Dow Defies Trade Drama as Booming Jobs Data Spellbinds Wall Street

A resurgent Dow Jones Industrial Average pounded higher on Thursday. | Source: Shutterstock

By CCN.com: The Dow and broader U.S. market raced deeper into recovery mode on Thursday after a pair of blue-chip companies reported better than expected quarterly earnings and fewer Americans applied for jobless benefits last week.

Dow Extends Blockbuster Rally; S&P 500, Nasdaq Follow

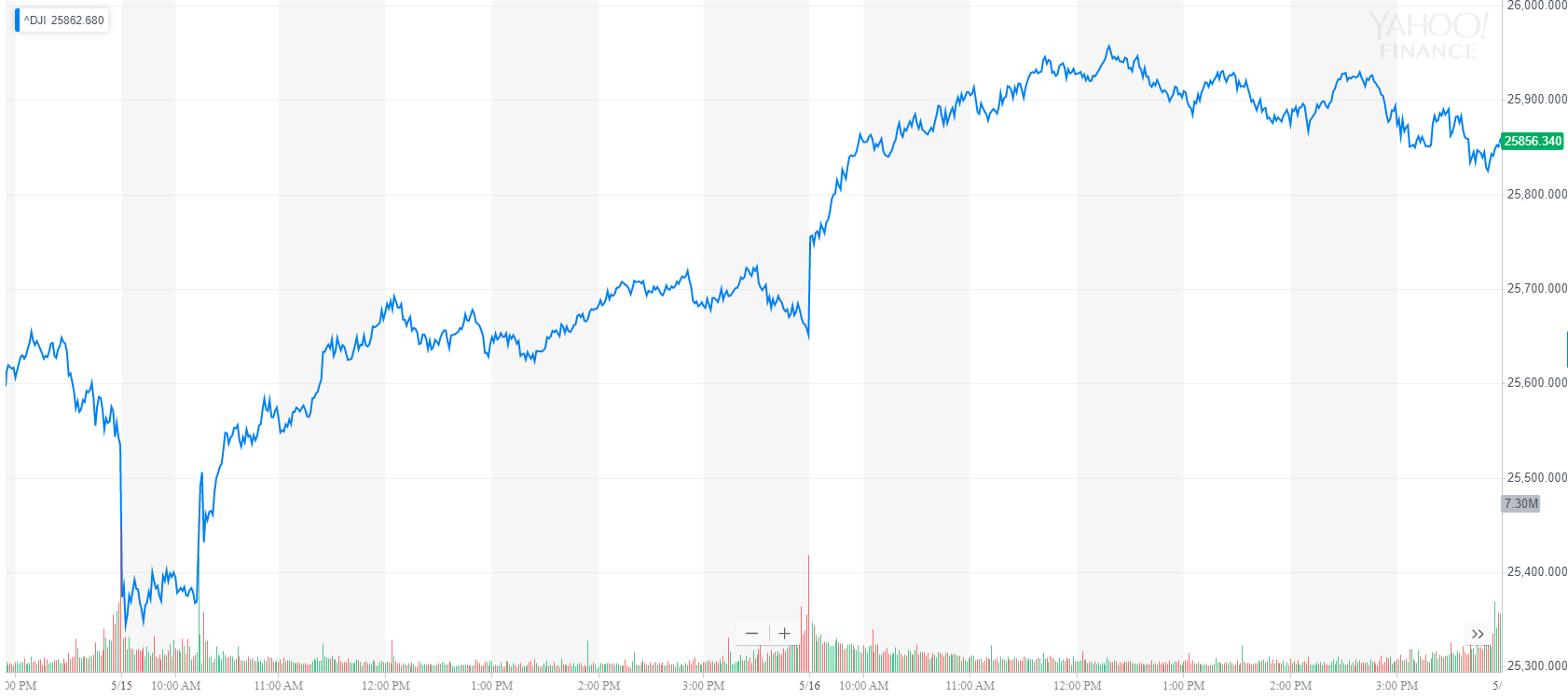

All of Wall Street’s benchmark indexes reported significant growth on Thursday, mirroring a strong pre-market session for Dow futures. The Dow Jones Industrial Average surged 214.66 points, or 0.8%, to 25,862.68.

Dow blue-chips Walmart Inc. (WMT) and Cisco Systems Inc. (CSCO) rose sharply after the companies reported better than expected quarterly earnings.

The broad S&P 500 Index of large-cap stocks gained 0.9% to close at 2,876.32. All 11 primary sectors recorded gains. Materials were the largest percentage gainers on Thursday, followed by financials and consumer discretionary stocks.

Strong performances in communication services and information technology propelled the Nasdaq Composite Index higher. The tech-driven average rose 1% to 7,898.05.

U.S. Labor Market Tightens

The U.S. labor market tightened much more than expected last week, further validating the Trump administration’s economic recovery.

Economists at the Labor Department said the number of Americans filing for unemployment benefits dropped by 16,000 to a seasonally adjusted 212,000 in the week ended May 11. Analysts were calling for a drop to 220,000.

A strong labor market provides a source of optimism for investors concerned that the global economic slowdown will soon hit American shores. Recessionary headwinds are being kept under control despite ongoing trade tensions with China and signs of a manufacturing downturn at home.

The U.S. housing market has been bogged down in a multi-year slowdown due to rising interest rates and higher home prices. Housing starts and building permits picked up last month, which may offer the struggling market a temporary reprieve.

Starts rose 5.7% in April to a seasonally adjusted 1.235 million units, the Department of Commerce reported Thursday. Building permits, which are a proxy for future construction plans, edged up 0.6% to a 1.296 million-unit pace.

Click here for a real-time Dow Jones Industrial Average price chart.