Is the New CFTC Chairman Heath Tarbert a Bitcoin Ally or Enemy?

Bitcoin fans are wistful since CFTC chair Christopher Giancarlo will step down in July. His successor, Heath Tarbert, was confirmed by the Senate this week. | Source: Shutterstock; Edited by CCN.com

By CCN.com: Bitcoin fans are wistful after learning that the pro-crypto CFTC (Commodity Futures Trading Commission) chairman Christopher Giancarlo is stepping down on July 15.

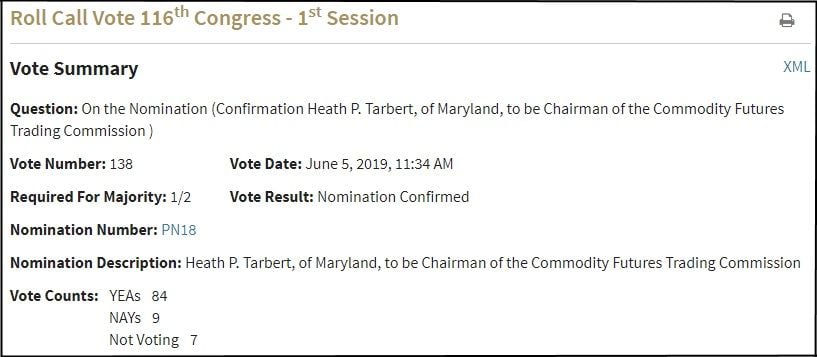

The U.S. Senate confirmed Giancarlo’s successor, Heath Tarbert, by a vote of 84 to 9.

Giancarlo Backs Heath Tarbert

Giancarlo was affectionately nicknamed “Crypto Dad” for his pro-bitcoin rhetoric. In a June 5 statement , Giancarlo expressed his “enthusiastic congratulations” to Tarbert, whom he called “highly qualified.”

Tarbert’s position on cryptocurrencies is unknown. However, Giancarlo says Tarbert shares his vision of helping the CFTC transition into “a 21st Century regulator for today’s digital markets.”

Tarbert, a Republican nominated by President Donald Trump, is very pro-business. Therefore, it’s likely that he opposes over-regulation that would stifle innovation.

Tarbert is currently an acting undersecretary at the U.S. Treasury. He is also a member of the Financial Stability Board, an international body that monitors the global economy.

As CCN.com reported, the FSB recently said that cryptocurrencies are not a threat to the world economy.

Giancarlo: Buckle Up For ‘Explosion of Interest’ in Cryptocurrencies

In his final speech before Congress in May, Giancarlo predicted that there would be an “explosion of interest in cryptocurrencies.”

At the time, Giancarlo said the CFTC had been trying to keep up with the rapidly-evolving developments in today’s high-speed tech environment.

However, he conceded that the meteoric pace of technology was overwhelming regulators. Accordingly, Giancarlo said the CFTC should adopt an “exponential growth mindset” that anticipates the rapid pace of innovation.

So basically, Giancarlo believes that bitcoin and the crypto market aren’t going away, so regulators should keep apprised of developments so they can respond accordingly.

SEC in the Midst of Sweeping Crackdown

The CFTC’s sister agency — the SEC — has been engaged in a sweeping crackdown of the crypto industry, specifically targeting financial fraud and insider trading.

Meanwhile, U.S. lawmakers recently introduced the Token Taxonomy Act. The bill would amend the Securities Exchange Act to exclude cryptocurrencies from securities laws. If the regulation passes, the SEC would not have jurisdiction over cryptocurrencies.

The lawmakers who are sponsoring the Token Taxonomy Act argue that it would keep the United States competitive by not strangling the budding crypto industry with overly cumbersome regulations.

“In the early days of the internet, Congress passed legislation that provided certainty and resisted the temptation to over-regulate the market. Our intent is to achieve a similar win for America’s economy and for American leadership in this innovative space.”

U.S. Lawmakers at Odds Over Bitcoin

However, Democratic Congressman Brad Sherman is urging his colleagues to pass a law that would ban cryptocurrencies in the United States.

“I look for colleagues to join with me in introducing a bill to outlaw cryptocurrency purchases by Americans, so that we nip this in the bud.”

“So whether it is to disempower our foreign policy, our tax collection enforcement or traditional law enforcement, the advantage of crypto over sovereign currency is solely to aid in the disempowerment of the United States and the rule of law.”

Sherman claims the ban is necessary because crypto will undermine the U.S. dollar and is only useful for criminal activities like money-laundering.