China’s Stock Rally Rages On as Analyst Predicts Unstoppable Upside

Chinese stocks jumped to a two-year high this week and there's more upside for markets to grow, an analyst has claimed. | Source: WANG Zhao / AFP

- China’s stock market could continue to see uninterrupted recovery strategists say, buoyed by positive fiscal policies.

- The PBoC announced a $100.99 billion loan program to inject more liquidity into the market.

- The SSE Composite is now 12% higher than pre-pandemic levels.

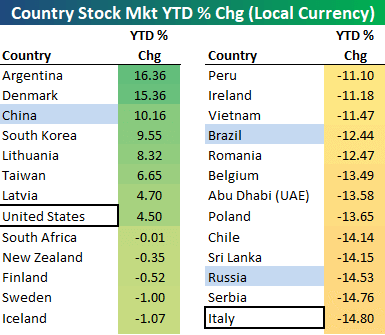

China’s stock market could see an uninterrupted recovery in the medium-term, strategists say. Despite heightening geopolitical risks and territorial tensions, the nation’s economy is quickly rebounding.

David Chao, a global market strategist at Invesco Asia Pacific, attributed the recovering economy to the handling of the pandemic.

The strategist emphasized that China controlled the pandemic early on, paving the economy’s path to recovery.

Consequently, Chao noted that the economy could “continue its recuperation somewhat interrupted,” expressing optimism towards the stock market.

China’s Stock Market Recovers Past Pre-Pandemic Levels, Buoyed By Strong Fiscal Policies

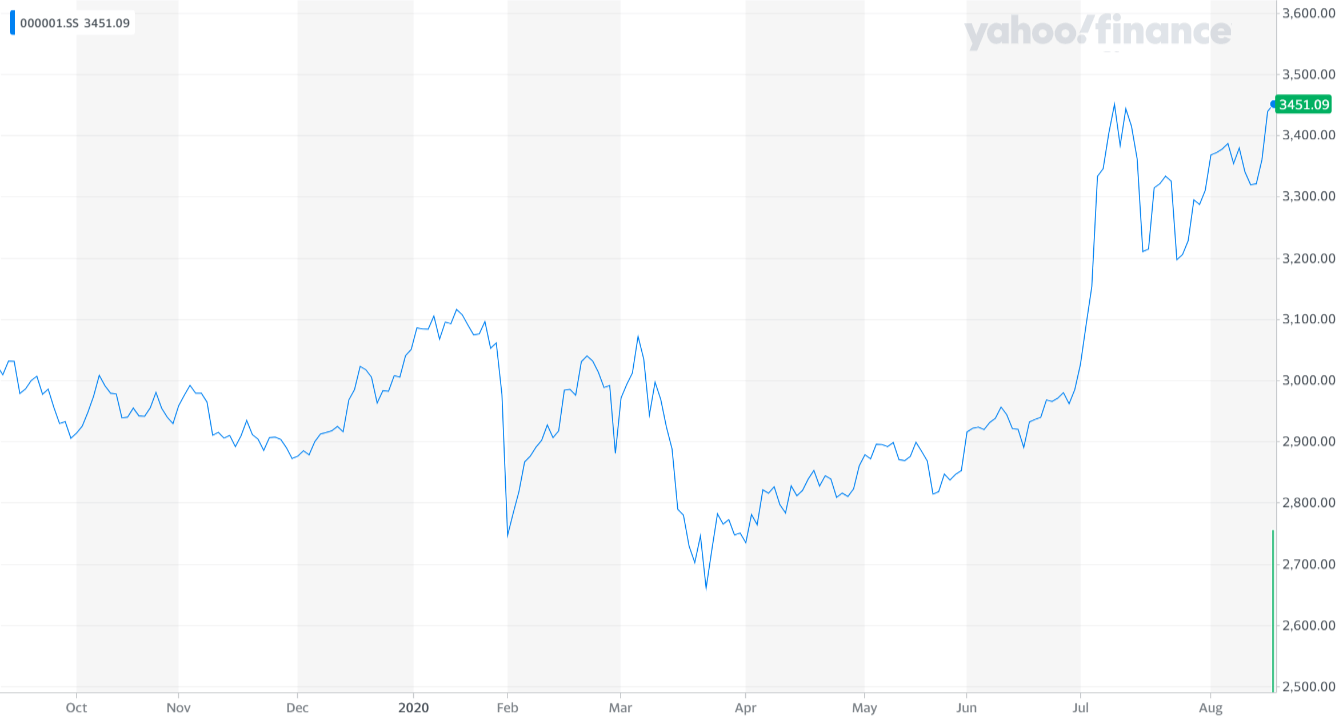

The SSE Composite index, which tracks all stocks on the Shanghai Stock Exchange, surpassed 3,451 points on August 18.

In February, before the pandemic, the SSE Composite index hovered at 3,071 at the peak of the first quarter.

The Chinese stock market has increased by more than 12% since pre-pandemic levels, completing a V-shape recovery.

According to Chao, he believes the Chinese stock market might see more upside. The economy has started to reopen, supported by the People’s Bank of China (PBoC) ‘s $100.99 billion loan program. Chao said:

“I think that it’ll continue to be constructive both on the Chinese economy and on the markets. I still think that’s there’s still meaningful upside from current levels.”

