Dow at 26,000? Not So Fast – US Stock Market Tumbles as VIX Bounces

The Dow is soaring toward 26,000 on Friday afternoon. | Source: AP Photo / Richard Drew

The Dow and U.S. stock market traded lower on Thursday after lackluster data offset renewed optimism that China and the United States were making strides on a new trade agreement.

US Stock Market Eyes Biggest Drop in Two Weeks

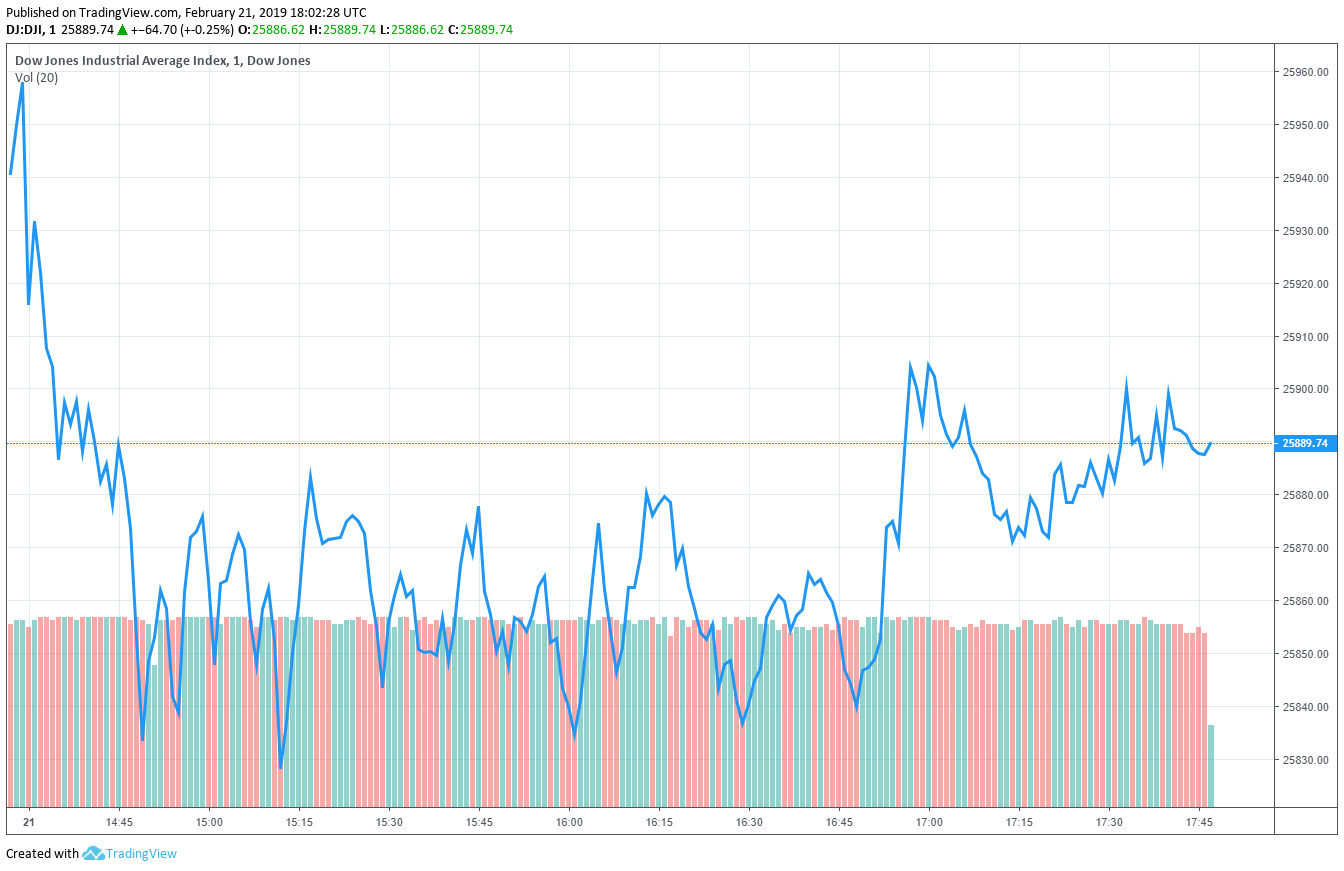

All of Wall Street’s major benchmarks reported declines midday, with the Dow Jones Industrial Average sliding 72 points, or 0.3%, to 25,881.99. The blue-chip index was down nearly 100 points earlier in the day, a carryover from a dismal pre-market session for Dow futures.

Shares of DowDuPont (DD) fell 1.9% to lead the index lower. Nike Inc. (NKE) fell 1.4% and Walgreens Boots Alliance (WBA) traded 1.2% lower.

The broad S&P 500 Index fell 0.2% to 2,777.91. Eight of 11 primary sectors traded lower, with energy shares falling 1.6%. Healthcare stocks were down 0.8% as a whole; materials dropped 0.7%.

Consumer staples and utilities, sectors known for their defensive posture, rose at least 0.4%.

The technology-driven Nasdaq Composite Index traded 0.2% lower to 7,471.89.

A measure of implied volatility known as the CBOE VIX bounced off four-month lows Thursday, gaining 2.9% to 14.42. The so-called “fear index” trades on a scale of 1-100 with 20-25 representing the historic average range. VIX spiked to the mid-30s during the height of the stock market selloff in December.

U.S.-China Trade Talks Continue

The United States and China resumed their trade negotiations on Wednesday ahead of a fast-approaching deadline that could trigger a new round of tariffs on Chinese exports. Based on the original agreement between Presidents Donald Trump and Xi Jinping, both sides have until Mar. 1 to reach a trade deal. Trump said last week he was open to letting this deadline “slide” if both sides made enough progress on a new deal. The White House has yet to confirm whether an extension will be granted.

According to Reuters , both countries have already started to lay down commitments on the most contentious issues in the trade dispute, marking significant progress in the negotiations. At the same time, a comprehensive deal remains a long shot ahead of next week’s deadline. Such an agreement would require that China make structural reforms to its economy, which would impact its trade policy with the United States.

Negotiations will continue in Washington over the next two days, though the meetings are described only as “high level.”

Read More: How will the Huawei probe impact U.S.-China trade negotiations? Find out here.

Last month, CCN.com reported several apparent breakthroughs in the negotiations, including China’s proposal to completely eliminate its trade surplus with Washington. The plan entailed a six-year buying spree of U.S. goods to the tune of $1 trillion. That’s above and beyond China’s existing commitments. At the same time, U.S. officials were considering lifting tariffs on Chinese goods to compel Beijing to make concessions elsewhere.

China’s surplus with the United States stood at $323 billion in 2018.

Featured image courtesy of AP Photo / Richard Drew. Chart via TradingView.