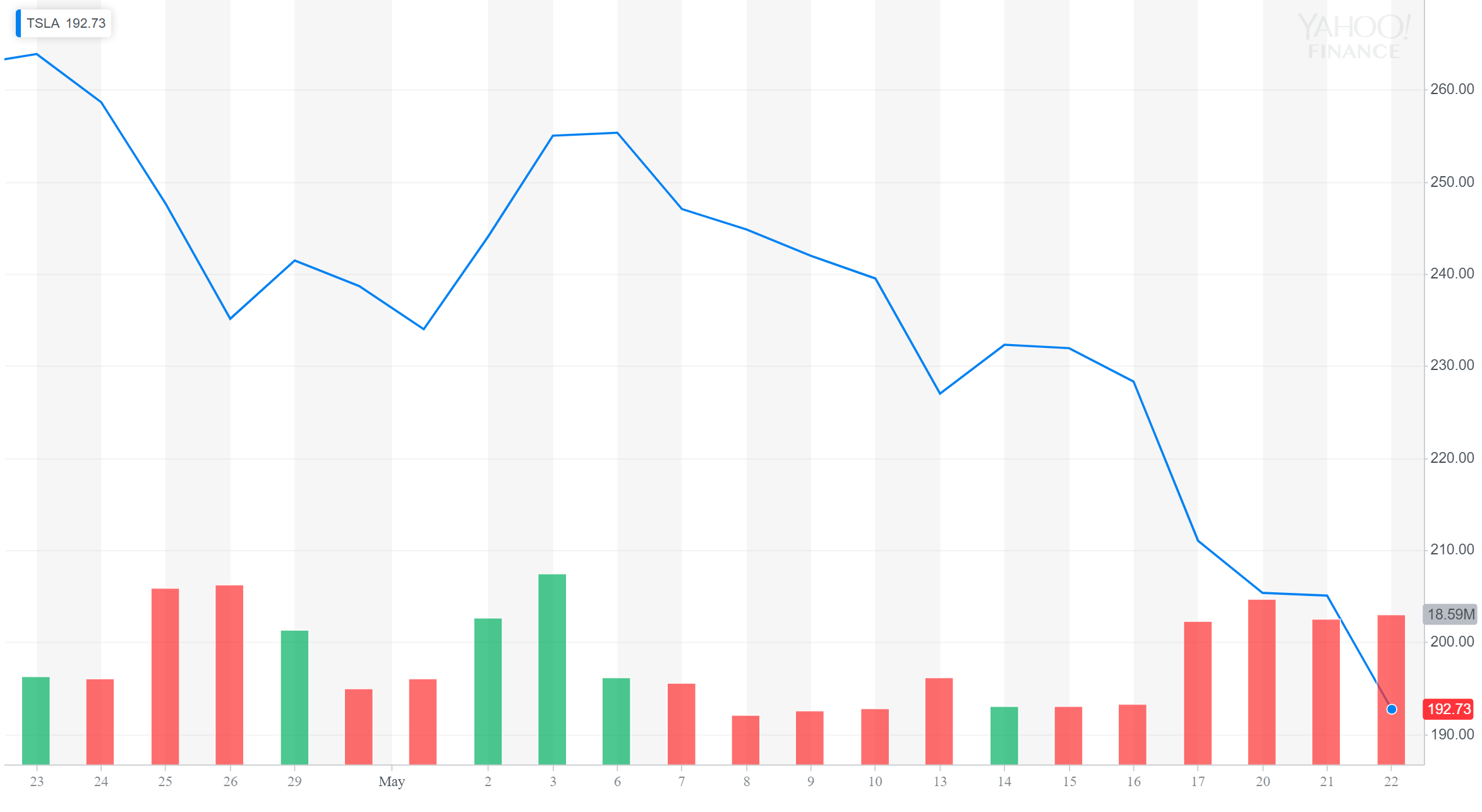

‘Code Red’ for Tesla: 80% Drop Forecasted as Stock Sinks to $192, a 30-Month Low

| Source: REUTERS/Lucy Nicholson/Files

By CCN.com: Within one month, the share price of the Tesla stock has dropped by a staggering 27 percent as it plunged below the $200 level for the first time since 2016.