Strategists are also optimistic about the relatively positive stance of the PBoC to provide enough firepower to aid economic recovery.

Natwest Group’s China economist Liu Peiqian said that the injection of new liquidity shows “a more accommodative stance.”

Peqian said the recent initiative of the PBoC demonstrates the government’s intent to sustain stability. She explained that it is positive because the move is not a reaction to slowing markets.

Instead, it indicates that the Chinese government currently sees a gradually rebounding economy, and its efforts are to stabilize it.

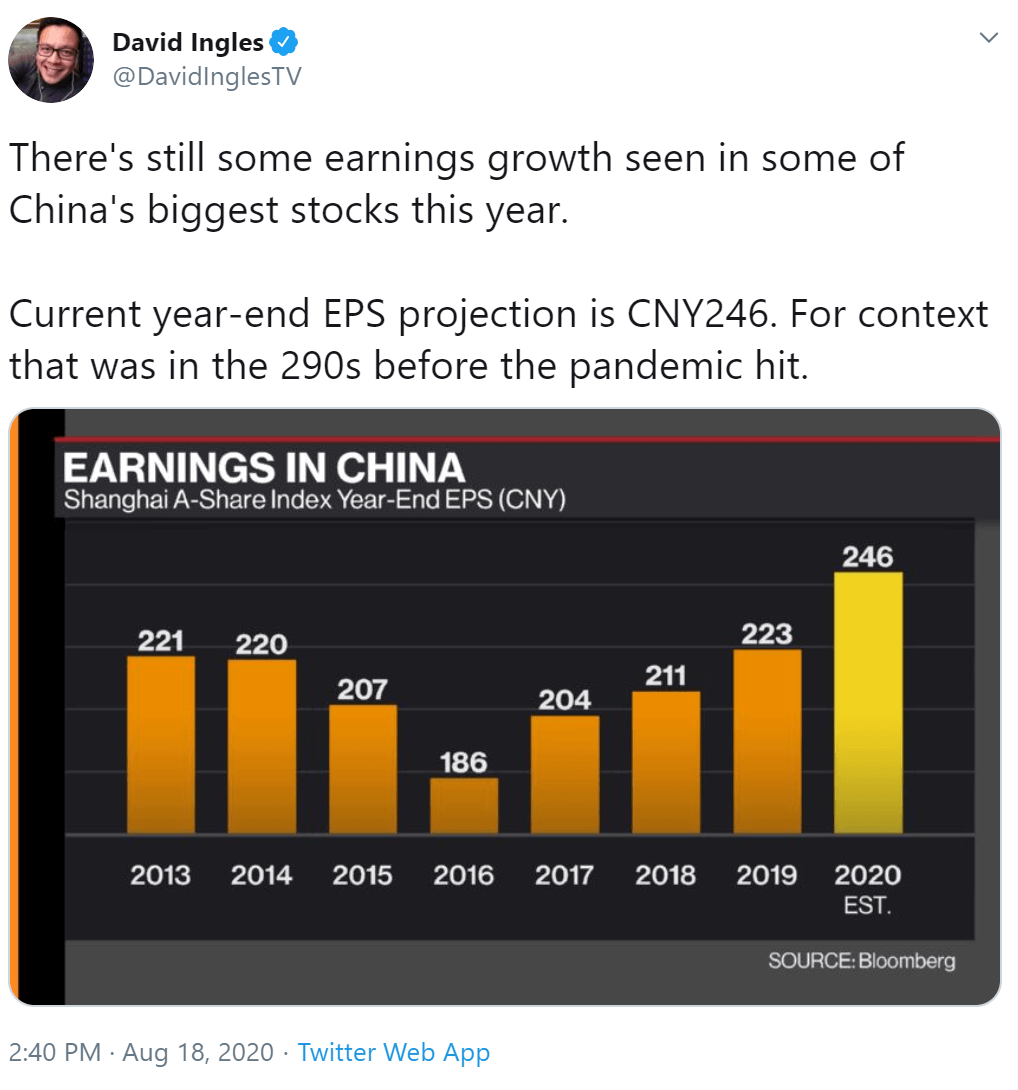

Strategist Says China’s Stock Market is On Track For 20% Gain

China Still Faces a Big Threat

Since earlier this month, U.S. President Donald Trump has continuously pushed towards banning TikTok and WeChat.

On August 7, President Trump officially released orders to ban the two Chinese social media giants.

For TikTok and WeChat to operate in the U.S., American companies would have to acquire their U.S. operations. Currently, Microsoft, Oracle, and Twitter are in talks to purchase the U.S. arm of TikTok .

The intensifying geopolitical risks resulting from direct restrictions on Chinese companies place pressure on China’s stock market.

When asked about the potential implementation of additional restrictions on more Chinese companies, President Trump said:

“We’re looking at other things, yes we are.”

Whether the U.S. and China could offset geopolitical risks through the continuation of trade discussions is still uncertain.

On August 15, the U.S. and China indefinitely delayed trade talks reportedly scheduled for the weekend.

China’s stock market appears to be unfazed by the prolonged trade talks and the worsening U.S.-China relations.

The confluence of growing liquidity, a recovering economy, and expectations of a new round of trade talks are sustaining the Chinese stock market’s momentum.