Dow Blasts Higher While Bitcoin Endures Painstaking Search for a Bottom

The Dow continued to soar on Tuesday morning, but things weren't quite so bullish for the bitcoin price. | Source: Shutterstock

A defiant US stock market opened to significant gains on Tuesday, brushing off bearish portents about declining corporate earnings. Bitcoin, meanwhile, continues to endure a painstaking search for a bottom as it seeks to bring its longest-ever bear market to a definitive close.

Defiant Dow Extends Early-Week Rally

Shortly after Tuesday’s opening bell, the Dow Jones Industrial Average had gained 99.61 points or 0.39 percent. The S&P 500 and Nasdaq also extended their gains, rising 0.24 percent and 0.41 percent, respectively.

On Monday, the Dow clawed back from an early-morning decline to mount a more than 175 point or 0.7 percent rally, closing the day at 25,239.37. The Nasdaq climbed by 1.15 percent and the S&P 500 added 0.68 percent as stocks flashed green across the board.

The Patriots Win Again [and so Does the Dow]

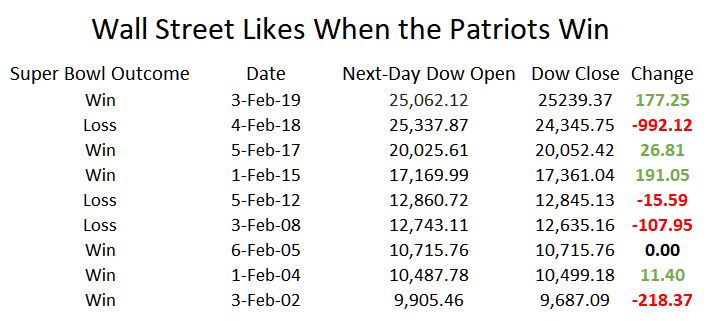

That single-day rally confirmed a surprising correlation between the stock market and the New England Patriots’ performance in Super Bowls throughout their 21st-century dynasty. While the Dow has declined on the Monday following each of the Patriots’ three Super Bowl losses, it has only ended the day in the red once following their six championship game victories. While correlation doesn’t equal causation, the trend is hard to ignore.

Trump & Powell Break Bread

Also bolstering the stock market was a report that Federal Reserve Chairman Jerome Powell sat down to an “informal dinner” to discuss the state of the economy. Trump had been harshly critical of Powell and the Fed for raising interest rates, blaming the independently-run central bank for throwing a wrench into the market’s historic bull run.

It’s unclear whether the stock market pullback or Trump’s one-sided war of words played a larger role in spooking Powell and the Fed, but the bank has lately curtailed plans to continue raising rates, a policy shift that has fueled the early-year recovery of the Dow and its peers.

Bitcoin Price Trades in Tight Window

On the cryptocurrency front, most large-cap assets continue to range-trade within a tight window while analysts spar over whether the bitcoin price has found a bottom or stands to take further losses ahead.

On his part, Alec Ziupsnys, a cryptocurrency analyst and the founder of Rhythm Technologies, said that he believes bitcoin may have moved into the final stage of the bear market cycle.

“The capitulation phase completed once we dropped another 50% past everyone’s “price floor” from $6,000 to $3,000,” he wrote on Twitter.

https://twitter.com/AlecZiupsnys/status/1092757021160628224

If bitcoin has moved past capitulation and into despair, then that means the market is close to turning a corner. Following the conclusion of the “despair” phase, the bitcoin price should return to a mean of around $6,400, according to Ziupsnys’ analysis.

In the near-term, the cryptocurrency market is likely to suffer from reduced trading volume during the Chinese New Year celebration, according to crypto brokerage BitOoda. Writing in a note to clients, the firm said that “business slows down substantially leading up to and following the week-long holiday – very comparable to the week between Christmas and New Years in the West. It will be interesting to see if volumes pick up in the coming weeks[.]”

As of the time of writing, bitcoin was priced at $3,429 on Bitstamp, just $5 below its intraday high of $3,434. BTC/USD has traded in a tight $38 window all morning, and several analysts expect it to see a breakout in the near future. The question is, which way will it break?

Altcoin prices held relatively stable throughout the 24-hour period. Only two large-cap cryptocurrencies — stellar and bitcoin sv — moved more than 1 percent, with both of them tilting to the downside. Altogether, the cryptocurrency market added approximately $150 million over the previous day, bringing it to a present value of $113.7 billion.

Featured Image from Shutterstock. Price Charts from TradingView .