Dow Booms After Trump Admin Flip-Flops on Ruthless Huawei Blacklist

The Dow enjoyed a significant bounce after the Trump administration flip-flopped on its controversial - and ruthless- Huawei blacklist. | Source: AP Photo / Alex Brandon

By CCN.com: The Dow raced toward recovery on Tuesday after the Trump administration caved to pressure to moderate its hardline stance on Chinese tech giant Huawei. However, as trade tensions grow increasingly fraught, investors should question the long-term health of the stock market.

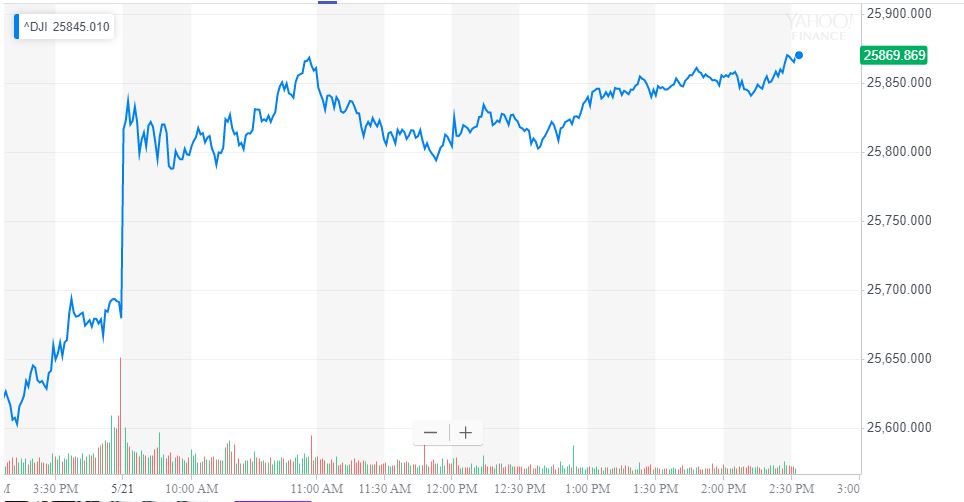

Dow Soars to 185 Point Rebound

All of Wall Street’s major indices surged on Tuesday. As of 2:35 pm ET, the Dow Jones Industrial Average had gained 187.26 points or 0.73% to bounce back to 25,867.16. The S&P 500 added 0.98% to recover to 2,868.11, while the Nasdaq rose 1.28% to 7,800.58 amid a bullish session for tech stocks.

Trump Admin Flip-Flops on Huawei Blacklist

This morning, stock futures jumped after the US Commerce Department announced that it would grant a 90-day reprieve to Huawei, allowing US companies to continue exporting components to the Chinese firm. The reprieve also eases pressure on rural telecom providers, many of whom utilize Huawei equipment.

“The Temporary General License grants operators time to make other arrangements and the Department space to determine the appropriate long term measures for Americans and foreign telecommunications providers that currently rely on Huawei equipment for critical services,” said Secretary of Commerce Wilbur Ross. “In short, this license will allow operations to continue for existing Huawei mobile phone users and rural broadband networks.”

Last week, the Trump administration blacklisted Huawei from operating in the US or transacting with US companies. The White House justified the move on national security grounds. However, most analysts believe it was actually a bargaining chip meant to give Washington leverage over Beijing, which appears to be in no hurry to resume trade negotiations.

Huawei, for its part, warned that the Trump administration “underestimates” the company’s strength.

“The current practice of US politicians underestimates our strength,” founder Ren Zhengfei told state broadcaster CCTV, according to a translation from TRT World .

He boasted that Huawei had already stockpiled chip components, anticipating that the US would target the company as part of its trade war strategy.

“We sacrificed [the interests of] individuals and families for the sake of an ideal, to stand at the top of the world,” Ren said, per the South China Morning Post . “For this ideal, there will be conflict with the United States sooner or later.”

The VanEck Vectors Semiconductor ETF (SMH) rose more than 2.3% on Tuesday following the Huawei reprieve, though it remains more than 15% below the year-to-date high it achieved less than a month ago.

Trade War’s Impact Will Be Felt in Stock Market for Years

The 90-day Huawei reprieve could merely be prolonging an inevitable stock market wipeout, as the Trump administration has demonstrated an inability to meet its own self-imposed trade deal deadlines, and tensions between Washington and Beijing are rapidly deteriorating.

Curtis Chin, an Asia fellow at the Milken Institute, told CNBC that the trade war would “get worse before it gets better” as the two economic superpowers grapple with China’s rapid ascendance over the past several decades.

“Some of the things we might have accepted from a poorer nation maybe no longer fit the bill in terms of where China should fit into this region,” Chin said.

Meanwhile, analysts warn that the trade war will exact a lasting influence on the global economy, regardless of when the US and China strike a deal.

The Organization for Economic Cooperation and Development said Tuesday that the Trump administration’s tariff regime has already triggered a 50% reduction in global business investment growth.

“It’s something that’s super worrying,” said Laurence Boone, the OECD’s chief economist, in an interview with the Wall Street Journal . “The less we invest today, the more we will be missing in the future.”

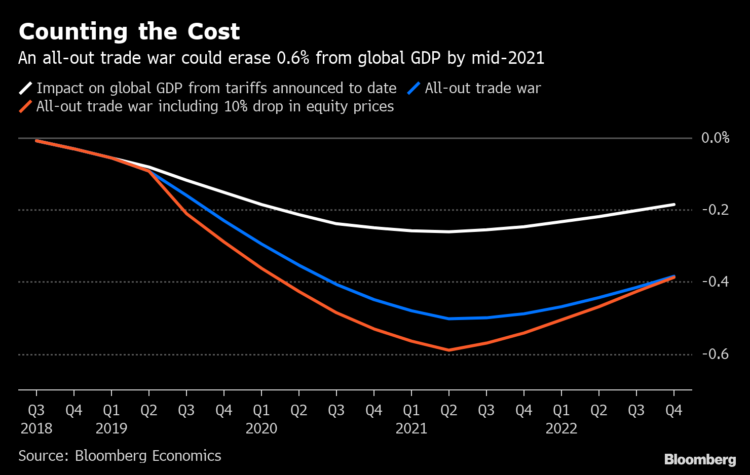

According to Bloomberg Economics , current US-China tariffs threaten to reduce global GDP by 0.3% over the next two years, while further escalation into an all-out trade war would bleed as much as $600 billion from the global economy, lowering worldwide GDP by 0.6%.

Dow & Sister Indices Seek to Recoup Losses

Tuesday’s widespread equities recovery helped Wall Street’s major indices recoup losses from the previous trading session.

On Monday, geopolitical tensions involving both the trade war and the burgeoning conflict between the US and Iran weighed heavy on the stock market. The Dow declined 84.1 points or 0.33% to close at 25,679.9. The S&P 500 and Nasdaq fared significantly worse, slipping 0.67% to 2,840.23 and 1.46% to 7,702.38.

Click here for a real-time Dow Jones Industrial Average price chart.