Declining GPU Sales to Cryptocurrency Miners ‘Healthy’: AMD CEO

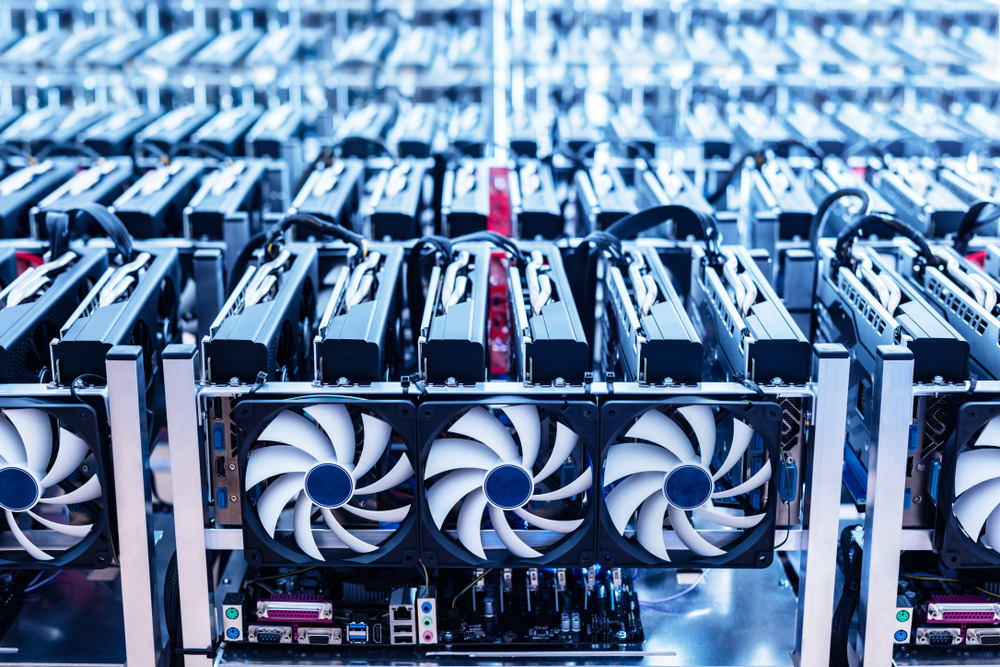

Source: Shutterstock

GPU manufacturers Nvidia and AMD each enjoyed massive sales over the past year, partially thanks to miners who buy GPUs to mine cryptocurrencies. However, those sales are now declining.

The demand for GPUs kept increasing as the value of cryptocurrencies went up throughout 2017. But after the market cap reached an all-time high of $830 Billion, the market crashed and is at half that now. The demand for mining has also cooled down as it is not as lucrative it was for a few months when cryptocurrency prices surged.

AMD reported revenue of $1.65 Billion for the first quarter of 2018 and claimed 10% of that was from GPU sales to miners. Nvidia, on the other hand, reported revenue of $3.21 billion, and $289 million (9% of their total revenue) was from sales to miners.

Though the companies have had massive sales in the cryptocurrency industry, they are not keen to expand on it. Both companies want their GPUs in the hands of consumers for gaming and research purposes rather than miners.

Jensen Huang, the CEO of Nvidia, said:

“The reason why they bought [GPU cards] is for gaming, but while they are not gaming; while they are at school, at work, or in bed — they will turn it on and do a little mining. There’s nothing wrong with that.”

Both companies now expect their revenue from miners to fall in the coming months, but that’s not necessarily because they believe the cryptocurrency market is flaming out.

Bitmain, the largest application-specific integrated circuit (ASIC) miner manufacturer announced ASIC miners for Ethereum last month. Ethereum is the most popular cryptocurrency mined on GPUs, and once the Antminer E3 is out, it might render the existing GPU miners useless.

But Bitmain was gaining ground even before it announced the Antminer E3. Last year, Nvidia posted a profit of $3 Billion, which includes all their products like cloud computing and AI chips. Bitmain posted an operating profit of nearly $4 billion selling just ASIC miners.

AMD CEO Lisa Su is bullish on blockchain and does not think it is going to go away. She expects the mining-related demand for GPUs to drop by two-thirds in the second quarter. However, she is not worried about the drop in sales and called it “healthy” for the company.

Commenting on the crypto-related demand for GPUs, Lisa Su said:

“I do think the blockchain infrastructure is here to stay. I think there are numerous currencies. There are numerous applications that are using the blockchain technology. We don’t see a significant risk of secondhand GPUs coming into the market. I think what you find is that, one, there are number of different currencies, and, two, a lot of these users that are buying GPUs these days are actually buying them for multiple use cases, both commercial and consumer.”

Both Nvidia and AMD have accepted the fact that cryptocurrencies and blockchain are here to stay. Both companies have been embracing these new technologies, but they also aren’t concerned if the revenue from these sales drops in the near future.

Featured Image from Shutterstock