Chinese Stocks Fall, U.S. Bonds Rise as Trump Administration Weighs Iran Retaliation

Asian stocks declined in the final session of the week on apparent progress in U.S.-China trade talks. | Image: AP Photo/Lee Jin-man

Asian stocks tumbled on Tuesday, as the flight from risk assets continued in the wake of devastating weekend attacks on Saudi Arabia’s oil industry.

Latest U.S. intelligence has been persistent in claiming that Iran was responsible for the attack. As The Wall Street Journal reports , Washington and its allies are already considering retaliation.

China Leads Asia Pacific Stocks Lower

Equity markets in the Asia Pacific region were mostly lower Tuesday, with Chinese shares extending an early-week slide. The benchmark Shanghai Composite Index fell 0.8% to 3,005.53.

The Shanghai Shenzhen CSI 300 Index was down 0.7% at 3,929.25.

In Hong Kong, the Hang Seng Index tumbled 0.9% to 26,884.40.

Japan’s Nikkei 225 index was down 0.1% to 21,964.74. Japanese markets were closed on Monday for a national holiday.

Australia’s benchmark S&P/ASX 200 Index pared losses to trade flat at 6,674.80.

U.S. Blames Iran for Saudi Oil Attack

The U.S. intelligence community believes Iran is responsible for weekend drone attacks that devastated Saudi Arabia’s oil fields, resulting in the loss of 5.7 million barrels per day of crude output. According to The Wall Street Journal, Washington and its allies are weighing retaliation.

Iran has denied any involvement in the attacks, which were claimed almost immediately by Yemen’s Houthi rebels at war with Saudi Arabia since 2015. The Saudis dismissed the Houthis’ claims on grounds that the weapons used were Iranian made.

On Sunday, President Trump tweeted that his military was “locked and loaded” to respond once the attackers were verified.

The assessment behind naming Iran responsible hasn’t been shared publicly. It’s also not entirely clear whether U.S. intelligence agencies believe Tehran carried out the attack directly or through one of its proxies.

U.S. Stock Futures Flat-Line

The U.S. futures market was surprisingly calm in overnight trading. Dow, S&P 500 and Nasdaq futures were little changed at the time of writing.

The Dow Jones Industrial Average (DJIA) fell more than 140 points on Monday as risk aversion dictated market tempo. It was the Dow’s first drop in nine sessions.

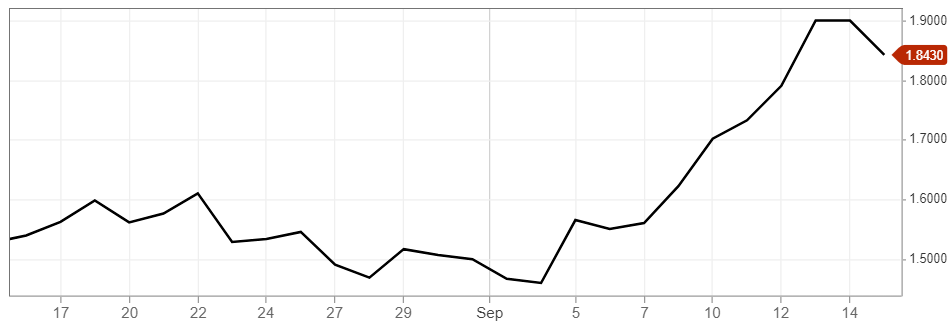

U.S. Treasury bonds are rising this week, sending bond yields tumbling. The yield on the 10-year U.S. Treasury bond is down roughly 8 basis points from Friday’s close.