Dow Flash Crash Will Intensify Unless Beijing Cuts the B.S.

The Dow's bloodbath could get even worse if Beijing refuses to cut the B.S. | Source: Shutterstock

By CCN.com: The Dow and broader U.S. stock market’s sudden reversal on Monday could intensify if China continues to backtrack on a new trade deal. As President Trump’s Twitter tirade revealed on Sunday, the White House won’t shy away from using tariffs to strangle China’s export industry.

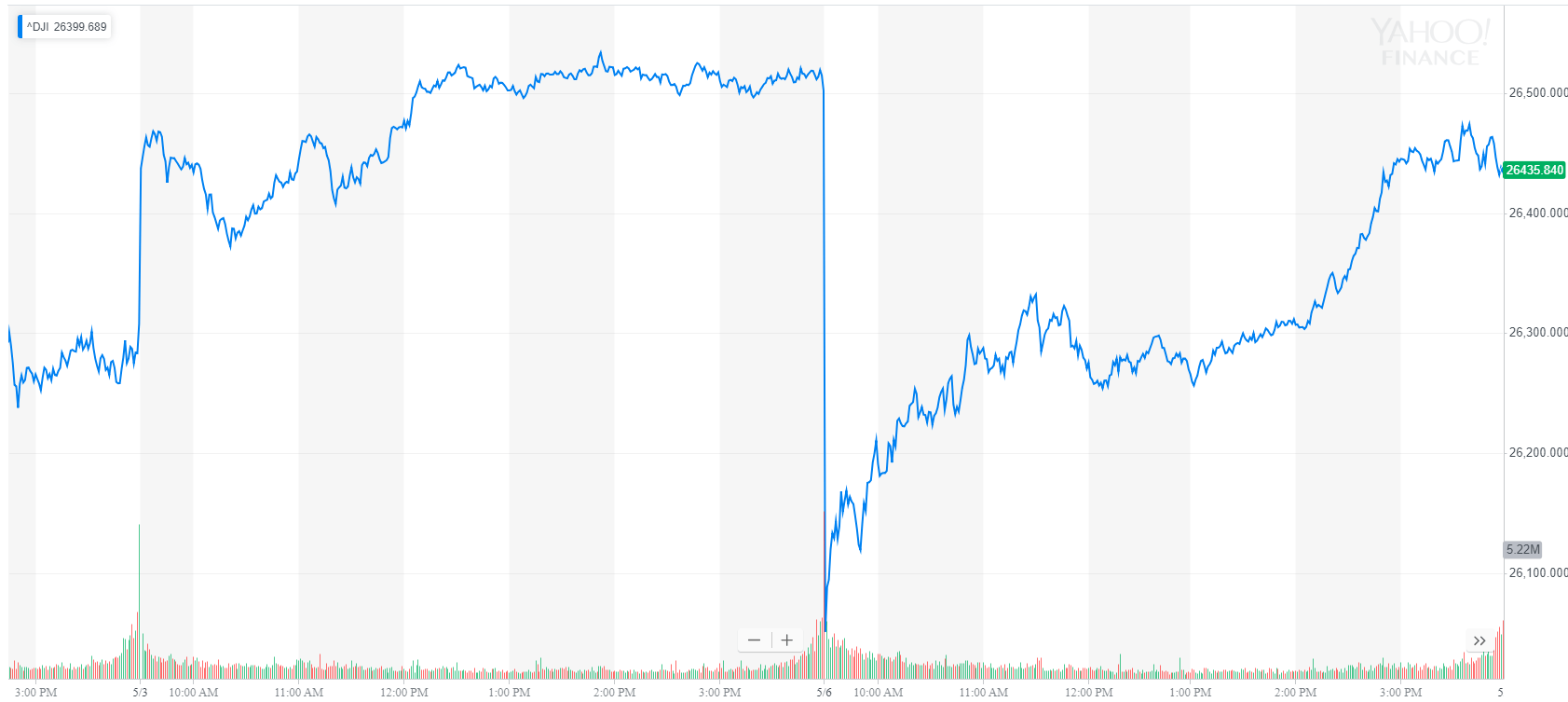

Dow Claws Back from Opening Bell Plunge; S&P 500, Nasdaq Follow

All of Wall Street’s equity benchmarks crashed after the open Monday, reflecting a brutal pre-market session for Dow futures. The Dow Jones Industrial Average declined by as much as 471 points and bottomed at 26,033.90. It would later pare the vast majority of those losses to settle down 66.47 points, or 0.3%, at 26,438.48.

The broad S&P 500 Index of large-cap stocks fell 0.5% to 2,932.47. It was off more than 1% earlier.

After setting a new record high on Friday, the technology-focused Nasdaq Composite Index declined 0.5% to 8,123.29.

The CBOE Volatility Index , commonly known as the VIX, spiked as much as 46% on Monday to reach the highest level since late January. The so-called “investor fear index” suggests investors should expect rocky market conditions over the next 30 days. By the late afternoon, the VI was up around 17%.

China Backtracks on Trade Deal

President Trump caught markets by surprise this weekend when he threatened additional tariffs on Chinese exports. In a series of Sunday tweets, Trump said he would apply the 25% import duty on $325 billion worth of Chinese goods. Currently, only $50 billion worth of Chinese goods are subject to that fee.

The Twitter tirade came after Trump’s top trade negotiator revealed to him that China was backtracking on a new trade deal following last week’s negotiations. As Bloomberg reports , Beijing is refusing to amend laws that force U.S. companies to share intellectual property when doing business in China. The Chinese delegation had previously agreed to amend such laws and reflect them in the official text of the agreement. Now, China appears to be backtracking.

For U.S. Trade Representative Robert Lighthizer, this is a clear sign that the matter of forced technology transfer hasn’t been settled. While China still plans to send a trade envoy to Washington this week, there are significant doubts about whether negotiations will take place.

China’s economy weathered the tariff-induced storm in the first quarter, growing slightly faster than expected. However, foreign direct investments are hurting, and as a net exporter to the U.S., its economy is unlikely to survive a trade war unscathed.

Click here for a real-time Dow Jones Industrial Average (DJIA) price chart.