Dow Booms on Fed Bailout, But Trump’s Ruthless Threats Spoil the Party

The Dow boomed after the Fed hinted that it would bail out the stock market, but more threats from Trump could spoil Wall Street's party. | Source: REUTERS / Jonathan Ernst

By CCN.com: The Dow bounced by triple digits for the second consecutive day on Wednesday, as the stock market looked to assemble a June winning streak to reverse the fallout from a brutal May.

However, as investors pine for a Federal Reserve “bailout,” Donald Trump’s latest international threats and scattershot economic strategy could once again spoil Wall Street’s party.

Dow Booms for Second Straight Day

All three major stock market indices jumped on Wednesday. As of 10:27 am ET, the Dow Jones Industrial Average had climbed 121.2 points or 0.48% to 25,453.38.

The S&P 500 added 6.07 points or 0.22% and last traded at 2,809.31.

The Nasdaq, meanwhile, underperformed; the tech-heavy index remained unchanged at 7,526.87 after giving up its earlier gains.

Federal Reserve Has No Choice But to ‘Bail Out’ Trump

It’s clear that Wall Street does not want the decade-long bull market to end, and traders continue to seize on every scrap of positive news to justify driving valuations higher.

The latest catalyst came courtesy of Federal Reserve Chair Jerome Powell, who appeared to signal that the central bank will (eventually) capitulate to White House demands for an interest rate cut.

Tim Duy, the senior director at the Oregon Economic Forum, wrote on his Fed Watch blog that the central bank is obligated to utilize every tool at its disposal to stave off a recession, even if it means bailing out Trump after the White House’s reckless policies hammer the Dow and broader stock market.

“[T]he Fed has little choice but to ‘bail out’ President Trump should his trade policies threaten the economy. That’s how it works. The Fed is not going to let the economy tumble into recession to punish Trump. That would simply be an instance of cutting off your nose to spite your face.”

The problem is that the ensuing recovery might only embolden President Trump, who views a strong stock market as a vindication of his unconventional approach to domestic governance and international diplomacy.

Just this week, Trump unleashed two ruthless threats that should concern investors, whether or not one agrees with them in principle.

Iran, Mexico Threats Should Worry Wall Street

First, he told ITV’s Good Morning Britain that there is “always a chance” his administration will pursue military action against Iran, even if that’s not the outcome he desires. That’s a measured statement, but remember that just last month he threatened to usher in the “official end of Iran.”

“If Iran wants to fight, that will be the official end of Iran. Never threaten the United States again!,” he tweeted on May 19.

Doubling down on his pot-stirring, Trump took to Twitter to assure Mexico that his shocking announcement that he would slap tariffs on Mexican imports was not a bluff.

“[N]o bluff,” he tweeted.

The first round of tariffs – 5% on all Mexican imports – will take effect on June 10, unless the White House reverses course. Trump claims the US will raise those tariffs as high as 25% to pressure Mexico into helping the US combat illegal border crossings.

Bullish Investors Ignore Thundering Alarm Bells

There’s also the lingering matter of Trump’s trade war with China. All-too-rare positive news on that front helped launch stocks higher on Tuesday, as Wall Street breathed a sigh of relief after Beijing signaled that it desires to return to the negotiating table.

Unfortunately, talks didn’t end so well the last time the two superpowers were at the negotiating table, and there’s no reason to believe that either side has had a fundamental change of heart.

These trade conflicts come at a steep cost, and the meter continues to spin.

According to Deutsche Bank, Trump’s trade wars have already cost the stock market $5 trillion in lost growth. That bill will swell much larger if his obsession with the US trade deficit ends up plunging the economy into a recession.

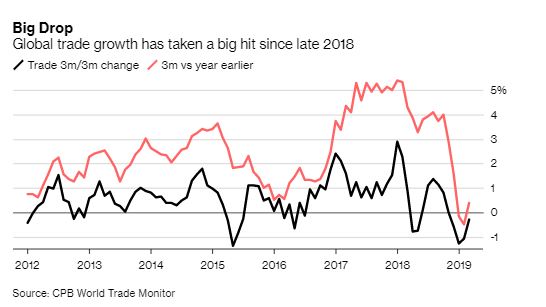

There’s ample evidence that they’re making a dent in global growth. Dutch bank ING estimates that worldwide trade could record its worst year since 2009 , when the economy found itself neck-deep in a brutal financial crisis.

The icing on the cake? Morgan Stanley researchers warn that the stock market is flashing an ironclad recession signal: an inverted yield curve, in which short-term Treasury yields exceed long-term Treasury yields. If this inversion – which is currently two weeks old – endures for a full month, a recession is virtually guaranteed, unless the market defies a 50-year trend.

Dow Looks to Build on Second-Best Rally of 2019

But Wall Street seems content to ignore these warnings, at least for a while longer, allowing the Dow to build on its early-week gains as it claws back from the 1,600 point hole it dug at the end of May.

On Tuesday, the stock market unleashed its second-best session of the year, launching all three major indices at least 2% higher.

The Dow surged a ridiculous 512.4 points or 2.06% to 25,332.18, not only clearing the psychologically-crucial 25,000 level but also providing it with some breathing room.

The S&P 500 also edged past a key level. The large-cap index climbed 58.82 points or 2.14% to close at 2,803.27.

The Nasdaq outperformed both the Dow and S&P 500. The tech bellwether soared 194.1 points or 2.65% to 7,527.12.

Click here for a real-time Dow Jones Industrial Average price chart.