Dow Bloodbath Barrels into Day 5 as Awful Jobs Data Portends Recession

Weak global growth has investors flocking to U.S. government bonds. | Source: REUTERS/Brendan McDermid

The Dow and broader U.S. stock market tanked on Friday after government data showed job creation slowed to a crawl in February, stoking fears that the world’s largest economy was barreling toward recession. Stronger than expected wage growth offered temporary reprieve but failed to instill confidence in an investing public that has seen manufacturing and housing activity tumble in recent months.

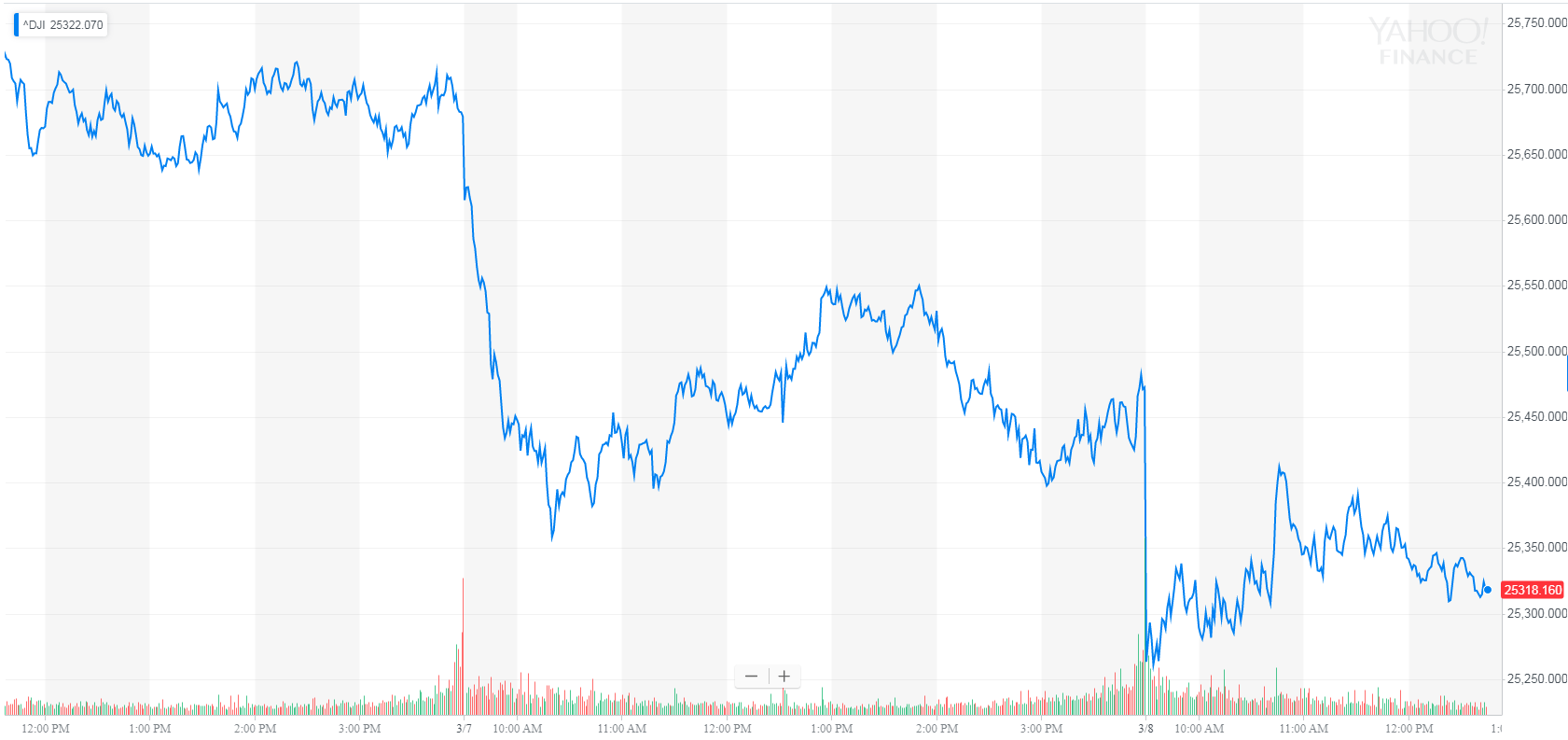

Dow Careens Toward Fifth-Straight Decline

All of Wall Street’s major indexes declined sharply after the open, reflecting a dismal pre-market session for Dow futures. The majors were well off session lows by mid-morning but were still on track to finish lower.

As of 12:45 p.m. ET, the Dow Jones Industrial Average was down 154 points, or 0.8%, to 25,318.46. Twenty-five of 30 index members reported declines, with Pfizer Inc. (PFE) leading the downtrend.

The broad S&P 500 Index of large-cap stocks declined 0.8% to 2,726.62. All 11 primary sectors were in the red, with energy shares plunging more than 2% on average. Shares of consumer discretionary and information technology companies also declined sharply.

The broad S&P 500 Index of large-cap stocks declined 0.8% to 2,726.62. All 11 primary sectors were in the red, with energy shares plunging more than 2% on average. Shares of consumer discretionary and information technology companies also declined sharply.

Meanwhile, the technology-focused Nasdaq Composite Index fell 0.8% to 7,364.41.

A measure of implied volatility known as the CBOE VIX surged to a high of 18.33 on a scale of 1-100 where 20 represents the historic average. That was the highest since late January. VIX was last up 4.8% at 17.36.

Nonfarm Payrolls Miss Mark by Spectacular Measure

U.S. employers added 20,000 workers to payrolls last month, the slowest pace of hiring since September 2017 and way undershooting expectations of around 180,000, the Department of Labor reported Friday. To get a sense of just how dismal the number was, consider that last time job creation slowed this severely was when two major hurricanes swept through the southeast.

The Labor Department revised the January hiring clip to 311,000 from a previously reported 304,000. That was the highest in over a year.

Despite the brutal miss on nonfarm payrolls, the monthly report showed strength in other areas. For starters, the unemployment rate fell back to 3.8% from 4% even as workforce participation held steady. The participation rate was unchanged at 63.2% in February.

Meanwhile, average hourly earnings – a proxy for wage inflation – climbed 0.3% on month and 3.4% annually, both higher than expected.

Investors are scrutinizing economic data more closely amid signs of a sharp slowdown in housing activity. The resale market plunged in December to the lowest in three years. Housing starts for single- and multi-family dwellings have also plummeted.

The U.S. economy expanded 2.6% annually in the fourth quarter, well above forecasts but significantly below the previous quarter’s pace.

Although productivity growth improved in the December quarter, it remains extremely weak overall. Analysts consider boosting productivity growth as one of the U.S. economy’s biggest challenges.