Dow Cuts Losses as Recession Fears Drive U.S. Dollar to Two-Year Highs

The Dow and broader U.S. stock market bounce off lows as the dollar extends winning streak. | Image: AP Photo/Richard Drew

The Dow and broader U.S. stock market trimmed their losses in late afternoon trading Thursday, as the dollar surged to its highest level in two years over global recession fears.

Dow Cuts Losses; S&P 500, Nasdaq Hold Lower

All of Wall Street’s major indexes ended in negative territory, mirroring a tepid pre-market for Dow futures. The Dow Jones Industrial Average (DJIA) closed down 79.59 points, or 0.3%, at 26,891.12.

The blue-chip index was off by as much as 167 points earlier in the day.

The broad S&P 500 Index of large-cap stocks fell 0.2% to 2,977.62. Losses were largely concentrated in energy and communication services, with health care and consumer discretionary shares also in the red. On the flip side, utilities and consumer staples traded sharply higher.

Meanwhile, the technology-focused Nasdaq Composite Index fell 0.6% to 8,030.66.

U.S. Dollar Spikes

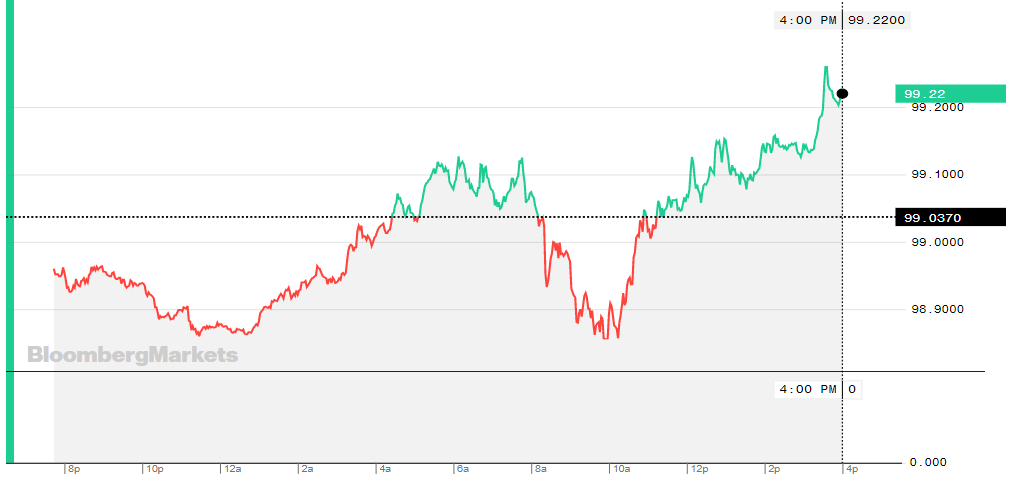

The U.S. dollar on Thursday notched fresh two-year highs against a basket of currencies, as a confluence of political and economic forces dragged down the euro, yen and British pound.

DXY – the weighted basket of currencies trading against the greenback – reached an intraday high of 99.37. It was last up 0.2% at 99.21, according to Bloomberg data.

On Wednesday, the dollar surged 0.7%, its largest percentage gain in three months.

The greenback is reasserting itself as a global reserve currency amid political drama in the United Kingdom and recessionary risks throughout Europe. An impeachment inquiry against President Trump hasn’t deterred investors from increasing their exposure to the greenback or other dollar-denominated assets.