Crypto Bull Analyst Predicts Sharp Bitcoin Price Correction Below $10,000

An analyst, who is bullish in the long-term, sees corrective retreat for bitcoin in the short-term. | Source: Shutterstock

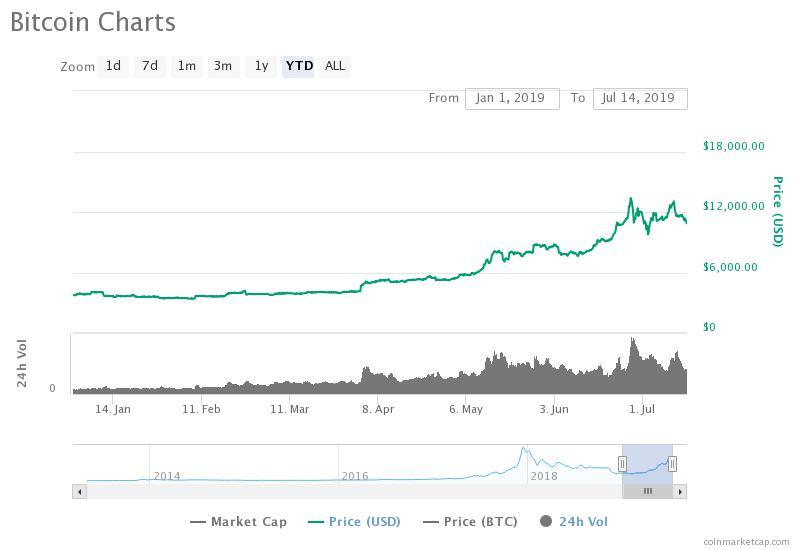

Since June 27, the bitcoin price has dropped from nearly $14,000 by more than 22 percent against the U.S. dollar in a relatively large pullback, leading the valuation of the crypto market to drop.

Still, despite the minor correction, the bitcoin price is up more than 210 percent year-to-date as one of the best-performing assets in the global market.

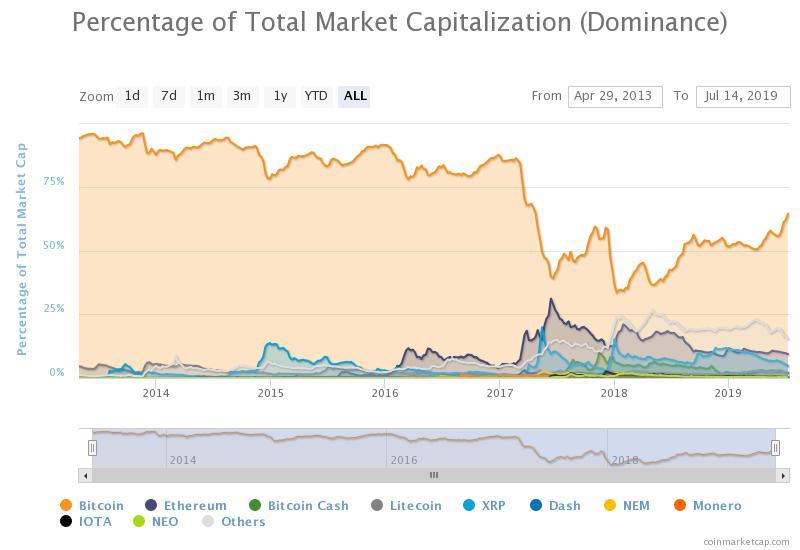

In comparison, other major crypto assets that tend to be substantially more volatile have struggled to record gains above 200 percent since January with the exception of Litecoin and Binance Coin.

A scenario in which bitcoin falls below $10,000

Considering that the bitcoin price has moved from $4,000 to nearly $14,000 within four months, large setbacks from the current price range remains a strong possibility.

Technical analysts like Josh Rager have said that if the bitcoin price fails to recover beyond the mid-$10,000 region at around $10,577, a pullback to the $9,000 region is likely.

“Really want price to stay and close above $10,900s to maintain hope Any break & close below $10,577 would signal a change in trend short term & I’d be looking at low $9ks as the next target on the daily. Still bull market in my opinion (would only be a pullback),” he said.

Rager emphasized that in the medium to long term, the trend of bitcoin is still bullish. There are several key fundamental factors to consider that could act as catalysts in the upcoming months, such as the emergence of trading venues like Bakkt and the block reward halving of bitcoin.

In May, on CNBC’s Fast Money, BKCM CEO Brian Kelly said that many miners have obtained enough capital to finance their operations for the next 12 months to hold onto BTC they produce, anticipating the value of the dominant crypto asset to rise as it moves towards halving.

Kelly said:

“I’ve talked to a lot of miners around the world, a lot of them have said they have sold enough bitcoin to get us through the next year or so and we are going to hoard bitcoin at this point in time and we are not going to sell it and the supply of bitcoin will get cut in half. Just real simple economics: lots of demand hitting little supply, price goes higher.”

Hence, while many technical indicators point toward a short term trend reversal if the asset continues to move down in the next 24 to 48 hours, `fundamental factors present a variable.

Alternative assets are suffering

As the bitcoin price fell around six percent on the day, various alternative crypto assets in the likes of Ethereum, XRP, Litecoin, Bitcoin Cash, and Binance Coin fell by 4 to 9 percent against the U.S. dollar.

According to ATHCoinIndex, bitcoin remains down by around 43 percent from its all-time high at around $20,000. Most alternative crypto assets are down by 80 to 90 percent from their record highs.

Ethereum, XRP, and Bitcoin Cash, for instance, are all down at least 83 percent from their record highs, unable to outperform bitcoin throughout the past seven months.

Consequently, the dominance of BTC over the global crypto market has risen to 65 percent for the first time since late 2017.