Crypto Money Managers Unleash Social Media Algos to Predict Bitcoin Volatility

Money managers are combing through social media to proactively catch onto crypto trends. | Source: Shutterstock

Money managers are hungry for yield. Crypto continues to outperform just about any other asset class making this nascent market a hot-bed for alternative prediction solutions. And social media algos are front and centre of that speculation.

Cryptocurrency prices, like foreign exchange, are largely decentralized providing plenty of opportunities for smart programmers to profit from the difference. But can those same programmers hone their craft to take advantage of a new form of opportunity, social media sentiment analysis? Some seem to think so.

Funds Head-Hunting Algo Programmers At Alarming Rates

Sentiment analysis is not particularly new, but crypto is. And retail investors don’t hang out in private meeting rooms and exclusive restaurants. They hang out on Twitter and a whole host of other digital mediums. Good-quality programmers who can tap this diamond mine are in high demand.

One report revealed that the number of blockchain job postings has soared to 4,086% since 2019. The large majority of those likely data-driven roles. According to PricewaterhouseCoopers, quantitative crypto funds significantly outperform their peers’ thanks to the analysis of online crypto chatter.

Coders with machine learning skills are particularly highly sought after. One Taiwan-based expert even used crowdsourcing to build an analysis algorithm. Mark Howard explains:

“It’s pretty hot right now, any fund that’s worth their salt, they are devoting some of their resources and allocation for sentiment analysis.”

Fake News and Paid Views

If you were thinking about jumping on the bandwagon, realize that sentiment analysis is not the holy grail of all crypto predictive analysis. At least not yet. Platforms like Twitter, Facebook, and Reddit are still plagued with bag-holders and marketers looking for every chance to punt their own coins.

BitSpread, a blockchain asset management advisory in London has built its own social media algo but warns of the dangers. In an interview with Reuters , CEO Cedric Jeanson explained:

“The sentiment itself, what we see on Twitter, can be really geared toward fake news. We are always very cautious about what we’re reading in the news because, most of the time, we’ve seen that there’s a bias.”

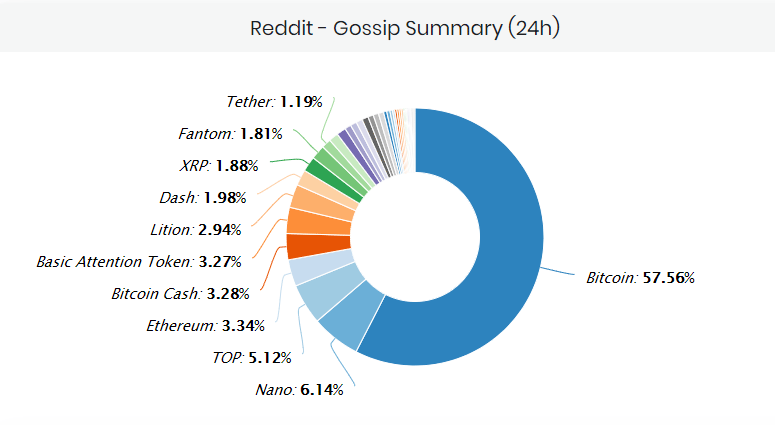

Scraping the most relevant data is no easy task. Indeed, getting an accurate picture of what people are trading compared to what they are saying is tricky. Part of Bitspread’s algorithm focuses on cryptocurrency exchange posts that highlight trading positions. Similar to this:

Retail Interest Not Catching up in This Crypto Bull Run

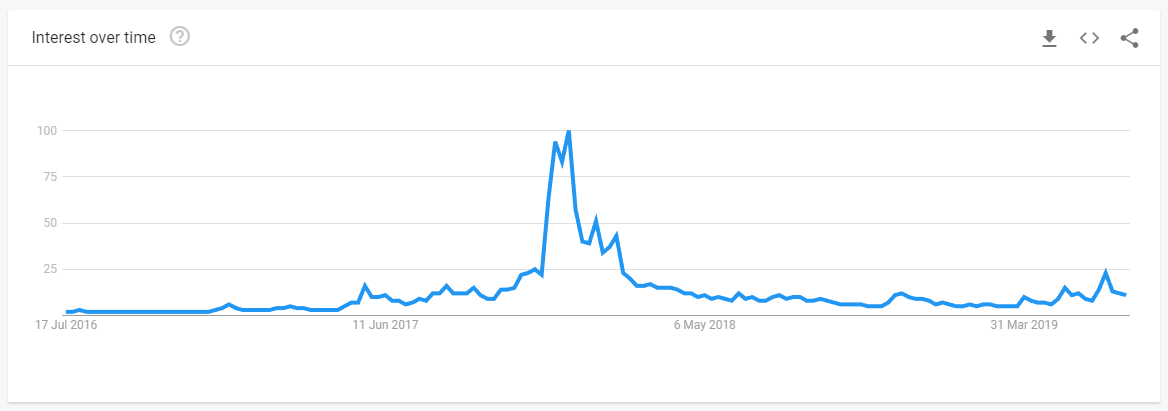

The jury is still out on how successful this approach will be. Despite Facebook’s Libra recently surpassing Bitcoin on crypto Twitter, the latest Google Trends data is not very encouraging.

While Google search interest for Bitcoin was at its highest 2019 level in June, it’s still well off the 2017 highs. Meanwhile, the price has rallied to $14 000, not far from its all-time highs. The data suggests that retail investors may not be driving this bull run as in previous years.

That could ultimately put a spanner in the works for crypto social media algos considering that institutional investors are highly unlikely to post their trades via social media. Either way, it’s early days and the volatility afforded by Bitcoin still offers potential lucrative gains.