Cloudflare Hits Market up 22 Percent After Dropping 8chan

Shares of American web infrastructure and website security company Cloudflare surged 22 percent on its first day of public trading today. | Source: AP Photo/Richard Drew

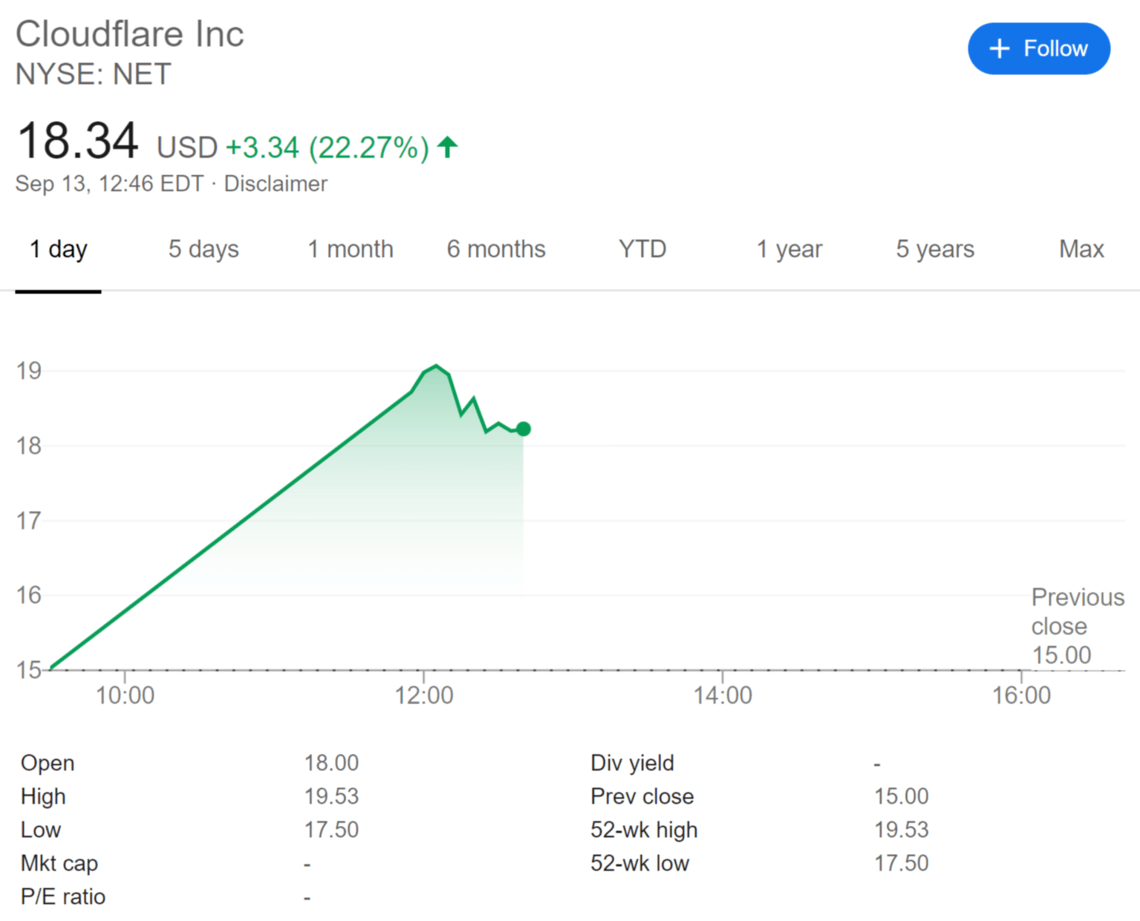

Shares of American web infrastructure and website security company Cloudflare surged 22 percent on its first day of public trading today, opening at $18 after its initial public offering (IPO) priced shares at $15.

Earlier in the week, Cloudflare’s IPO shares were increased from between $10-12 to $12-14 per share. The company raked in $525 million after selling 35 million shares.

Weathering the Storm

Cloudflare has seen itself involved in multiple unwanted controversies over the past few years.

Early last month, the company ceased servicing online message board 8chan after the El Paso shooter posted anti-immigrant and anti-government content on the website.

Cloudflare CEO Matthew Prince stated that though 8chan itself did not violate any laws, the website was out of alignment with his company’s goals of helping build a better internet. Prince wrote in a blog post :

“Unfortunately, this is not an isolated incident. Nearly the same thing happened on 8chan before the terror attack in Christchurch, New Zealand. The El Paso shooter specifically referenced the Christchurch incident and appears to have been inspired by the largely unmoderated discussions on 8chan which glorified the previous massacre. In a separate tragedy, the suspected killer in the Poway, California synagogue shooting also posted a hate-filled “open letter” on 8chan. 8chan has repeatedly proven itself to be a cesspool of hate.”

Cloudflare also terminated services with The Daily Stormer after the neo-Nazi and white supremacist message board claimed that the web infrastructure company was secretly supporting its ideology .

The decision to cut-off services to problematic websites has seemingly worked out well for Cloudflare, as evidenced by today’s surge in the company’s share price.

The question now revolves around whether or not Cloudflare can fare better than its 2019 IPO counterparts Uber, Lyft, and Slack — all of which have seen serious losses since debuting on the public market.