Dow Disaster: How Trump Created a $5 Trillion Stock Market Crisis

As Donald Trump wages ruthless trade wars on multiple fronts, his antics have come at a brutal price for the stock market: $5 trillion - and counting. | Source: REUTERS/Leah Millis (i), Drew Angerer / Getty Images / AFP (ii). Image Edited by CCN.com.

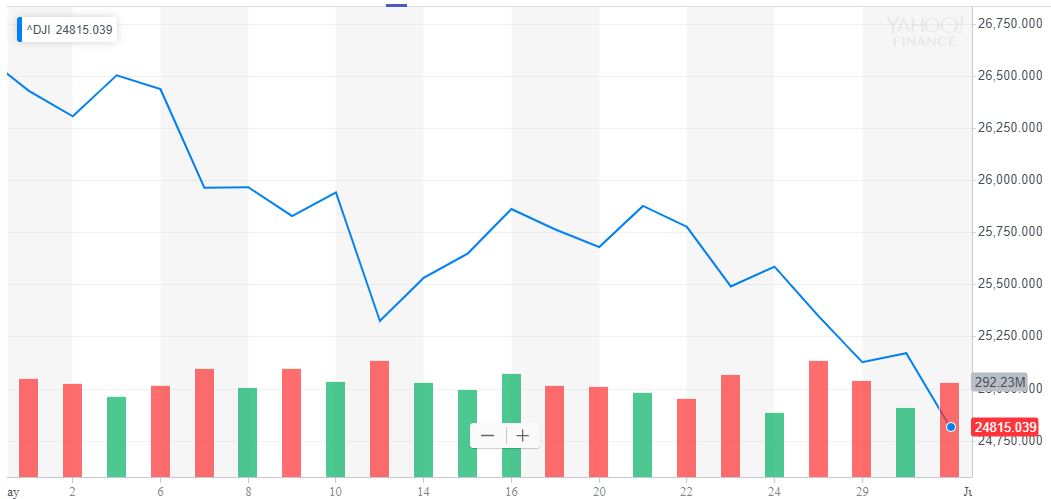

By CCN.com: The Dow recoiled on Friday after President Trump dragged the United States into a trade conflict with Mexico, wreaking havoc on an already-fragile stock market.

As Wall Street buckles up for yet another tariff-induced shellacking, equities analysts warn that Trump’s trade war tab is coming due, and the cost already adds up to a staggering $5 trillion.

Deutsche Bank: Trump’s Trade War Price Tag Has ALREADY Hit $5 Trillion

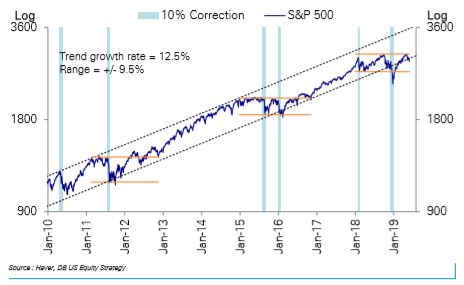

That’s according to Deutsche Bank chief strategist Binky Chadha, who identified the US-China trade war as the key hurdle preventing a recovery in global growth.

And while the S&P 500 and Nasdaq have both hit new all-time highs in 2019, Chadha blamed the dispute for knocking the stock market off the decade-long bullish track it had been on since 2009.

“The costs of the trade war in our view are about its indirect impacts,” said Chadha in a note to clients, according to CNBC . “The trade war has been key in preventing a recovery in global growth and keeping US equities range bound. Foregone US equity returns from price appreciation (12.5% annual rate) for 17 months are worth $5 trillion.”

Even more alarming is that this $5 trillion price tag could only be the down payment on a much larger reckoning for the Dow Jones and other major stock market indices.

Stock Market Recoils as China Mimics Trump With Tech Firm Blacklist

US-China relations rapidly deteriorated during May and now stand at perhaps their most fraught since Trump initiated the trade war in 2018.

Responding to Trump’s threats to hike tariffs on Chinese imports, Beijing has bared its fangs this week, attacking the US with several blistering rhetorical critiques.

More seriously, China has hinted that it will weaponize its economy to punish the US. Most recently, Beijing announced that it would blacklist “unreliable” foreign firms that it believes harm the interests of Chinese companies.

According to Bloomberg , China’s Ministry of Commerce could use that blacklist to target US tech giants like Apple and Alphabet, echoing the Trump administration’s decision to ban Chinese telecom giant Huawei from operating in the US.

Consumers Will Pay a Heavy Price for Mexico Tariffs

Now, Wall Street must also grapple with Trump’s unexpected assault on Mexico, which was borne from his desire to reduce the flow of undocumented immigrants across the US-Mexico border.

In short, the White House plans to slap 5% tariffs on all Mexican imports, gradually increasing that rate to 25% until the Mexican government takes concrete steps to reduce illegal immigration.

Those tariffs come at an inopportune for the US stock market, and not just because the US is on the verge of an economic cold war with China.

US economic growth has weakened in the second quarter, but analysts have remained optimistic due to strong consumer confidence readings. However, consumer sentiment could sour rapidly once Trump’s Mexico tariffs take effect.

Analysts warn that US consumers will quickly feel the pinch from those tariffs, which will trigger sharp increases in vehicle prices.

“It seems lost on the White House that the only losers in a tariff on Mexico are Americans via higher import costs,” wrote David Rosenberg, the chief economist at Gluskin Sheff, in a withering Twitter post.

Altogether, Bank of America Merrill Lynch estimates that the tariffs could cost US consumers $93 billion. That assumes that the White House follows through on its threats to hike the duty rate to 25% over a period of several months. Even the baseline 5% tariff rate would effectively impose an $18.6 billion tax on Americans.

There’s also the matter of the revised NAFTA agreement, which has not been ratified – and now might never be if the Mexican government decides to retaliate against the United States. The new NAFTA deal would have injected an estimated $68 billion into the US economy.

Stock Market Foots the Bill for Trump’s Aggressive Trade Policy

One month ago, the US and China appeared to be on the verge of striking a historic trade deal, and there was nary a rumor about imposing aggressive tariffs on Mexico. But it’s 2019; a single tweet can change everything, and – at least so far as Wall Street is concerned – a few weeks can feel like a lifetime.

Remember, Deutsche Bank’s analysis isn’t a sensationalist prediction. Trump’s trade policies have already cost the stock market $5 trillion, and the meter continues to spin. What will it read when the dust finally settles?

Justified or not, Trump’s aggressive trade strategy will cost US consumers billions.

It will cost investors trillions.

And – if analysts like David Rosenberg are correct – it just might cost President Trump a second term.