If that weren’t enough doom and gloom for one day, the European Central Bank threw fuel on the fire this morning. In a fresh report, the central bank warned of “persistent downside risks” going into 2020 .

Specifically, the report highlighted the dramatic slowdown in European bank profitability (here’s looking at you, Deutsche Bank). The ECB also warned that investors were increasingly taking high risks.

Downside risks to global and euro area economic growth have increased and continue to create financial stability challenges.