Dow Energy Stocks Boom as Trump Shocks Oil Market

Two key energy stocks in the Dow Jones Industrial Average boomed on Monday after the Trump administration shocked the global oil market. | Source: AP/AFP. Image Edited by CCN.com.

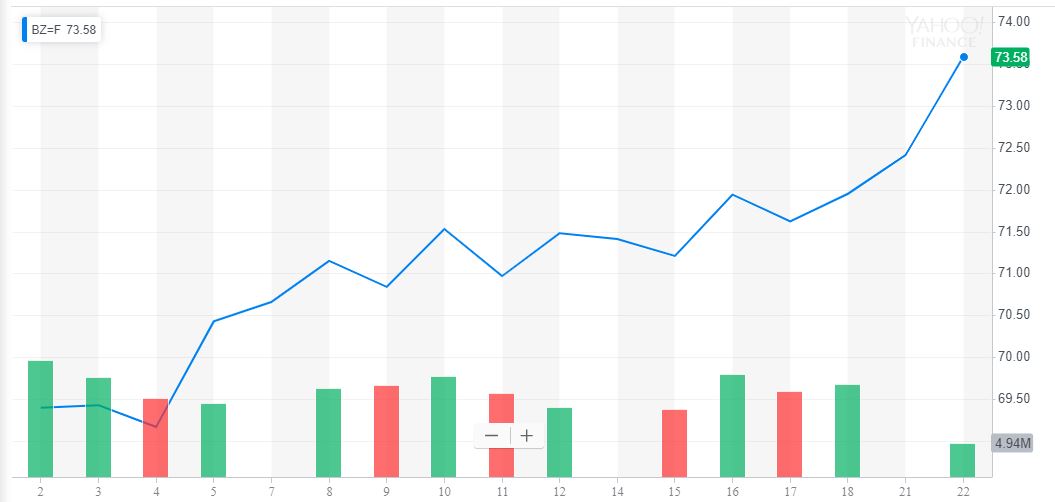

By CCN.com: The global energy market quaked on Monday after the Trump administration took aim at Iran, yanking lucrative sanctions exemptions with the explicit goal of bringing “Iran’s oil exports to zero.” As oil prices spike toward six-month highs, the stunning policy reversal has buoyed two key energy stocks in the Dow Jones Industrial Average.

Trump Yanks Sanctions Exemptions from Iran’s Oil Customers

https://www.youtube.com/watch?v=1fo7jiB1Aj0

The White House explained that it hoped to cripple the rogue Iranian regime by removing its “principal source of revenue.”

Previously, the Obama and Trump administrations had given special exemptions to major Iranian customers such as China, India, and South Korea, allowing them to continue importing Iranian oil without violating US sanctions on the Islamic republic.

No longer.

“President Donald J. Trump has decided not to reissue Significant Reduction Exceptions (SREs) when they expire in early May,” the White House said in a statement. “This decision is intended to bring Iran’s oil exports to zero, denying the regime its principal source of revenue.”

Oil prices surged on the unexpected news, which tightened the global crude supply at a time when prices had already been grinding higher.

That Trump caused oil prices to spike was more than a bit ironic, given that the president has put pressure on OPEC and other oil producers to ramp up crude output and give US consumers some relief at the gas pump.

Writing on Twitter, Trump continued to sing that same tune. He promised that the Saudi-led OPEC would “more than make up the Oil Flow difference in our now Full Sanctions on Iranian Oil.”

He also blamed former Secretary of State John Kerry for dragging the US into an uneasy political cease-fire with Iran in the first place.

Dow Energy Stocks Jump on Reduced Oil Supply

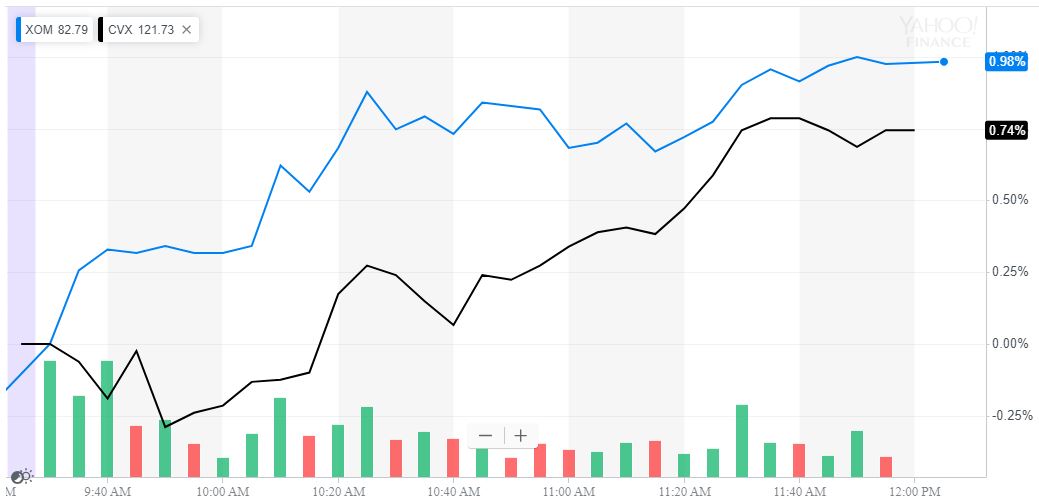

Regardless, the renewed sanctions push bolstered several key energy stocks in the Dow Jones Industrial Average, namely Exxon Mobil Corp and Chevron Corp.

Exxon earned the biggest bump, spiking 2.18 percent from last week’s close. XOM shares last traded at $82.90. Chevron, meanwhile, climbed 1.7 percent to $121.90.

However, the Chevron-Exxon bump had failed to launch the Dow into positive territory following a dismal open.

Five stocks – Nike Inc, Travelers Companies Inc, Boeing Inc, American Express Co, and Pfizer Inc – lost at least 1 percent, and 18 of the DJIA’s 30 members posted declines.

Altogether, the Dow dropped 48.49 points or 0.18 percent to 26,511.05.