The intensifying downtrend of the Tesla stock is said to have been triggered by a barrage of negative factors including CEO Elon Musk’s admittance of a cash flow issue at the company and the decline in the exports of its flagship models further fueled by the ongoing U.S.-China trade war.

Can Tesla Survive “Code Red” Situation?

Last week, Daniel Ives at Wedbush suggested Tesla, Musk & Co. are facing a code red situation as investors continue to express bearish concerns over the company’s margins, increase in competition in the global electric car market, and the firm’s financial stability.

He said :

With a code red situation at Tesla, Musk & Co. are expanding into insurance, robotaxis, and other sci-fi projects/endeavors when the company instead should be laser focused on shoring up core demand for Model 3 and simplifying its business model and expense structure in our opinion with headwinds abound.

Since Ives reaffirmed his bearish stance towards the short to medium-term performance of Tesla, the share price of the company has fallen from $211 to $193, to a level the market has not seen for nearly two years and a half.

Tesla has found itself some breathing room after a successful $2.7 billion capital raise and a $500 million loan from China, which could reduce the concerns of investors towards potential liquidity or cash flow issues.

But, with analysts at major financial institutions in the likes of Morgan Stanley and Citi becoming overwhelmingly downbeat regarding the near-term trend of the company, the Tesla stock may face difficulty in easing the pressure placed upon the stock.

John Murphy, an analyst at Bank of America Merrill Lynch, for instance, said that the newly obtained capital of Tesla is not enough to eliminate his concerns about the company and the pathway towards profitability.

“Tesla’s $2.7 billion capital raise, along with a $500 million-plus Chinese bank loan, and potential cash from incoming Model Y reservations, are good steps that could put liquidity concerns about Tesla to rest (for now) and buy additional time for the company. However, Tesla‘s pathway to becoming a self-funding entity is still unclear. As such, we continue to question Tesla’s longer-term profitability, cash flow, and valuation,” said Murphy.

80% Drop a Possibility?

Amidst uncertainty surrounding cash flow and profitability, the downtrend of Tesla accelerated as the latest trade talks between U.S. and Chinese negotiations fell apart, primarily due to the lack of appetite of China to push for a comprehensive deal with strong industrial policy change requests by the U.S.

As CCN.com reported, Friedrich Wu, a professor at Nanyang Technological University in Singapore, said the current structure of the trade deal is simply not appealing to the domestic audience and that the Chinese people can “endure more pain” for the prospect of a compelling agreement.

Tesla has already committed a grand project in the form of a Gigafactory to the Chinese market. However, as tariffs on automobile exports rise to 25 percent, Tesla may be forced to raise the pricing of its flagship models like the Model S once again to the $80,000 to $100,000 range.

Itay Michael, a global markets analyst at Citi, said he foresees the share price of the Tesla stock plummeting to as low as $36 shall the cash flow issues at Tesla are sustained throughout the short to medium-term.

“Maintain sell/high risk as the risk/reward still appears negatively skewed despite the recent capital raise and stock pullback, mainly on lingering demand/FCF (free cash flow) concerns. Reducing estimates to reflect the recent capital raise, Q1 results/guide and our own inputs,” Michael noted .

The market capitalization of Tesla, which surpassed that of Ford at one point, remains at $34 billion, around $6 billion less than Ford’s current valuation of nearly $40 billion.

Too Early to Write it Off

Tesla did experience a poor start to 2019 due to a culmination of factors but its flagship Model 3 continues to boast popularity in key markets.

According to CleanTechnica, the Tesla Model 3 was the 3rd top-selling vehicle in California in the first quarter of 2019, after surpassing all electric car makers in Europe.