Disney Gets $20 Billion Handout From Investors Confused About Disney+

Over-zealous investors bid up Disney stock on news that its streaming service surpassed 50 million subscribers. But that’s peanuts compared with the cost of shutting down Disney amusement parks. | Image: REUTERS/Dado Ruvic

- Investors added more than $20 billion to Disney’s market cap on news that its streaming service surpassed 50 million subscribers.

- That’s not nearly enough to offset the revenue losses its parks segment will suffer as a result of coronavirus.

- It’s unclear whether the bulk of those subscribers will quit once lockdowns have lifted.

This week Disney (NYSE:DIS) announced that its streaming service racked up more than 50 million subscribers in just five months. That far surpasses the company’s expectations—last quarter Disney+ was hoping to have between 60 million and 90 million customers in four years time .

The news pushed DIS stock 11% higher, adding more than $20 billion to the firm’s market cap in just a few days.

But is Disney+ the white knight the market made it out to be? A deeper dive into Disney’s overall business suggests it’s not going to save the ailing entertainment conglomerate.

50 Million Disney+ Subscribers is a Drop in the Bucket

Disney’s rapid rise in subscribers is by no means a small feat—the firm only launched its streaming platform a few months ago. If it weren’t for the coronavirus pandemic, it would be exceedingly positive news from every angle. But through the lens of the current public health crisis, it doesn’t hold much weight.

Before the pandemic, Disney’s newly released streaming service was seen delivering $4 billion in revenue over the next two years. Presumably, that figure is an estimate of how much DIS stands to make as it nears its 60 million subscriber goal.

Assuming the firm hits 60 million subscribers this year, you can expect Disney+ to deliver around $1 billion in additional revenue during each quarter of 2020.

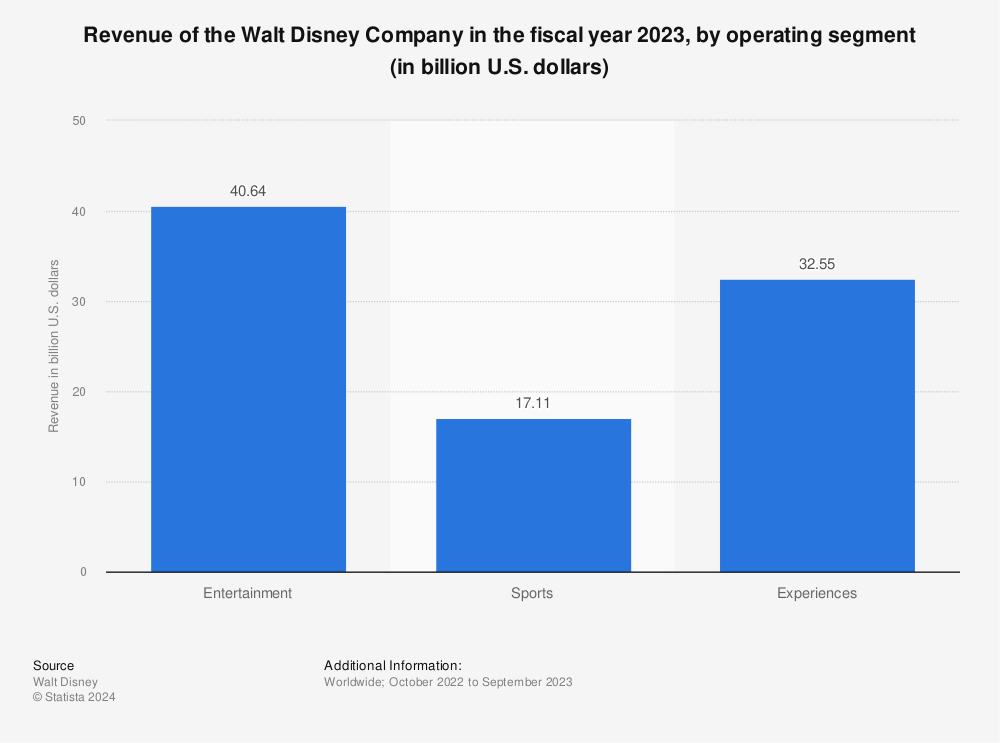

Source: Statista

But $1 billion in additional revenue isn’t nearly enough to make up for the dire losses the firm will see from the rest of its businesses.

Disney’s Parks, Experiences and Products brings in $7.3 billion , about 36% of the firm’s total revenue, each quarter. Coronavirus has caused a complete shutdown of Disney’s theme parks around the world. Disneyland Shanghai has been closed for nearly three months, though some of its restaurants and stores have started to reopen.

In a best-case scenario, Disney’s parks division didn’t bring in any revenue for a month. That’s $2.4 billion in lost revenue—more than double what Disney+ is bringing on board.

A Bleak Future for Parks

Now consider that the estimate above is extremely optimistic. After all, Disneyland Shanghai was closed for virtually an entire quarter . On top of that, the park hasn’t fully reopened yet as China continues to exercise caution to prevent another coronavirus outbreak.

That’s going to be the case globally. Even in the unlikely case that Disneyland reopens in a week or two, people will be hesitant to visit. Visitors from afar, who make up a huge percentage of the park’s entrants, won’t want to cram into a plane to get there. More than half of Disney World Orlando’s visitors are from out of state.

There’s going to be pain coming from Disney’s Parks segment until a coronavirus vaccine becomes available—an outcome that’s at least a year away. Some estimates say the parks won’t return to normal attendance for up to two years . A $4 billion influx from Disney+ simply won’t be enough to offset those losses.

Disney+ Subscribers’ Staying Power

There’s another big reason investors should be cautious about celebrating Disney’s subscriber milestone—staying power. When it comes to subscription services it’s not all about quantity, quality matters too. With the service being so new, it’s unclear exactly how sticky its subscriber base is.

As was seen with companies like Blue Apron , sometimes people sign up for introductory offers and leave when it comes time to pay full price. In Disney’s case, people may be signing up in droves right now because they’re stuck inside and they need a way to entertain their children while they work from home.

Come September, most are expecting to see schools reopen as parents head back to work. Meanwhile, the economy will continue to sputter against the strain of coronavirus and consumers will be cutting back— will they keep their Disney+ subscription?

Not only that, but industry-wide production on new content has come to a standstill. Rich Greenfield of LightShed Partners believes the disruption to media will be significant :

I do not believe there’s going to be a fall TV season for the first time ever.

Without new content to drive value for subscribers, it’s difficult to say how many will be willing to continue renewing their service once lockdown is lifted.

The opinions expressed in this article do not necessarily reflect the views of CCN.com. As of this writing, Laura Hoy did not hold a position in any of the aforementioned securities.