Judge: Coinbase ‘Incompetent,’ But No Fraud in Bitcoin Cash Launch

A San Francisco judge cleared Coinbase of fraud, but slammed the exchange for its 'incompetent' handling of the BCH launch. Source: Shutterstock

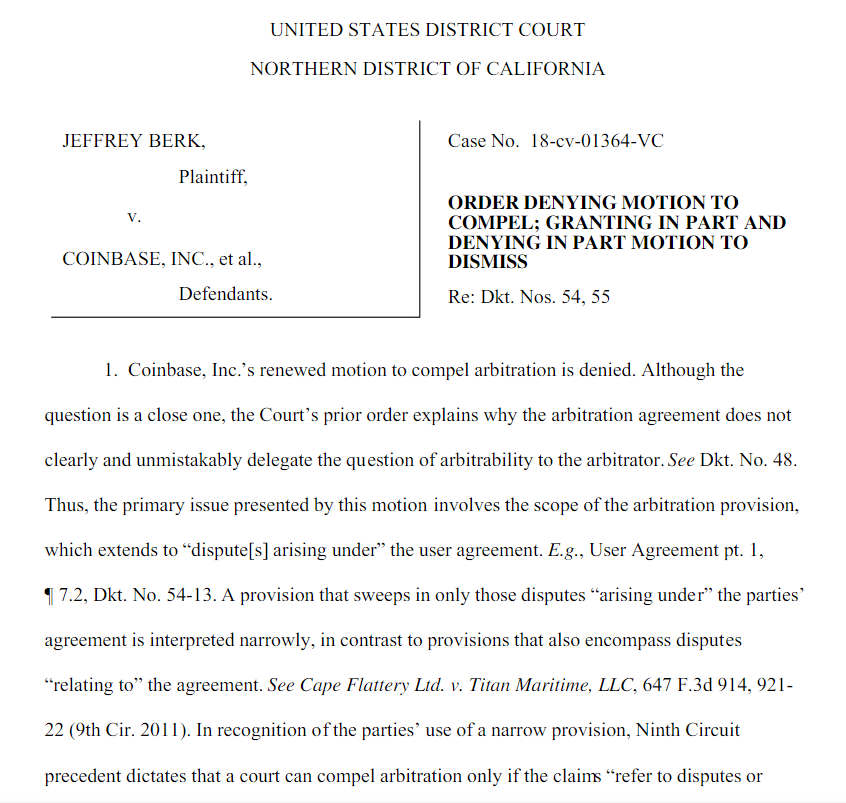

The Northern District Court of California has slammed Coinbase’s ‘incompetence ’ over its controversial Bitcoin Cash launch in 2017. The court denied a renewed motion by the company to force arbitration against plaintiff Jeffrey Berk, but dismissed allegations of fraud against Coinbase.

“Moreover, while the factual allegations paint a compelling picture of an incompetent launch by Coinbase, the complaint does not outline a coherent account of fraud by Coinbase, Armstrong, and Farmer.”

As reported by CCN.com earlier this year, the cryptocurrency trader sued the exchange for insider trading in Bitcoin Cash. While the ruling cleared Coinbase and its leadership of outright fraud, they clearly can’t be too pleased with the current state of affairs.

The arbitration ruling was a win for Berk; however, the judge also threw out multiple claims that he and other plaintiffs made. Crucially, US District Judge Vince Chhabria sided with Coinbase regarding the alleged market manipulation:

“That standard plainly has not been met for the plaintiffs’ claims premised on Coinbase’s alleged facilitation of insider trading or alleged market manipulation.”

Buyers, not sellers, to move forward with negligence lawsuit due to Bitcoin Cash Launch

BCH spiked a day before listing on the popular American exchange back in 2017 causing Berk and others to speculate on whether Coinbase had provided insiders the opportunity to buy ahead of the news.

Readers will recall that Coinbase subsequently halted trading in Bitcoin Cash within a few minutes of officially listing. At the time, they cited “significant volatility” as the cause for suspension.

That’s a rather dubious claim in a market that is generally quite volatile. And Judge Chhabria agreed:

“The complaint also lays out a plausible account that Coinbase breached its duty to maintain a functional market. For starters, the fact that Coinbase halted trading within three minutes of the launch is indicative of dysfunction.”

He further noted the premiums that many buyers were forced to pay given the situation. As such, Judge Chhabria has given the go-ahead for buyers, not sellers, to move forward with a negligence lawsuit against the cryptocurrency exchange.