Dogecoin Creator: Crypto Bubble 'More Epic Scale' than Dot-Com Bust

Dogecoin creator Jackson Palmer weighed in on the cryptocurrency bubble debate, stating that he believes the markets are in a bubble and that the eventual pop will make people less likely to embrace the underlying cryptocurrency and blockchain technology.

Palmer told the New York Times that he sees parallels between the crypto finance industry–initial coin offerings in particular–and the dot-com bust, when Internet companies achieved market caps in the hundreds of millions of dollars despite not having clear business models, eventually leading to a stock market crash.

He is confident the same fate awaits the cryptocurrency markets. As he warns:

People are treating cryptocurrency now like penny stocks….It’s become a securities market.

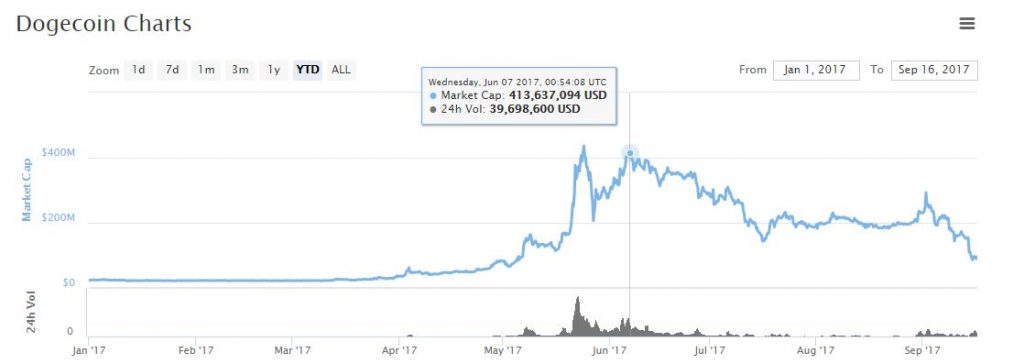

Palmer left the Dogecoin project several years ago after he became disillusioned with its commercialization. What Palmer had intended as a joke had become, in a way, big business and had begun to attract “toxic” characters. In his absence, Dogecoin continued to appreciate, along with the wider markets. It currently has a market cap of about $100 million, and that figure was as high as $400 million as recently as June.

Recently, Palmer started a YouTube series to help crypto novices better understand the technology that underpins this burgeoning industry. He hopes that these videos will get people excited about the technology–as he was when he first was first introduced to bitcoin–rather than the profits they may or may not make by investing in coins or tokens.

Ultimately, Palmer says that he fears the impending crash will leave the mainstream public with such a negative connotation about cryptocurrency and blockchain technology that people will be hesitant to use cryptocurrency and blockchain technology at all.

The bigger this bubble goes, the bigger negative connotation it’s going to have….It’s going to be like the dot-com bust, but on a much more epic scale.

Featured image from Shutterstock.