Dow Surges to Record Territory as Markets Eye Titanic Rate Cut

Jerome Powell and the Fed appear ready to give Trump his interest rate cut. | Source: AP Photo / Susan Walsh

The Dow and broader U.S. stock market approached record highs on Wednesday, as traders doubled down on their bets that the Federal Reserve will cut interest rates aggressively to bolster a weakening economy.

Dow Hits Intraday High; S&P 500, Nasdaq Follow

All of Wall Street’s major indexes surged after the open, as stocks tracked a positive pre-market for Dow futures. The Dow Jones Industrial Average climbed 72.43 points, or 0.3%, to 26,855.92. The blue-chip index was up more than 200 points after the open.

The broad S&P 500 Index of large-cap stocks touched an intraday high of 3,002.98 before paring gains later in the session. It was last up 0.4% at 2,991.93. Eight of 11 primary sectors reported gains.

The technology-focused Nasdaq Composite Index also reached all-time highs, gaining 0.6% to 8,193.36.

Markets Expect Deep Rate Cuts

In prepared testimony before the House Financial Services Committee, Federal Reserve Chairman Jerome Powell on Wednesday left little doubt that the central bank will lower interest rates later this month. Markets are now betting on the possibility of a 50 basis-point reduction to the federal funds rate following the July 30-31 Federal Open Market Committee (FOMC) meeting.

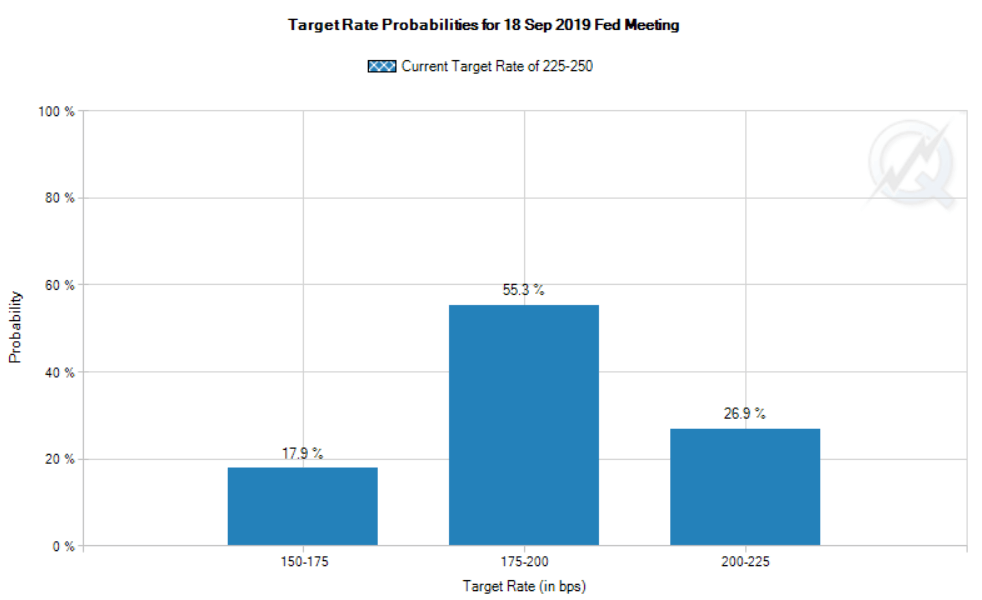

The target for the federal funds rate, currently 2.25% to 2.50%, could fall to 1.75% to 2.00% on July 31, according to CME Group’s FedWatch Tool. The chance of that happening this month is 28.7%, based on the latest Fed Fund futures prices.

The likelihood of a 50 basis-point or more reduction grows to 71.5% in September.

The Fed changed its tone on monetary policy back in January, mere weeks after the U.S. stock market entered bear-market territory. Fed-speak has grown incrementally more dovish in recent months after it became clear that the Sino-American trade war wouldn’t be resolved anytime soon.

After growing 3.1% annually in the first quarter, American gross domestic product (GDP) likely wavered in the April-June period. The U.S. economy likely expanded just 1.4% annually in the second quarter, according to the Atlanta Fed’s GDP tracker.

Click here for a real-time Dow Jones Industrial Average (DJIA) price chart.