China’s iPhone 11 Love Affair Could Send Apple Stock to New Highs

China's unexpected love affair with the iPhone 11 could send Apple stock to new highs, lingering trade war concerns or not. | Source: Justin Sullivan/Getty Images/AFP

Analysts have expressed concerns towards declining sales of Apple products since early 2019, particularly after AAPL’s $44 billion sell-off last month. Its flagship iPhone 11, however, is selling unexpectedly well in China, which may be the catalyst Apple stock needed.

Pinched by the U.S.-China Trade War, as well as shifting tastes among Chinese consumers towards more affordable devices offered by local brands like Huawei and Xiaomi, Apple has had a difficult year targeting one of its main markets in China.

In January, former Apple retail executive Carl Smit indicated that it would require a radical change for Apple to be competitive in the Chinese market once again, noting that the company wasn’t adapting well to the evolving climate.

“They’re not adapting quick enough. These apps and systems are how people communicate in China, and if you don’t have seamless integration, the Chinese manufacturers have an edge,” he said at the time.

However, based on the reception of the iPhone 11 in the past two days, Apple may have found a solution to boost its performance in the Chinese market: offering the device at a price point that appeals to local consumers.

Apple stock could see solid recovery if performance can be sustained

According to Ming-Chi Kuo, an analyst at TF International Securities, pre-orders coming from China for the iPhone 11 are beating expectations, even though U.S. demand has been lackluster.

“The demand for iPhone 11 in the Chinese market is stronger than that in the U.S. market. iPhone 11′s price is roughly equivalent to 1–1.3 times the average monthly salary in China, which is close to the price sweet spot (vs. iPhone XR’s price equivalence of 1.5–1.7 times the average monthly salary in China),” Kuo said .

Ever since Apple’s smartphone sales began to decline in China, analysts suggested that the price point of the iPhone was no longer appealing to local consumers, especially considering the premiums that are charged over local smartphones.

With the plateauing growth of smartphone development lessening the need to change to a new model on a yearly basis, the demand to purchase the flagship models of Apple and other phone makers like Samsung dropped.

As Kuo explained, the newly released iPhone 11’s price point appeals to Chinese consumers for the first time in years, allowing the company to boost its performance in the country.

Analyst Daniel Ives of Wedbush Securities said that the firm’s performance in China remains the biggest variable for Apple stock’s trajectory over the next 12 months.

Based on the apparent popularity of the iPhone 11, Apple stock could extend its recent rally.

“China sales remaining the biggest X variable for Cook & Co. over the next year with trade tensions and the Huawei situation remaining black clouds over Cupertino’s head in the region,” said Ives.

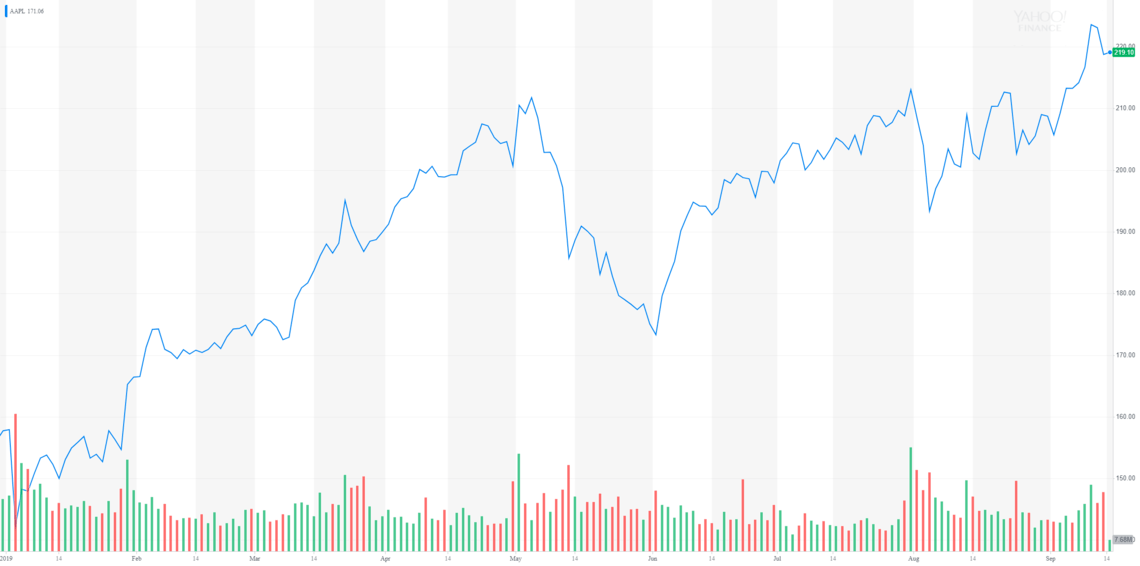

Apple stock has already surged by more than 38 percent year-to-date, pushing it within a few billion dollars of a $1 trillion market cap – followed soon after by a new all-time high.