Don’t Blame Crypto: Nvidia’s Collapsing Stock Could Kill Nasdaq’s Winning Streak

The Dow endured a slight dip on Monday as the U.S. stock market lurched toward critical tests on multiple key economic fronts. | Source: Photo by Johannes EISELE / AFP

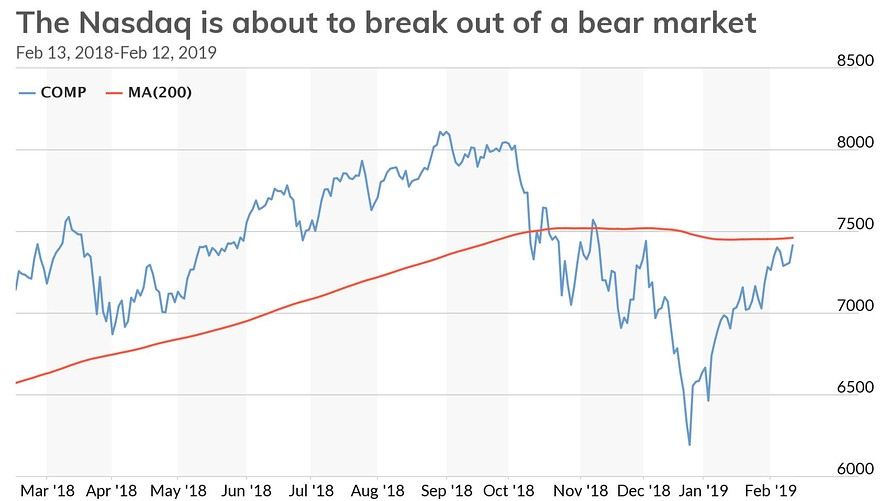

The Nasdaq Composite Index is on the verge of breaking out of its bear market . With a rebound of 12.9% since the infamous Christmas Eve massacre, tech stocks are on fire. But the winning streak could be halted by Nvidia’s earnings report tonight.

Chipmaker Nvidia sent an unprecedented early warning to investors last month, bracing them for disappointing revenue figures. It slashed revenue expectations from $2.7 billion to just $2.2 billion. Nvidia’s stock price plunged 14% in response.

If the numbers come in even lower tonight, it could kill the Nasdaq’s momentum. Poor forecasts at Nvidia have rattled the Nasdaq in the past . It could do the same again today.

Why is Nvidia struggling?

The chipmaker, which specializes in video game graphics cards (GPUs), blamed slow growth in China for the slashed forecasts. The company says a lack of consumer demand is hitting sales hard.

The result is a huge pile-up of unshipped products. Nvidia is now trying to sell them off at a discount.

There are other issues too. Nvidia has emerging bets in data centers, artificial intelligence (AI), autonomous vehicles, and cryptocurrency mining.

Last month’s profit warning revealed that growth in its data center business has slowed down. Meanwhile, cloud computing companies are developing their own AI chips that could kill demand for Nvidia’s products.

Will Nvidia kill the Nasdaq’s momentum?

The Nasdaq Composite Index, which tracks US tech stocks, has staged a phenomenal rebound since Christmas. In total, it has climbed 12.1% in January, more than most analysts expect in a year.

If it closes above 7,431.50, the index will officially exit bear market territory. A bear market is defined as a 20% drop from its high.

The rally was spurred by growth in FAANG stocks – Facebook, Amazon, Apple, Netflix, and Google (Alphabet). While Nvidia holds less sway over the Nasdaq index, it is seen as an indicator of technology shares. If Nvidia disappoints again tonight, it could trigger a broader selloff in the tech sector.

When Nvidia lowered forecasts in November, Nasdaq futures fell 1% . In other words, Nvidia has the power to move the markets.

Don’t blame cryptocurrency for Nvidia’s problems

As the crypto hangover continues, Nvidia has seen a decline in demand for its GPUs from cryptocurrency miners.

However, the impact of this decline on Nvidia’s bottom line is dramatically over-estimated. Nvidia’s CFO Colette Kress admitted that cryptocurrency mining makes up just a “small portion of our business. ”

During one quarter last year, Nvidia generated $300 million in revenue from cryptocurrency mining sales. But that’s was a relatively small fraction of its $3.1 billion quarterly revenue at the time.

Even though Nvidia’s revenue from crypto is now effectively zero, does it really justify the $23 billion drop in market valuation? No. Nvidia’s problems are rooted in the gaming sector, where it derives almost 60% of its total revenue.

Nvidia: looking good long term

Despite the short-term worries, Nvidia still looks good long-term. Analyst Christopher Rolland at Susquehanna Financial Group just reiterated his “buy” rating on the stock . Citing the potential of artificial intelligence, Rolland said:

“We view Nvidia as a pure and levered way to invest in the future prospects of the GPU [graphics processing units] a device we believe is undergoing a renaissance.”

The sentiment is echoed by Nvidia’s founder and CEO Jensen Huang who highlighted the importance of AI in the company’s future :

“The foundation of our business is strong and more evident than ever – the accelerated computing model NVIDIA pioneered is the best path forward to serve the world’s insatiable computing needs. The markets we are creating – gaming, design, HPC, AI and autonomous vehicles – are important, growing and will be very large. We have excellent strategic positions in all of them.”

Nvidia reports earnings tonight after the US market closes.