Don’t Blame the Fed or Tariffs Alone for this Stock Market Rout

Corporate earnings season is underway, and fundamentals are driving the stock market more than usual because valuations are so lofty already. | Source: Shutterstock

Stock market investors who were expecting that the Fed would be more accommodating with its monetary policy or that trade talks between the U.S. and China would go swimmingly were in for a rude awakening. Instead, they got a one-two punch comprised of a mere quarter-point interest rate cut and threats of more tariffs on China rather than any compromise. But if you take a step back and look at the full market picture, you’ll see that there is more at play here than just the Fed and trade.

https://twitter.com/paulollivier_/status/1157359188957368325

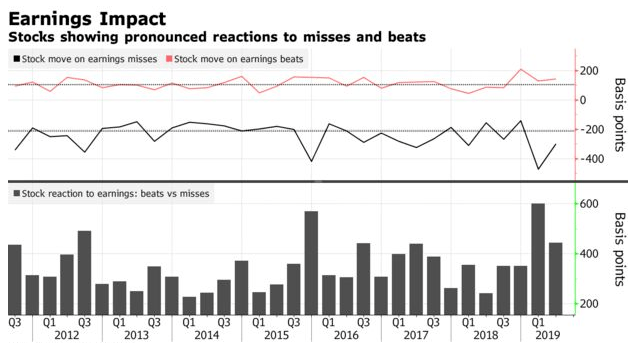

Corporate earnings season is underway, and fundamentals are driving the stock market more than usual because valuations are so lofty already. This means that investors are punishing stocks that fall short of Wall Street estimates more severely than they are rewarding those that manage to beat consensus views. Goldman Sachs data cited in Bloomberg reveals that the stocks of S&P 500 companies that miss the mark shed 3 percent in the next trading session. Those that exceed estimates are seeing their stocks rise less than 1.5 percent, creating a wider spread between the positive and negative stock moves than has been the case in seven years.

Worse, corporate America is slashing its outlook for the current quarter, and that is rattling investors, as evidenced by a 14 percent drop in Square’s stock after Wall Street didn’t get what it wanted to hear. But the broader stock market isn’t doing too shabby with the S&P 500 still up more than 15 percent year-to-date.

The Fed Could Still Sway the Stock Market

The coming week is going to be light on economic data. As a result, investors will likely be focused on the perfect storm of earnings, the Fed, and tariffs. In the coming days, a trio of dovish fed members are expected to provide their remarks on various topics, which has the potential to sway the markets one way or the other.

On Aug. 5, Fed Governor Brainard will talk about payments, and it will be interesting to see if Facebook’s Libra coin is discussed. On Aug. 6, St. Louis Fed President Bullard is scheduled to address monetary policy. On Aug. 7, Chicago Fed President Charles Evans will comment on the state of the economy.