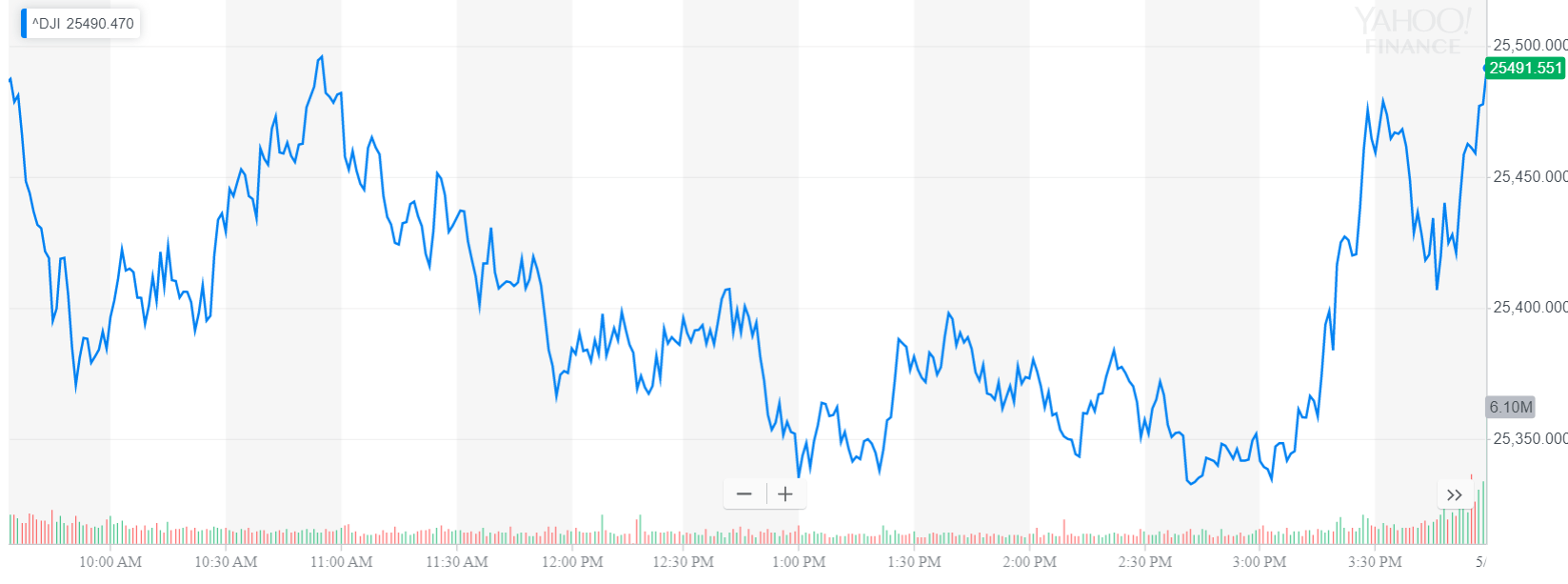

Dow Collapse Hits Crushing Level as Bond Yields Ignite Investor Panic

The Dow Jones collapse hit a crushing level on Thursday. Meanwhile, troubling bond yields ignited investor panic as recession alarms reached a fever pitch. | Source: Drew Angerer / Getty Images / AFP

By CCN.com: The Dow and broader U.S. stock market extended their slide on Thursday, as investors cut ties with riskier assets and piled into the perceived safety of Treasurys after an emboldened China called out the United States for its apparent transgressions on free trade.

Dow Plummets; S&P 500, Nasdaq Follow

All of Wall Street’s major indexes headed for big losses on Thursday, with the Dow Jones Industrial Average on track for its fifth straight weekly decline. The blue-chip index declined by as much as 448 points, mirroring a volatile pre-market for U.S. stock futures.

The Dow pared some of its losses to settle down 286.14 points, or 1.1%, at 25,490.47.

The broad S&P 500 Index of large-cap stocks declined 1.2% to 2,822.24. Nine of 11 primary sectors traded lower, with energy stocks plunging 3.2%. The commodity-sensitive sector was driven lower by another massive drop in oil prices that was stoked by rising U.S. inventories and the threat of a prolonged trade war.

U.S. West Texas Intermediate crude futures plunged more than 5% on Thursday and were on track for their worst day in six months.

Other sectors to report significant losses included financials, industrials, and information technology.

Plunging technology shares weighed on the Nasdaq Composite Index, which fell 1.6% to close at 7,628.28.

U.S. Treasury Yields Plummet

U.S. Treasury yields declined sharply on Thursday as investors fled riskier assets following the latest flare-up between Washington and Beijing. On Thursday, a Chinese Ministry of Commerce spokesperson told CNBC that the United States should “adjusts its wrong actions” if it wants Beijing to return to the negotiating table.

Trade talks between the two superpowers broke down earlier this month after Beijing reportedly backtracked on a deal. This prompted President Trump to raise tariffs on $200 billion worth of Chinese imports. China responded with additional duties on some $60 billion worth of U.S. goods.

The yield on the benchmark 10-year U.S. Treasury fell to 2.296%, which was the lowest since late 2017. With the decline, the yield on the 10-year note has returned below the yield on the three-month Treasury bill. For investors, this is a warning sign that economic headwinds and even a recession are looming.

Click here for a real-time Dow Jones Industrial Average (DJIA) price chart.