Dow Crumbles as Stock Market Braces for Consumer Chaos

The Dow crumbled on Monday as ballooning oil prices caused stock market investors to brace for a consumer confidence reckoning. | Source: AP Photo / Richard Drew

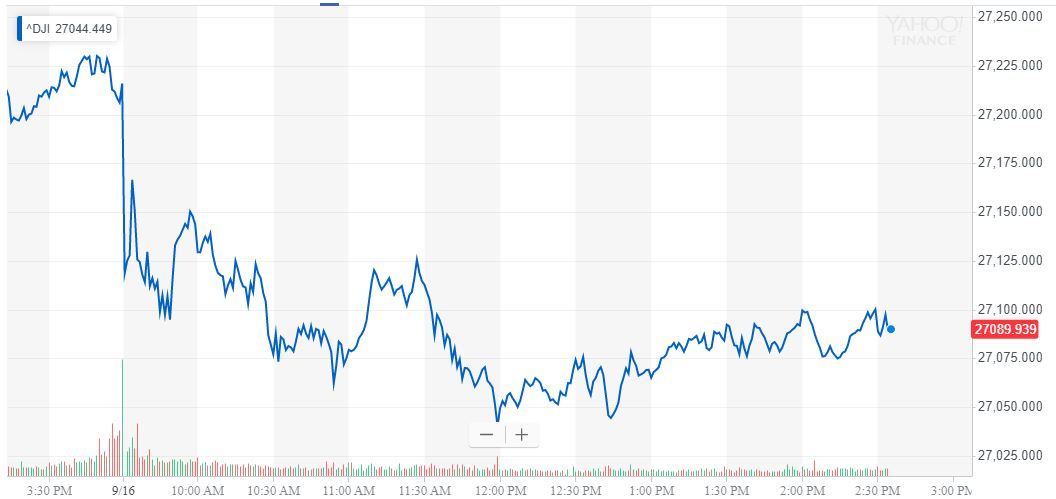

The Dow Jones was rocked on Monday by a devastating surge in the price of crude oil after the attacks on Aramco’s key refinery.

The strike not only dashed hopes for a détente between the US and Iran but also put considerable pressure on the vital US consumer.

Dow Jones Falls as Dollar Rises & Oil Soars

In late afternoon trading, the Dow Jones Industrial Average had lost 127.71 points or 0.47%, pushing the DJIA down to 27,091.81.

Both the Nasdaq and S&P 500 fell with the Dow Jones, as the US dollar saw haven flows out of risk assets amid the turmoil in the Middle East. This move from risk was confirmed as gold (XAU/USD ) rose, defying the stronger DXY. Weak Chinese data was also a burden on the stock market, worsening the outlook for global growth.

The Saudi drone attack was undoubtedly serious, and the world facing a crude shortage will have dramatic implications on price pressure. Such an impact could subdue consumer spending and affect the growth outlook on one hand, while on the other, it could accelerate rising inflationary pressures.

Federal Reserve Faces Difficult Choice This Week

This paints a confusing picture for the Federal Reserve meeting this week.

Jerome Powell will not be keen to surprise the stock market (given how plenty of easing is priced into the Dow).

Longer-term, the Fed’s appetite to ease would likely be constrained by higher oil prices, given the effect on the CPI.

President Trump disagrees and believes the economy needs stimulus now more than ever.

Boris Johnson’s Brexit Antics Weigh on Markets

Providing an additional hit to the Dow, Boris Johnson’s much-anticipated trip to speak with EU heads ended in farce. The UK PM skipped a joint press conference he was supposed to attend, leaving an empty stand. Knocking the British pound and worsening risk sentiment in Europe, this was an additional negative to consider for the US stock market.

https://www.youtube.com/watch?v=v7HtVKvP1iQ

It was also hard for Dow bulls to ignore the footage of rebels in Hong Kong hurling gasoline bombs at government buildings and setting fire to the city’s subway.

Nordea: Stock Market in for a Rude Awakening

Due to these dramatic events, the China-US trade war has been pushed to the back of many traders’ news feeds. Economist Martin Enlund at Nordea believes that this period of calm could be short-lived, as Trump’s tariff tactics still pose a significant threat to equity indexes like the Dow.

“It could be that some of the positive news the market is currently having to digest is driven by the vicinity of the 70th anniversary of the People’s Republic of China (October 1). Trump is being a good cop for now (even bringing China a birthday present), China is reciprocating – even USD/CNY is behaving nicely – i.e. declining – despite PBoC easing. [A} stronger CNY usually goes hand in hand with higher industrial metal prices, which in turn is good news for certain cyclical equities. Basically, it could be that markets could be in for a rude awakening in October. But that’s a story for another day.”

Dow Stocks: Oil Companies Shine, Retail Crushed

Unsurprisingly, Chevron and Exxon Mobile were the shining stars of the Dow 30 . The two major oil companies enjoyed the giant bounce in crude as US shale gets ready to turn on the taps .

Apple was another rare gainer, as the tech giant eked out a 0.43% gain.

Walmart and Walgreens were among the worst-hit, with the former losing approximately 1.5% as consumers prepared to feel the pinch from higher energy prices.

Procter and Gamble languishes at the bottom of the table for the Dow Jones (-2.15%). The rise in petroleum prices will likely increase its costs and weigh on its profitability.

Click here for a live Dow Jones Industrial Average chart