Crypto Giant Coinbase Launches Cross-Border Payments with XRP and USDC

Coinbase has expanded into international payments with XRP and USDCoin. | Source: Shutterstock

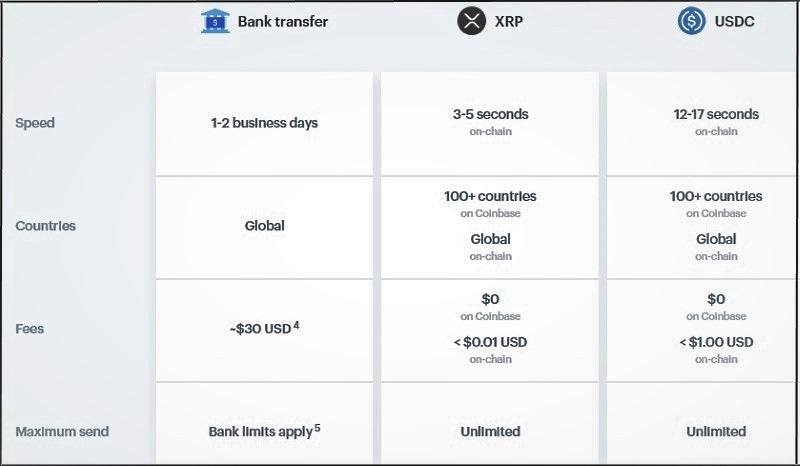

Crypto exchange Coinbase is now offering cross-border payments service to enable customers to transfer funds using Ripple (XRP) and the stablecoin USDCoin (USDC).

Coinbase made the announcement on its website , touting the service as fast and convenient:

“You can now send money to any user with a Coinbase account around the world using XRP or USDC.”

“By using cryptocurrencies that are optimized for cross-border transmission, you can send and receive money virtually instantly by sending those cryptocurrencies and having the recipient convert them into local currency.”

“There’s zero fee for sending to other Coinbase users, and a nominal on-chain network fee for sending outside of Coinbase.”

Circle Launched USDC in September 2018

Crypto unicorn Circle launched the stablecoin USDCoin (USDC) in September 2018.

As CCN.com reported, USDC is pegged to the U.S. dollar and enables individuals and institutions to tokenize physical currency for use in overseas trading and other cross-border transactions that require rapid settlement.

Unlike other USD-backed stablecoins, Circle is not USDCoin’s sole issuer. Instead, the token is designed to have multiple issuers as more organizations join Centre, an open-source consortium that develops a decentralized network of fiat stablecoins.

Binance Mulls xRapid Partnership

The crypto industry is making strides in the cross-border payments market. In February, Binance CEO Changpeng Zhao said he “definitely” wants to partner with Ripple’s xRapid cross-border payment platform at some point.

“With xRapid, there’s nothing going on right now,” CZ said. “But in the future, we definitely want to add them as a partner.”

XRapid is a Ripple product that uses its native XRP cryptocurrency to provide real-time liquidity and reduce the capital requirements necessary for financial institutions to operate in emerging markets.

Analyst: Bitcoin Is a Threat to Payment Giants

Research analyst Lisa Ellis of MoffettNathanson says crypto could become an existential threat to payment giants Visa, Mastercard, and PayPal. However, that’s not happening anytime soon, she noted.

“Cryptocurrency systems (e.g., Bitcoin, Ethereum, Ripple) are potentially disruptive to private payment systems,” Ellis wrote in a client note.

“Their core design characteristics — which are aimed at enabling ‘freedom of money’ — are in direct contrast to the characteristics of most traditional, private payment systems.”

Ellis says bitcoin or another cryptocurrency won’t supplant PayPal and credit cards as payment options yet, but they could in time.

That’s why she says these established players should embrace crypto or risk losing market share to Ripple and Veem, which are leveraging cryptocurrencies for cross-border payments.