Crypo Market Defends $120 Billion Mark But Bitcoin Price Takes Losses

The Bitcoin price tilted downwards on Wednesday. | Source: Shutterstock

Bitcoin and the other top 5 cryptocurrency assets suffered insignificant losses through the 24-hour period, but they were all in the red. Globally speaking, the only top 10 crypto to see a gain during the period was Tether, which indicates a good deal of selling took place. Litecoin continued its trend of daily volume exceeding $1 billion.

Bitcoin Drops Below $3,600 on Coinbase

Bitcoin lost less than 1% over the 24-hour period in a global manner of speaking. At Coinbase, the usual loss leader and retail trading final boss, the flagship cryptocurrency trades around $3,570 at press time. Overall volume for the Bitcoin market was $6.5 billion.

Support at $3,500 still appears strong for the foreseeable future, but the markets have their ways. If Bitcoin tests $3,500, we can likely expect further downward pressure. But if higher prices are attained on the next batch of sell-offs, we could push back toward $3,650 and on to $3,700.

Ethereum Holds Above $120

At press time, Ethereum trades around $121 globally, but closer to $120 on Coinbase. Percentage-wise, as shown below, it’s been pumping in a more popular rhythm than Bitcoin.

Global volume for ETH was about half that of BTC, which could signify an interesting future.

If Ethereum begins to trade equal or greater than Bitcoin’s volume, would we see a break from the BTC-peg and a run north?

Lots of bulls waiting in the wings certainly hope so.

Bitcoin Cash Worth More Than Ether?

For the first time in a while, Bitcoin Cash (BCH) had a per-token price higher than Ethereum.

Its ~$235 million volume was overwhelmingly dwarfed by Ether, however, and we had to do a closer inspection to see what fueled the global average.

What we learned is that a few lesser-known exchanges are fueling the high BCH price. One seems pretty out of touch with reality, putting it at over $135.

Therefore, in real terms and subject to volume guidelines, Bitcoin Cash is probably not actually more valuable than Ethereum.

Litecoin Maintains Solid Trading Volume

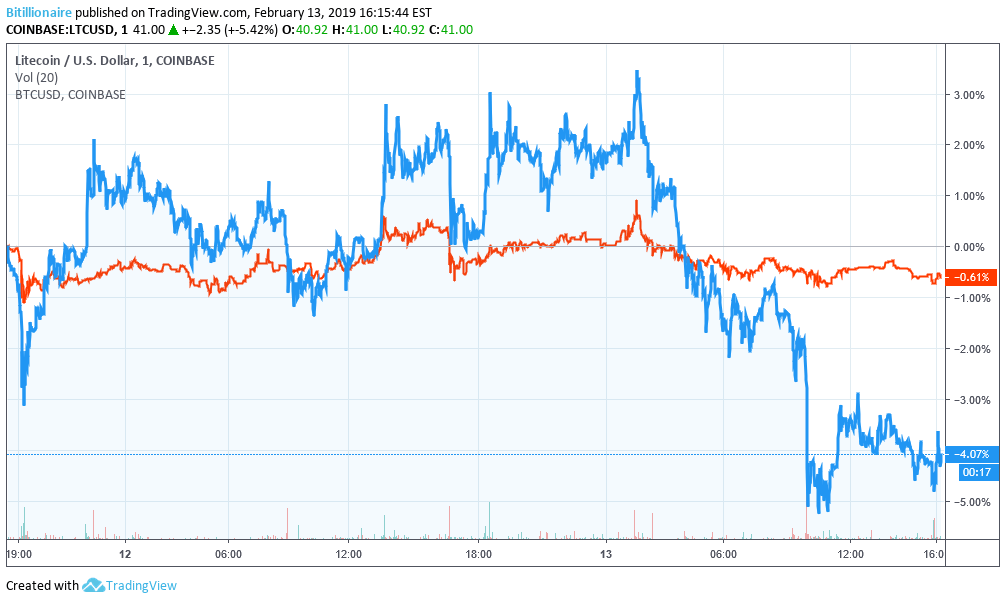

Litecoin might be growing into its own. With a regular daily volume past $1 billion these days, the LTC charts no longer follow Bitcoin’s movements so closely.

The ideal crypto market is one where multiple coins are held to their own standards and traded against fiat. Litecoin, perhaps the oldest altcoin still massively traded, represents a viable third-wheel to Bitcoin and Ethereum in this regard.

A true valuation of Litecoin will emerge when the majority of its charts look foreign to the Bitcoin charts. Bitcoin dives, Litecoin stays still – or does the opposite. These are the signs of market maturity we’re looking for. Otherwise, the market is a house of cards: the largest coin falls, everyone goes with it. Not ideal.

Featured Image from Shutterstock. Price Charts from TradingView .