Crypto-Friendly Robinhood under the Hood: Payments for Order Flow

Robinhood wants to become the largest cryptocurrency trading platform. | Source: Shutterstock

Robinhood is no doubt quite a revolutionary start-up. They have managed to completely rewrite the rulebook when it comes to retail brokerage and trading.

Using a no fees model, they are giving users the opportunity to purchase assets such as equities, Indices and cryptocurrency at the same rate as the institutional markets. Many view them as democratizing the investing space and leveling the playing field.

There have been many that have questioned how a brokerage that charges no fees is able to make money in a sustainable way.

This skepticism led them to uncover some interesting SEC disclosures of Robinhood which showed that the brokerage had a pretty interesting business model. They were selling their client order flow to High Frequency Trading (HFT) Firms.

Of course, this raised more questions than it answered and led many to conclude that Robinhood was anything but a modern-day redistributor of wealth.

Is this criticism justified?

I will take an in-depth look into the Robinhood business model, the HFT industry and how this could impact the end user – you, the trader.

Payments for Order Flow

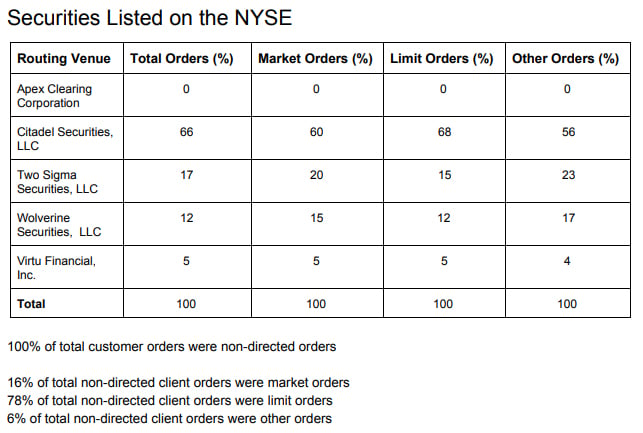

It was first brought under the spotlight in Robinhood’s SEC rule 206 disclosure for the second quarter. These are reports that broker-dealers are required to publish which disclose their order routing practices.

In this case, the Robinhood report showed that they routed all of their orders to 4 different HFT firms. These were Citadel Securities, Two Sigma Securities, Wolverine Securities and Virtu Financial.

In the same report they also outlined the financial relationships that they had with these firms. Robinhood is paid for each order that they route to these market makers. For example, Citadel securities paid them “less than $0.00026 per dollar of executed trade value”.

So, in other words, instead of Robinhood making money from the trader, they are being paid by the market maker to send them your order. The market maker will then execute your order on their books at the market rate.

That this is happening is not too surprising.

For one, the founders of Robinhood used to work with HFT firms in their previous startup, Chronos Research. This company developed software that was used by HFT firms in order to place their orders.

Moreover, it is not just Robinhood that sells access to their order flow. This is practiced by other brokers including TD Ameritrade Holding Corp., E*Trade Financial Corp. and Charles Schwab Corp.

So, we now know that this practice is ongoing in the highly regulated and transparent equity markets. Could the same practice be happening in the relatively nascent cryptocurrency markets?

Robinhood in the Crypto Markets

At the beginning of this year, Robinhood made it their mission to jump head first into the crypto markets. CCN.com has previously covered the efforts that Robinhood is making in these markets.

They have now launched in a number of US states and offer Bitcoin, Ethereum, Litecoin, Bitcoin Cash and Dogecoin. Users were quite excited about the prospect of buying their favorite coins with no fees.

However, when the disclosure became public many in the crypto community were concerned with Robinhood’s business model.

This is further compounded by the fact that the cryptocurrency markets are still unregulated. This means that even if Robinhood had similar agreements with firms, they would not be obliged to disclose it.

It is unlikely that have agreements with the firms we mentioned above. This is because both Citadel and Two Sigma have not entered crypto markets on account of their founder’s skepticism. Virtu said that they would like to enter the physical bitcoin markets but only when they become more regulated.

However, we do know of a number of other HFT crypto firms that have been making markets over the past year. These include the likes of Jump Trading and Cumberland digital (a subsidiary of DRW).

So, it is entirely possible that there are market makers who would be willing to pay Robinhood for the orders they route through their books.

What’s in it For the HFTs?

You can be forgiven for thinking that HFTs buy the order flow in order to make money on the orders. This is not really the case and they are after something much more valuable.

HFTs are looking for information and market data which they can plug into their trading algorithms . More specifically, they are looking for a better understanding of what the current retail market flow is like (individual traders).

This is important as it will help them to better position their trading books for institutional market flow. They use the data in their computer models in order to map order flow and segment out the retail demand from the institutional demand.

This is perhaps best illustrated in the below image of HFT strategies. Their passive market making is their least profitable strategy. However, by identifying institutional order flow and hence being able to ascertain direction, they can use directional strategies. These are much more profitable.

Of course, the institutions are well aware that the HFT firms are trying to take advantage of market and order data. They will try to cover their orders either through the use of iceberg orders or through the OTC markets using “dark pools “.

This is just scratching the surface when it comes to the cat and mouse games that large investors and HFT firms play. It is also perhaps one of the reasons that the former despises the latter so much.

What does this mean for the average retail trader though?

Implications for Markets

While the HFTs often become the proverbial whipping boy for a number of participants in the market, they can provide liquidity and drive down spreads.

The agreement that Robinhood has with the HFTs still provides a net gain for the end user. You are still able to purchase your coin or share commission free.

Some may say that the fact that HFTs are paying Robinhood for their order flow means it creates a perverse incentive for Robinhood to choose only the highest paying Market Makers. However, Robinhood must by law seek best execution for client trades. Best execution takes a number of important factors into play including price.

So, who could be losing out from this arrangement?

Big institutions or crypto whales are probably going to find it bit harder to place large orders under the radar. Their order flow could be sniffed out by the HFTs which will then use this information to the benefit of the market maker.

However, if you are getting commission free best execution trading at the expense of a crypto whale, is that not the Robin Hood spirit?

Featured image from Shutterstock.